The pompous 2007 version of me might speculate where the bottom is, the 2025 version of me is like "Meh...beatings will continue until they don't."

Truth be told there's some crucial data here, I tried not to make it a snore-fest, short, sweet, & to the point.

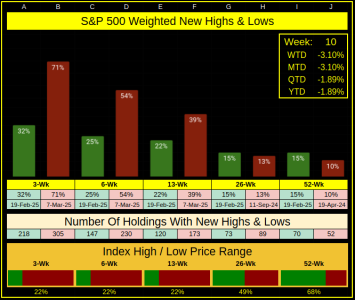

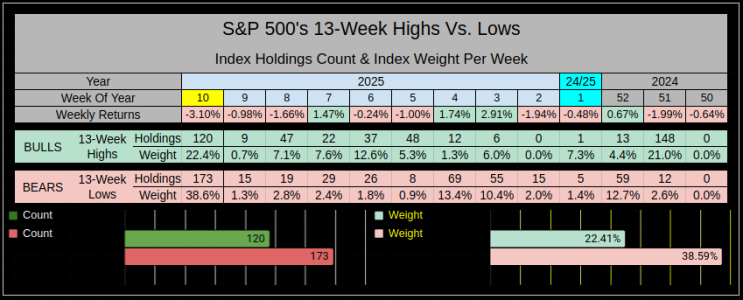

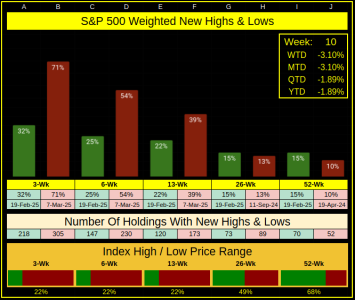

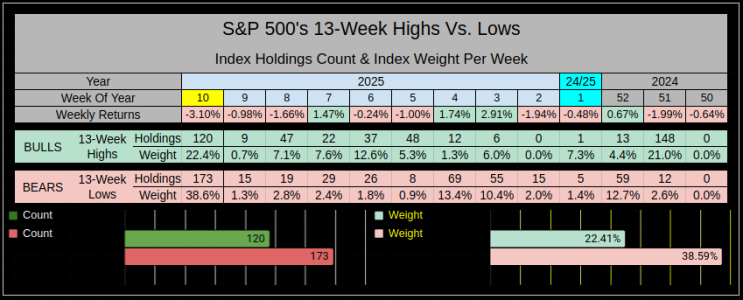

March 7th gave us a fresh set of new 3, 6, & 13 Week lows. Within these timeframes, the index is at 22% of it's high & low price range.

So essentially what we've seen here is a 3-Week -7.83% pullback which has erased 25 weeks of gains.

Something I'd forgotten (and have adjusted), most years start off on Week-2, because week one typically ends in January, but had started in December.

Week-10 lost -3.10%, that's in the bottom 5.9% percentile range of 3,297 weeks. Once again the bears controlled both the holdings & weight of the index.

I've been working on a 13-Week Rolling Linear Regression Chanel, both on price & volume, which goes back from 1962-present. This gives us a 13-Week sliding window, normalizing 3,297 weeks of data in sets of 13. This enables us to more fairly compare today's conditions against previous conditions.

For price: Week-10's low briefly pierced Standard Deviation 3-support (SD 3 S 1st on the chart). This is an extremely rare event, ranking 28th in the bottom .80% of 3,297 weeks.

For Volume: LR-13's Volume, was heavy, in the top 75% percentile range. Setting Linear Regression aside, would you believe it was the heaviest weekly volume we've seen in 103 weeks, going back to March 13th 2023? That particular date was the final week in a 7-week low, and the final low for 2023.

For ATR: The weekly Average True Range was 5.37% placing it in the Top 90% percentile.

For 52-MA: We closed 2.5% above the 52-Week Moving Average (representing a year's worth of price action). It's not a significant event, but it is the closest we've been to this MA since it was breached in Oct-2023. That Oct was the final of a 4-month low which led to an end of year 16.23% rally (that continued higher into 2024).

For myself, I'm in a state of news-fatigue, and I'm sure most of us here are as well. Emotionally charged news, has an impact on the markets, but at some point, I think the markets will look past this and focus on what's "actually happening".

Last I checked

___25% Steel and aluminum tariffs are set to go into effect on Wednesday

___CPI on Wednesday

___Can US Congress avert shutdown by Friday?

Is the news already priced in?

Truth be told there's some crucial data here, I tried not to make it a snore-fest, short, sweet, & to the point.

March 7th gave us a fresh set of new 3, 6, & 13 Week lows. Within these timeframes, the index is at 22% of it's high & low price range.

So essentially what we've seen here is a 3-Week -7.83% pullback which has erased 25 weeks of gains.

Something I'd forgotten (and have adjusted), most years start off on Week-2, because week one typically ends in January, but had started in December.

Week-10 lost -3.10%, that's in the bottom 5.9% percentile range of 3,297 weeks. Once again the bears controlled both the holdings & weight of the index.

I've been working on a 13-Week Rolling Linear Regression Chanel, both on price & volume, which goes back from 1962-present. This gives us a 13-Week sliding window, normalizing 3,297 weeks of data in sets of 13. This enables us to more fairly compare today's conditions against previous conditions.

For price: Week-10's low briefly pierced Standard Deviation 3-support (SD 3 S 1st on the chart). This is an extremely rare event, ranking 28th in the bottom .80% of 3,297 weeks.

For Volume: LR-13's Volume, was heavy, in the top 75% percentile range. Setting Linear Regression aside, would you believe it was the heaviest weekly volume we've seen in 103 weeks, going back to March 13th 2023? That particular date was the final week in a 7-week low, and the final low for 2023.

For ATR: The weekly Average True Range was 5.37% placing it in the Top 90% percentile.

For 52-MA: We closed 2.5% above the 52-Week Moving Average (representing a year's worth of price action). It's not a significant event, but it is the closest we've been to this MA since it was breached in Oct-2023. That Oct was the final of a 4-month low which led to an end of year 16.23% rally (that continued higher into 2024).

For myself, I'm in a state of news-fatigue, and I'm sure most of us here are as well. Emotionally charged news, has an impact on the markets, but at some point, I think the markets will look past this and focus on what's "actually happening".

Last I checked

___25% Steel and aluminum tariffs are set to go into effect on Wednesday

___CPI on Wednesday

___Can US Congress avert shutdown by Friday?

Is the news already priced in?

Last edited: