That's how the character of this market is described by some as larger institutions ramp up or reduce market exposure relative to perceived risk. We saw this kind of trading activity during the first half or so of 2010.

I don't how long we can expect this will last, but I do know it makes for challenging trading in our TSP accounts.

So stocks had another follow-through day after last week's end of week rally. And it's been impressive as the market's performance these last three trading days are similar to the runs we saw last September. And those runs came after significant weakness over a good part of last Summer.

I don't know if the market is gearing up for another run to fresh 2-year highs though, as risk would still seem to be a major component of this market. The military action in Libya over the weekend has spiked oil prices, which are now back above $102/barrel. But at the same time it appears the worst is over for Japan's nuclear disaster, so risk may be tempered for now.

Notably, the S&P 500 was not able to close above 1300, although it did trade above that level for a short period of time. But it's not far from that level now, so if it's going to close above it, I suspect it'll happen by the end of this week, assuming risk remains muted.

The dollar saw renewed selling interest, which resulted in the Dollar Index falling to a level not seen since 2009. Of course our I fund was a beneficiary of that action as it posted a gain just short of 2.5%.

On to the charts:

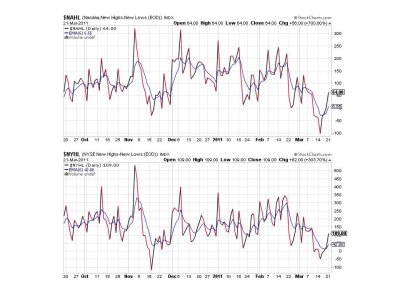

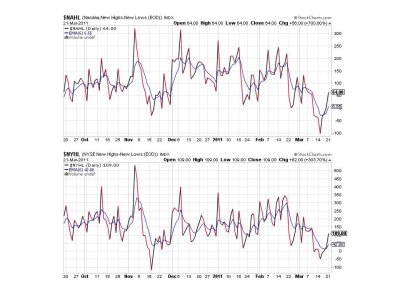

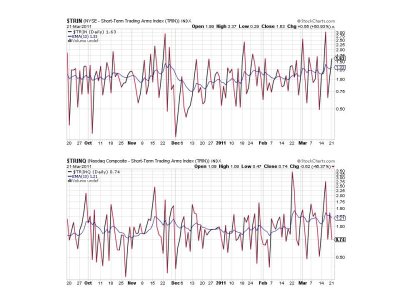

There's a lot of upside momentum right now in this market, and these two charts show it. Both are now back in positive territory after being down significantly just 3 days ago. That up-ramp is impressive and sure looks bullish at the moment.

NAHL and NYHL also look bullish and remain in a buy condition.

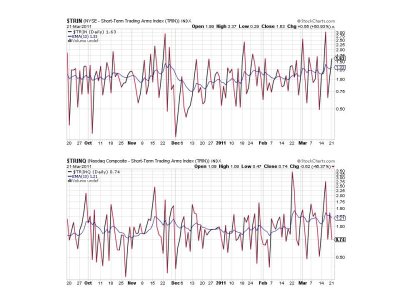

TRIN flipped to a sell, but TRINQ fell into buy territory.

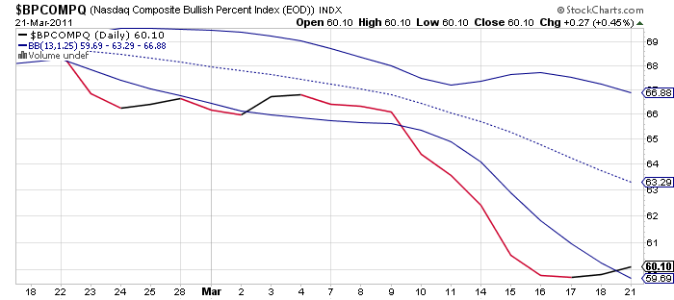

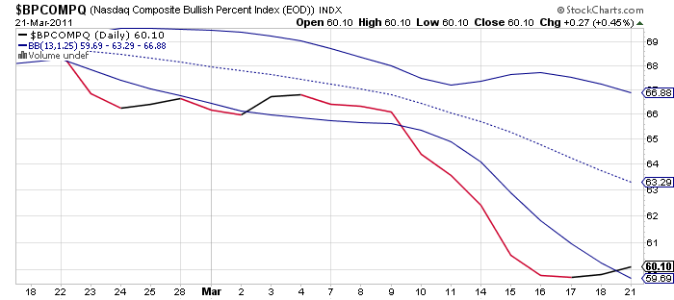

BPCOMPQ has crossed back into the lower bollinger band, which flips it to a buy condition.

So all but one signal is in a buy condition, and that signal (TRINQ) can easily flip back to a buy condition with more buying pressure in the short term. But even if that happens the system will only issue an "unconfirmed" buy signal. NYMO is still roughly 30 points from hitting a new 28-day trading high. That's what is needed to get a confirmed buy. And that could happen very soon if this latest rally has any legs. But that's a big if, as risk is still with us.

I don't how long we can expect this will last, but I do know it makes for challenging trading in our TSP accounts.

So stocks had another follow-through day after last week's end of week rally. And it's been impressive as the market's performance these last three trading days are similar to the runs we saw last September. And those runs came after significant weakness over a good part of last Summer.

I don't know if the market is gearing up for another run to fresh 2-year highs though, as risk would still seem to be a major component of this market. The military action in Libya over the weekend has spiked oil prices, which are now back above $102/barrel. But at the same time it appears the worst is over for Japan's nuclear disaster, so risk may be tempered for now.

Notably, the S&P 500 was not able to close above 1300, although it did trade above that level for a short period of time. But it's not far from that level now, so if it's going to close above it, I suspect it'll happen by the end of this week, assuming risk remains muted.

The dollar saw renewed selling interest, which resulted in the Dollar Index falling to a level not seen since 2009. Of course our I fund was a beneficiary of that action as it posted a gain just short of 2.5%.

On to the charts:

There's a lot of upside momentum right now in this market, and these two charts show it. Both are now back in positive territory after being down significantly just 3 days ago. That up-ramp is impressive and sure looks bullish at the moment.

NAHL and NYHL also look bullish and remain in a buy condition.

TRIN flipped to a sell, but TRINQ fell into buy territory.

BPCOMPQ has crossed back into the lower bollinger band, which flips it to a buy condition.

So all but one signal is in a buy condition, and that signal (TRINQ) can easily flip back to a buy condition with more buying pressure in the short term. But even if that happens the system will only issue an "unconfirmed" buy signal. NYMO is still roughly 30 points from hitting a new 28-day trading high. That's what is needed to get a confirmed buy. And that could happen very soon if this latest rally has any legs. But that's a big if, as risk is still with us.