Giving Thanks for Going Deaf and Losing Everything

At this time of Thanksgiving, I am grateful for the struggles I have faced in life.

I am a fortunate person. I make a very good living doing something I enjoy tremendously, and I can help other people improve their lives as well. I have a great family and people who love me.

Every year at Thanksgiving, I write a column about my stock market journey. I have done it for more than two decades now, and many readers already know the story. I keep doing it, for the same reasons I still pay attention to the basic rules of trading even after all these years: repetition matters. You have to learn the same thing many times before it becomes the fabric of your life. Traditions force you to pause, reflect, and remember what is important when daily life is pulling your attention in a hundred different directions.

Thanksgiving is also a good reminder that your mindset is not a minor issue. It is a driver of outcomes. A grateful perspective tends to produce optimism, and optimism leads to better effort and action. It helps you persist. It helps you to keep working. It helps you stay constructive during inevitable drawdowns in the market or in life.

And that brings me to the point of this annual column:

I never imagined that going completely deaf and broke would turn out to be the best thing that ever happened to me.

Losing the Future I Was Building

My story begins in the 1990s. I graduated from the University of Michigan (Beat Ohio State!) with degrees in business and law, earned a CPA designation after working for two international CPA firms, and was slowly building a legal practice focused on tax and corporate matters. It wasn't easy, but I was making progress. The future looked promising.

Then I started to become totally deaf very quickly.

I had dealt with hearing loss since I was a teenager. My mother’s family had a history of deafness, and I had inherited the defective gene. For years, it was an annoyance and an embarrassment, but I could usually compensate for it. I could hide it well enough that it stayed in the background of my life until it didn’t.

One day, I was on the phone handling a complicated matter with the IRS and realized that, no matter what I did, I couldn’t hear a thing. It was not a temporary problem. My hearing had started to decline rapidly, and within a short period of time, I was totally deaf. No hearing aid could help me because there was no hearing left to amplify. I could lip-read a little, but sign language only helps if the person you are dealing with knows it too. Most communication had to be done by written notes.

There isn’t much demand for lawyers who can’t hear, and I was forced to give up my practice. My small savings account was depleted quickly. I had already been through a divorce. I was broke, isolated, and deeply depressed.

Helen Keller once said that blindness separates you from things, but deafness separates you from people. That is exactly right. When you cannot communicate, you are cut off from the world. Few things are more debilitating than long stretches with little human interaction.

I did have one lifeline: a small disability policy through the Bar Association. I was not going to starve, but I had no idea what I would do with my life. The work available to me was menial and unfulfilling because it required communication skills I didn’t have. At the time, the future felt bleak.

The Unlikely Salvation

My life began to change when I stumbled onto a personal computer owned by my brother-in-law. Early online services like Prodigy and CompuServe allowed people to interact through written messages. That may not sound like much today, but to someone who could not hear, it was a breakthrough. It allowed me to reconnect with people without needing sound. I embraced it with great enthusiasm.

Eventually, I found online stock discussion boards. In many ways, they were not that different from what we see on social media today. There was plenty of noise, stupidity, and personal attacks—but there were also sharp insights from people who had learned the market in a practical way, not an academic way.

In business school, I had learned Modern Portfolio Theory, valuation formulas, diversification, and the standard long-term buy-and-hold approach. I learned almost nothing about technical analysis, momentum, price action, or the psychological realities that drive markets day to day. So I started experimenting with my meager savings.

At first, I did what most people do: I tried traditional, “safe” stocks, but they moved too slowly to matter. I focused on fundamentals and learned that the market can ignore “value” for long periods. Then I moved into more speculative names and got burned—sometimes because the businesses were weak, sometimes because the stocks were outright frauds. I lost more than I could afford, which is a cruel lesson but a good teacher.

What finally clicked for me was a simple truth: if you want to make money in the market, you have to respect what the market is actually doing. The advice in the media, financial statements, news, economic commentary, valuations, etc, can be very interesting and creates an illusion of insight. But price is the final arbiter, and price moves because of behavior. If you want to understand opportunity, you have to understand that behavior.

I gravitated toward a disciplined approach that combined fundamentals with technicals, with a heavy emphasis on charts and capital protection. It appealed to me because it was rooted in psychology and rules rather than in hope. I wanted to be in stocks that were moving, and I wanted a framework that kept me from giving back my gains when conditions changed.

Most importantly, I realized I could not compete with institutional money by doing what it does. I had to use my advantages as a small investor, which are speed, flexibility, and the ability to focus on price behavior without committee thinking. I needed to ride the coattails of the whales, not pretend I was one of them.

Building a New Life One Trade at a Time

Active trading in those days was not easy, especially if you were deaf. For a period of time, I had to physically go to a broker’s office to place trades because I could not trade by phone. Eventually, online brokers emerged and removed that barrier. That was another life-changing innovation for me as the market became accessible in a way it had not been before.

I began placing trades and sharing ideas in various forums. I had early successes in names like II-VI, which produced extraordinary returns in the mid-1990s. Those wins were not just money. They were proof. They were a demonstration that I could build something new from a terrible situation, and I was driven to succeed.

I also discovered that I loved the process. The market is a constant puzzle. It is a game of probabilities, discipline, and emotional control. Charts are a visual record of crowd psychology; I studied them constantly as I developed strategies.

The late 1990s and the bubble years were ideal for aggressive momentum investing, and I made far more money than I dreamed possible. But the more important achievement was developing the ability to play defense. When the market topped in 2000, I gave back some gains, like most people do when they face their first true market crisis, but I adapted. Within months, I had my accounts back near highs and refocused on finding the next good trade while protecting what I had earned.

The “defense first” mindset and ‘keeping accounts close to their highs’ became core mantras and still are.

The Trading Community.

As the message boards evolved, I found myself in constant debate with long-term buy-and-hold advocates, including the early Motley Fool community. That led to a vibrant group of active traders and, eventually, to an invitation from Herb Greenberg to establish a trading area and chatroom on his AOL site. We built one of the earliest stock market chatrooms. Capacity was limited, and people would wait hours to gain entry.

Eventually, I moved that community online and established SharkInvesting.com, where the Shark Tank still operates today, with many members who have been with me for more than 20 years.

I loved sharing ideas. I loved the teaching aspect. It was deeply satisfying to take what I was learning and help other people apply it.

That is what led me to TheStreetPro. I reached out to an editor to see if there was interest in my commentaries. Unbeknownst to me, Jim Cramer had followed some of my stock picking back in the AOL days. I was offered the chance to write, and I have been doing it ever since.

I still find it meaningful that my work can help people earn income, protect their savings, and approach the market with more discipline. The market can be a source of great opportunity, but as I often say, the reason it is so lucrative is that it is so hard. If I can help someone avoid unnecessary mistakes and keep them engaged long enough to develop real skill, I have helped to make the world a better place.

The Blessing of Family and Medical Technology

My personal life improved dramatically as well. I met the woman who became my wife, and we built a life together. Communicating was not simple at first, but we found a way, including our own version of sign language. We have been blessed with three children, and the family has become the center of everything. My youngest son, Jessie, will soon head off to study nuclear engineering at North Carolina State or Georgia Tech, and our nest will be empty.

Medical technology brought another gift: a cochlear implant. It is not perfect, but it is remarkable. With the aid of captioning, I can communicate normally in most situations now, but I will never have perfect hearing.

The Next Challenge-Health

One downside of trading and writing is that they are very sedentary. It requires sitting at a computer for many hours a day, with no physical activity. Over the years, I gained substantial weight and developed type 2 diabetes.

Earlier this year, my brother developed an aggressive form of prostate cancer and recently passed away, and I underwent a biopsy for bladder cancer, which turned out negative.

It became pretty clear to me that wealth and success in the stock market didn’t mean much if I didn’t have good health to enjoy it. I love what I do, and I never plan to retire, and I want to be able to do it for a very long time.

I attacked the issue of health the same way I attacked the issue of trading. At the core, it comes down to understanding emotions and developing good habits. Like most people, I have tried various diets over the years with limited success. The main issue wasn’t finding an effective diet. The main issue was changing my habits so I wouldn’t have to rely on willpower. Willpower is not the answer because we all have a limited amount.

It wasn’t easy, but I changed the way I ate and eliminated some bad habits. Eventually, it became routine to eat more protein and fewer carbohydrates, and it didn’t feel like punishment. I added weightlifting, and I stay active by working on my ‘farm’. At one point, I weighed close to 250 pounds, but I’m now around 170 and have a body fat percentage of about 10%. My body composition is in the top 2% for someone my age.

This has given me renewed energy and optimism and has made me an even better trader. My only regret is that I didn’t make this effort many years ago.

Why I’m Grateful for the Challenges In Life

Bad things happen to good people, but those bad things often have hidden blessings. I never dreamed that going deaf and broke would turn out to be what made my life much more successful and fulfilling.

I am an optimist, but that doesn’t mean that I think the future will be easy. Optimism is the belief that you can find a way to do well if you stay disciplined, flexible, and persistent.

I never imagined that going deaf and losing everything would lead to a career I love, a community I’m proud of, and a family that has enriched my life beyond measure.

On this Thanksgiving, I am grateful, not just for the good things, but for the struggles that forced me to change, adapt, and build something better than I originally planned.

I wish all of you a wonderful Thanksgiving. If you are facing obstacles that feel overwhelming, I will offer this: bad periods end. If you keep going, keep learning, and keep your mindset constructive, life can surprise you in ways that you have never dreamed of.

At this time of Thanksgiving, I am grateful for the struggles I have faced in life.

I am a fortunate person. I make a very good living doing something I enjoy tremendously, and I can help other people improve their lives as well. I have a great family and people who love me.

Every year at Thanksgiving, I write a column about my stock market journey. I have done it for more than two decades now, and many readers already know the story. I keep doing it, for the same reasons I still pay attention to the basic rules of trading even after all these years: repetition matters. You have to learn the same thing many times before it becomes the fabric of your life. Traditions force you to pause, reflect, and remember what is important when daily life is pulling your attention in a hundred different directions.

Thanksgiving is also a good reminder that your mindset is not a minor issue. It is a driver of outcomes. A grateful perspective tends to produce optimism, and optimism leads to better effort and action. It helps you persist. It helps you to keep working. It helps you stay constructive during inevitable drawdowns in the market or in life.

And that brings me to the point of this annual column:

I never imagined that going completely deaf and broke would turn out to be the best thing that ever happened to me.

Losing the Future I Was Building

My story begins in the 1990s. I graduated from the University of Michigan (Beat Ohio State!) with degrees in business and law, earned a CPA designation after working for two international CPA firms, and was slowly building a legal practice focused on tax and corporate matters. It wasn't easy, but I was making progress. The future looked promising.

Then I started to become totally deaf very quickly.

I had dealt with hearing loss since I was a teenager. My mother’s family had a history of deafness, and I had inherited the defective gene. For years, it was an annoyance and an embarrassment, but I could usually compensate for it. I could hide it well enough that it stayed in the background of my life until it didn’t.

One day, I was on the phone handling a complicated matter with the IRS and realized that, no matter what I did, I couldn’t hear a thing. It was not a temporary problem. My hearing had started to decline rapidly, and within a short period of time, I was totally deaf. No hearing aid could help me because there was no hearing left to amplify. I could lip-read a little, but sign language only helps if the person you are dealing with knows it too. Most communication had to be done by written notes.

There isn’t much demand for lawyers who can’t hear, and I was forced to give up my practice. My small savings account was depleted quickly. I had already been through a divorce. I was broke, isolated, and deeply depressed.

Helen Keller once said that blindness separates you from things, but deafness separates you from people. That is exactly right. When you cannot communicate, you are cut off from the world. Few things are more debilitating than long stretches with little human interaction.

I did have one lifeline: a small disability policy through the Bar Association. I was not going to starve, but I had no idea what I would do with my life. The work available to me was menial and unfulfilling because it required communication skills I didn’t have. At the time, the future felt bleak.

The Unlikely Salvation

My life began to change when I stumbled onto a personal computer owned by my brother-in-law. Early online services like Prodigy and CompuServe allowed people to interact through written messages. That may not sound like much today, but to someone who could not hear, it was a breakthrough. It allowed me to reconnect with people without needing sound. I embraced it with great enthusiasm.

Eventually, I found online stock discussion boards. In many ways, they were not that different from what we see on social media today. There was plenty of noise, stupidity, and personal attacks—but there were also sharp insights from people who had learned the market in a practical way, not an academic way.

In business school, I had learned Modern Portfolio Theory, valuation formulas, diversification, and the standard long-term buy-and-hold approach. I learned almost nothing about technical analysis, momentum, price action, or the psychological realities that drive markets day to day. So I started experimenting with my meager savings.

At first, I did what most people do: I tried traditional, “safe” stocks, but they moved too slowly to matter. I focused on fundamentals and learned that the market can ignore “value” for long periods. Then I moved into more speculative names and got burned—sometimes because the businesses were weak, sometimes because the stocks were outright frauds. I lost more than I could afford, which is a cruel lesson but a good teacher.

What finally clicked for me was a simple truth: if you want to make money in the market, you have to respect what the market is actually doing. The advice in the media, financial statements, news, economic commentary, valuations, etc, can be very interesting and creates an illusion of insight. But price is the final arbiter, and price moves because of behavior. If you want to understand opportunity, you have to understand that behavior.

I gravitated toward a disciplined approach that combined fundamentals with technicals, with a heavy emphasis on charts and capital protection. It appealed to me because it was rooted in psychology and rules rather than in hope. I wanted to be in stocks that were moving, and I wanted a framework that kept me from giving back my gains when conditions changed.

Most importantly, I realized I could not compete with institutional money by doing what it does. I had to use my advantages as a small investor, which are speed, flexibility, and the ability to focus on price behavior without committee thinking. I needed to ride the coattails of the whales, not pretend I was one of them.

Building a New Life One Trade at a Time

Active trading in those days was not easy, especially if you were deaf. For a period of time, I had to physically go to a broker’s office to place trades because I could not trade by phone. Eventually, online brokers emerged and removed that barrier. That was another life-changing innovation for me as the market became accessible in a way it had not been before.

I began placing trades and sharing ideas in various forums. I had early successes in names like II-VI, which produced extraordinary returns in the mid-1990s. Those wins were not just money. They were proof. They were a demonstration that I could build something new from a terrible situation, and I was driven to succeed.

I also discovered that I loved the process. The market is a constant puzzle. It is a game of probabilities, discipline, and emotional control. Charts are a visual record of crowd psychology; I studied them constantly as I developed strategies.

The late 1990s and the bubble years were ideal for aggressive momentum investing, and I made far more money than I dreamed possible. But the more important achievement was developing the ability to play defense. When the market topped in 2000, I gave back some gains, like most people do when they face their first true market crisis, but I adapted. Within months, I had my accounts back near highs and refocused on finding the next good trade while protecting what I had earned.

The “defense first” mindset and ‘keeping accounts close to their highs’ became core mantras and still are.

The Trading Community.

As the message boards evolved, I found myself in constant debate with long-term buy-and-hold advocates, including the early Motley Fool community. That led to a vibrant group of active traders and, eventually, to an invitation from Herb Greenberg to establish a trading area and chatroom on his AOL site. We built one of the earliest stock market chatrooms. Capacity was limited, and people would wait hours to gain entry.

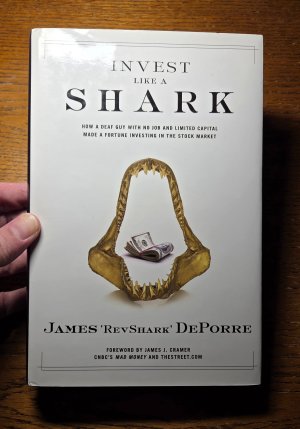

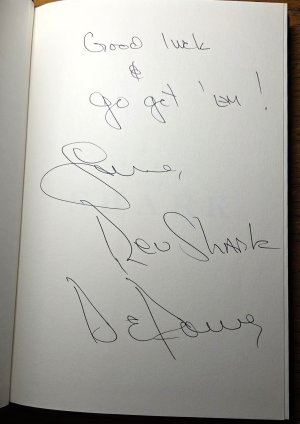

Eventually, I moved that community online and established SharkInvesting.com, where the Shark Tank still operates today, with many members who have been with me for more than 20 years.

I loved sharing ideas. I loved the teaching aspect. It was deeply satisfying to take what I was learning and help other people apply it.

That is what led me to TheStreetPro. I reached out to an editor to see if there was interest in my commentaries. Unbeknownst to me, Jim Cramer had followed some of my stock picking back in the AOL days. I was offered the chance to write, and I have been doing it ever since.

I still find it meaningful that my work can help people earn income, protect their savings, and approach the market with more discipline. The market can be a source of great opportunity, but as I often say, the reason it is so lucrative is that it is so hard. If I can help someone avoid unnecessary mistakes and keep them engaged long enough to develop real skill, I have helped to make the world a better place.

The Blessing of Family and Medical Technology

My personal life improved dramatically as well. I met the woman who became my wife, and we built a life together. Communicating was not simple at first, but we found a way, including our own version of sign language. We have been blessed with three children, and the family has become the center of everything. My youngest son, Jessie, will soon head off to study nuclear engineering at North Carolina State or Georgia Tech, and our nest will be empty.

Medical technology brought another gift: a cochlear implant. It is not perfect, but it is remarkable. With the aid of captioning, I can communicate normally in most situations now, but I will never have perfect hearing.

The Next Challenge-Health

One downside of trading and writing is that they are very sedentary. It requires sitting at a computer for many hours a day, with no physical activity. Over the years, I gained substantial weight and developed type 2 diabetes.

Earlier this year, my brother developed an aggressive form of prostate cancer and recently passed away, and I underwent a biopsy for bladder cancer, which turned out negative.

It became pretty clear to me that wealth and success in the stock market didn’t mean much if I didn’t have good health to enjoy it. I love what I do, and I never plan to retire, and I want to be able to do it for a very long time.

I attacked the issue of health the same way I attacked the issue of trading. At the core, it comes down to understanding emotions and developing good habits. Like most people, I have tried various diets over the years with limited success. The main issue wasn’t finding an effective diet. The main issue was changing my habits so I wouldn’t have to rely on willpower. Willpower is not the answer because we all have a limited amount.

It wasn’t easy, but I changed the way I ate and eliminated some bad habits. Eventually, it became routine to eat more protein and fewer carbohydrates, and it didn’t feel like punishment. I added weightlifting, and I stay active by working on my ‘farm’. At one point, I weighed close to 250 pounds, but I’m now around 170 and have a body fat percentage of about 10%. My body composition is in the top 2% for someone my age.

This has given me renewed energy and optimism and has made me an even better trader. My only regret is that I didn’t make this effort many years ago.

Why I’m Grateful for the Challenges In Life

Bad things happen to good people, but those bad things often have hidden blessings. I never dreamed that going deaf and broke would turn out to be what made my life much more successful and fulfilling.

I am an optimist, but that doesn’t mean that I think the future will be easy. Optimism is the belief that you can find a way to do well if you stay disciplined, flexible, and persistent.

I never imagined that going deaf and losing everything would lead to a career I love, a community I’m proud of, and a family that has enriched my life beyond measure.

On this Thanksgiving, I am grateful, not just for the good things, but for the struggles that forced me to change, adapt, and build something better than I originally planned.

I wish all of you a wonderful Thanksgiving. If you are facing obstacles that feel overwhelming, I will offer this: bad periods end. If you keep going, keep learning, and keep your mindset constructive, life can surprise you in ways that you have never dreamed of.