I've been traveling all day today and have had very little opportunity to watch the markets, although I see we reversed early gains and ended up significantly lower on the day.

Let's go to the charts:

Not surprisingly, NAMO and NYMO both moved lower today, although without the initial rally they'd have been even lower. Still, this is consistent with what I anticipated after yesterday's action.

Same for NAHL and NYHL.

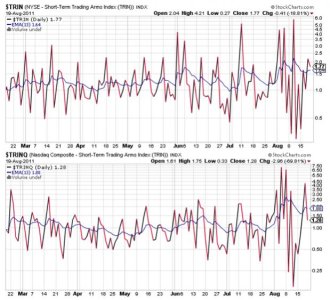

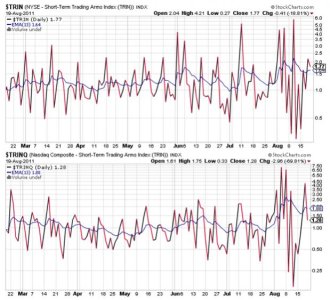

TRIN actually worked off a bit of its oversold condition believe or not, and TRINQ actually triggered a buy, which is a bit odd, but that's almost certainly due to the up and down action we saw today. These signals suggest to me that the downside is not over, although they are both largely neutral at the moment.

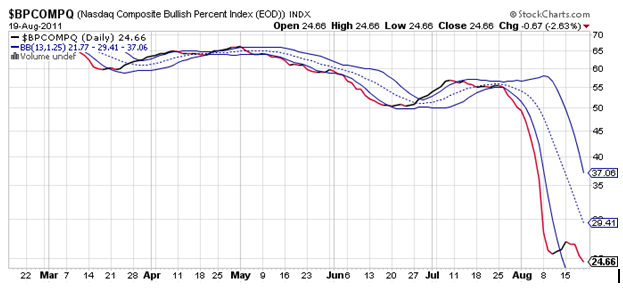

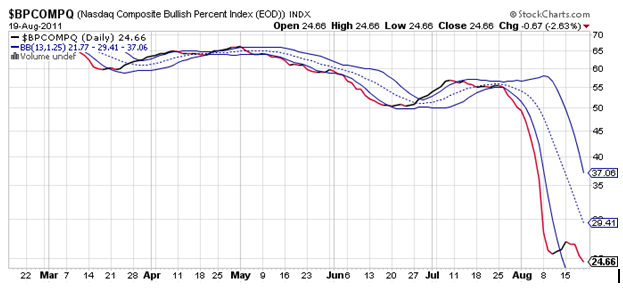

Lower still for BPCOMPQ, which remains on a buy (because that lower bollinger band had flared out so much due to the initial sell-off). It still looks quite bearish to my eye.

So the system remains firmly in an intermediate term sell condition.

I know our sentiment survey was overly bearish for next week (bullish), but as of yesterday other surveys were not. Many traders are simply expecting a test of the lows and then another shot higher. But I think there's too many trading on that expectation, which only adds to my expectation of lower prices in the days and weeks ahead. No doubt we'll see some rallies, but they may not be easy to get in front of.

I'll be posting the tracker charts later this weekend, but I already know that the Top 50s bullish positioning for this week only paid off on Monday. After that it was pretty much downhill for the rest of the week. More on that once I get the charts assembled. See you then.

Let's go to the charts:

Not surprisingly, NAMO and NYMO both moved lower today, although without the initial rally they'd have been even lower. Still, this is consistent with what I anticipated after yesterday's action.

Same for NAHL and NYHL.

TRIN actually worked off a bit of its oversold condition believe or not, and TRINQ actually triggered a buy, which is a bit odd, but that's almost certainly due to the up and down action we saw today. These signals suggest to me that the downside is not over, although they are both largely neutral at the moment.

Lower still for BPCOMPQ, which remains on a buy (because that lower bollinger band had flared out so much due to the initial sell-off). It still looks quite bearish to my eye.

So the system remains firmly in an intermediate term sell condition.

I know our sentiment survey was overly bearish for next week (bullish), but as of yesterday other surveys were not. Many traders are simply expecting a test of the lows and then another shot higher. But I think there's too many trading on that expectation, which only adds to my expectation of lower prices in the days and weeks ahead. No doubt we'll see some rallies, but they may not be easy to get in front of.

I'll be posting the tracker charts later this weekend, but I already know that the Top 50s bullish positioning for this week only paid off on Monday. After that it was pretty much downhill for the rest of the week. More on that once I get the charts assembled. See you then.