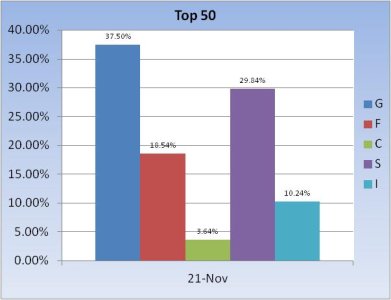

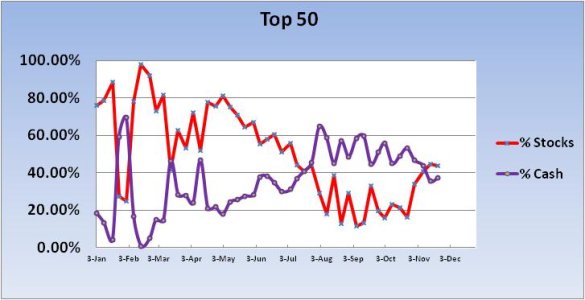

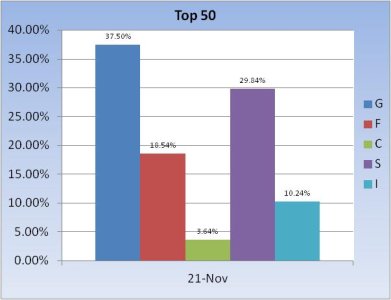

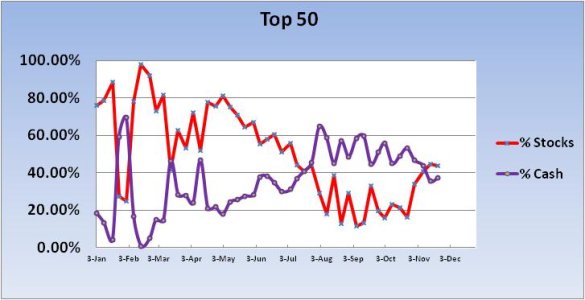

In general, we've been increasing our stock positions for the past 4 weeks. On 23 October the Top 50 had a paltry 16.24% stock exposure. Three weeks later (last week) they hit a total stock allocation of 44.72%. This week they backed off a bit and now have a 43.72% stock exposure going into tomorrow's (Monday) trading session.

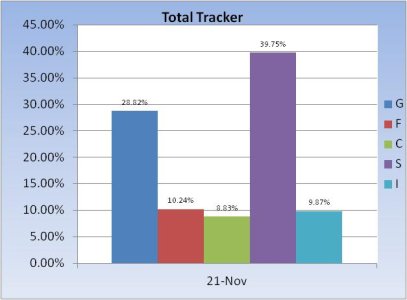

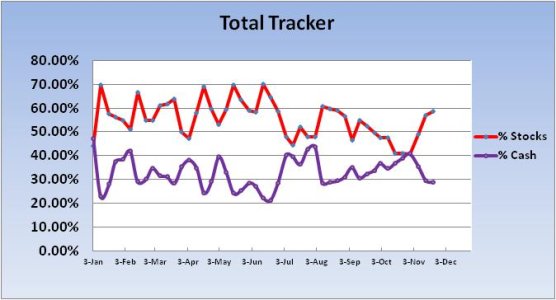

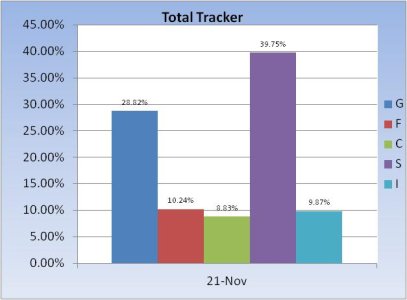

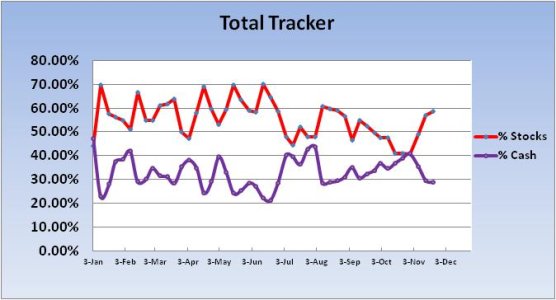

The Herd (Total Tracker) has also been increasing their stock position during the same time frame. On 23 October they had an overall stock position totaling 40.94%. Last week they were up to a 57% allocation and this week they bumped it up a bit more to a 58.44% allocation.

Throughout all that time, our sentiment survey has been in a sell condition. And this week is no different as we had a bulls (49%) to bears (39%) ratio of 1.26 to 1, which keeps the system on a sell.

Here's this week's charts:

The Top 50 are still maintaining a health cash/bond position.

The herd is carrying about 15% more stock exposure overall than the Top 50.

Our sentiment survey appears to be largely reflecting our overall allocations. The Top 50 are about 5% below the 49% bullish sentiment number, while the herd is almost 10 points above it.

I don't take a whole lot of meaning from this data this week though, as the market's volatility can change quickly during the course of any given week. But in any event, this is where we stand going into the new week

The Seven Sentinels remain in a sell condition. And in Friday's blog I pointed out that we had numerous potentially market moving catalysts to contend with this week. Perhaps the biggest one being the Super Committee deadline Wednesday. And the news this weekend has not been hopeful for an agreement between the two sides.

I'm not sure how the market will react regardless of the outcome either. An agreement may sound like a positive should one be reached, but there's going to be winners and losers regardless. And not reaching an agreement will supposedly kick in deep automatic cuts to the DoD and certain entitlement programs.

Things look like they could get real interesting going into the Thanksgiving holiday.

The Herd (Total Tracker) has also been increasing their stock position during the same time frame. On 23 October they had an overall stock position totaling 40.94%. Last week they were up to a 57% allocation and this week they bumped it up a bit more to a 58.44% allocation.

Throughout all that time, our sentiment survey has been in a sell condition. And this week is no different as we had a bulls (49%) to bears (39%) ratio of 1.26 to 1, which keeps the system on a sell.

Here's this week's charts:

The Top 50 are still maintaining a health cash/bond position.

The herd is carrying about 15% more stock exposure overall than the Top 50.

Our sentiment survey appears to be largely reflecting our overall allocations. The Top 50 are about 5% below the 49% bullish sentiment number, while the herd is almost 10 points above it.

I don't take a whole lot of meaning from this data this week though, as the market's volatility can change quickly during the course of any given week. But in any event, this is where we stand going into the new week

The Seven Sentinels remain in a sell condition. And in Friday's blog I pointed out that we had numerous potentially market moving catalysts to contend with this week. Perhaps the biggest one being the Super Committee deadline Wednesday. And the news this weekend has not been hopeful for an agreement between the two sides.

I'm not sure how the market will react regardless of the outcome either. An agreement may sound like a positive should one be reached, but there's going to be winners and losers regardless. And not reaching an agreement will supposedly kick in deep automatic cuts to the DoD and certain entitlement programs.

Things look like they could get real interesting going into the Thanksgiving holiday.