Pre-Bell  Brief

Brief

Time: 2025-10-28 08:39 (ET)

Key Takeaway

Key Takeaway

• U.S. futures are near flat as traders brace for mega-cap earnings and the Fed meeting. [1]

• The focus is on rates and policy tone: a cut is widely expected, guidance matters more. [2]

• Dollar is slightly softer and volatility calm pre-bell: watch if that holds into the open. [3]

What Moved Overnight

What Moved Overnight

• S&P 500 futures hovered around unchanged while Dow futures edged higher ahead of earnings. [4]

• DXY ticked down modestly; 10-year yield hovered near 4 percent. [5]

• Global stocks were mixed with Asia softer and Europe uneven into the U.S. open. [6]

How the Prior Session Closed

How the Prior Session Closed

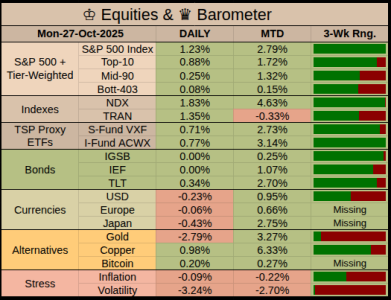

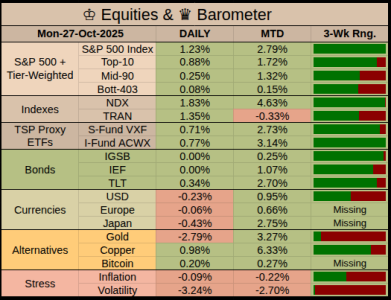

• SPX rallied +1.23% to a record close; Nasdaq outpaced as tech led. [7]

• Dow added +0.71%; breadth improved with gains across large growth and discretionary. [7]

• Financial conditions eased as equities rose and volatility slipped. [7]

• Top SPX Winner: QCOM (Qualcomm) +11.09% (Information Technology) [8]

• Bottom SPX Loser: ALB (Albemarle) −8.90% (Materials) [8]

TSP Stats

TSP Stats

G-Fund Estimated Forward Returns • +0.0115% per session [9]

• 5 Sessions: +0.058% • November: +0.22% • 3 Months: +0.73% • 1 Year: +2.95%

FCSI Past-5 Sessions

• F-Fund +0.29% • C-Fund +1.07% • S-Fund +1.63% • I-Fund +0.21%

Today's 1st Hour of Trading, What to Watch For

Today's 1st Hour of Trading, What to Watch For

• Can SPX hold yesterday’s breakout while traders fade pre-Fed moves. [10]

• Does DXY stay soft and the 10-year ^TNX stay under 4 percent: that supports risk. [11]

• Tape sensitivity to headlines on Fed timing and tonight-tomorrow’s mega-cap earnings. [2]

Upcoming Headlines (5-Day Window, ET)

Upcoming Headlines (5-Day Window, ET)

• {10/29 WED 14:00} — [Fed] FOMC decision and statement: policy path and guidance. [12]

• {10/29 WED 14:30} — [Fed] Chair press conference: tone on labor, inflation, cuts. [12]

• {10/28 TUE 13:00} — [Auction] 7-year Treasury auction: demand and term premium read. [13]

• {10/29–10/30} — [Earnings] Microsoft, Alphabet, Meta, Amazon, Apple: AI spend vs margins. [14]

• {10/31 FRI} — [Options] Month-end positioning, potential flows into close. [3]

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 2025-10-28: Barrons.com: “S&P 500 Futures Flat in Premarket Trading; Rambus, F5 Lag”

[2] 2025-10-28: Reuters.com: “Wall St futures pause with focus on earnings rush, Fed decision”

[3] 2025-10-28: WSJ.com: “Dow Futures Gain After UnitedHealth Earnings”

[4] 2025-10-28: WSJ.com: “Dow Futures Gain After UnitedHealth Earnings”

[5] 2025-10-28: MarketWatch.com: “U.S. Dollar Index (DXY) intraday”

[6] 2025-10-28: APNews.com: “Wall Street makes modest gains ahead of Fed rate announcement, Trump-Xi meeting”

[7] 2025-10-27: Yahoo.com: “S&P 500 (^GSPC) Historical Data”

[8] 2025-10-27: Investopedia.com: “S&P 500 Gains and Losses Today”

[9] 2025-10-27: TSPtalk.com: “TSP Share Prices”

[10] 2025-10-28: WSJ.com: “Dow Futures Gain After UnitedHealth Earnings”

[11] 2025-10-28: MarketWatch.com: “U.S. Dollar Index (DXY) intraday”

[12] 2025-10-28: FederalReserve.gov: “FOMC: October 28–29 schedule”

[13] 2025-10-28: TreasuryDirect.gov: “Upcoming Auctions”

[14] 2025-10-27: MarketScreener.com: “Earnings calendar for Oct 27–31, 2025”

Time: 2025-10-28 08:39 (ET)

• U.S. futures are near flat as traders brace for mega-cap earnings and the Fed meeting. [1]

• The focus is on rates and policy tone: a cut is widely expected, guidance matters more. [2]

• Dollar is slightly softer and volatility calm pre-bell: watch if that holds into the open. [3]

• S&P 500 futures hovered around unchanged while Dow futures edged higher ahead of earnings. [4]

• DXY ticked down modestly; 10-year yield hovered near 4 percent. [5]

• Global stocks were mixed with Asia softer and Europe uneven into the U.S. open. [6]

• SPX rallied +1.23% to a record close; Nasdaq outpaced as tech led. [7]

• Dow added +0.71%; breadth improved with gains across large growth and discretionary. [7]

• Financial conditions eased as equities rose and volatility slipped. [7]

• Top SPX Winner: QCOM (Qualcomm) +11.09% (Information Technology) [8]

• Bottom SPX Loser: ALB (Albemarle) −8.90% (Materials) [8]

G-Fund Estimated Forward Returns • +0.0115% per session [9]

• 5 Sessions: +0.058% • November: +0.22% • 3 Months: +0.73% • 1 Year: +2.95%

FCSI Past-5 Sessions

• F-Fund +0.29% • C-Fund +1.07% • S-Fund +1.63% • I-Fund +0.21%

• Can SPX hold yesterday’s breakout while traders fade pre-Fed moves. [10]

• Does DXY stay soft and the 10-year ^TNX stay under 4 percent: that supports risk. [11]

• Tape sensitivity to headlines on Fed timing and tonight-tomorrow’s mega-cap earnings. [2]

• {10/29 WED 14:00} — [Fed] FOMC decision and statement: policy path and guidance. [12]

• {10/29 WED 14:30} — [Fed] Chair press conference: tone on labor, inflation, cuts. [12]

• {10/28 TUE 13:00} — [Auction] 7-year Treasury auction: demand and term premium read. [13]

• {10/29–10/30} — [Earnings] Microsoft, Alphabet, Meta, Amazon, Apple: AI spend vs margins. [14]

• {10/31 FRI} — [Options] Month-end positioning, potential flows into close. [3]

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 2025-10-28: Barrons.com: “S&P 500 Futures Flat in Premarket Trading; Rambus, F5 Lag”

[2] 2025-10-28: Reuters.com: “Wall St futures pause with focus on earnings rush, Fed decision”

[3] 2025-10-28: WSJ.com: “Dow Futures Gain After UnitedHealth Earnings”

[4] 2025-10-28: WSJ.com: “Dow Futures Gain After UnitedHealth Earnings”

[5] 2025-10-28: MarketWatch.com: “U.S. Dollar Index (DXY) intraday”

[6] 2025-10-28: APNews.com: “Wall Street makes modest gains ahead of Fed rate announcement, Trump-Xi meeting”

[7] 2025-10-27: Yahoo.com: “S&P 500 (^GSPC) Historical Data”

[8] 2025-10-27: Investopedia.com: “S&P 500 Gains and Losses Today”

[9] 2025-10-27: TSPtalk.com: “TSP Share Prices”

[10] 2025-10-28: WSJ.com: “Dow Futures Gain After UnitedHealth Earnings”

[11] 2025-10-28: MarketWatch.com: “U.S. Dollar Index (DXY) intraday”

[12] 2025-10-28: FederalReserve.gov: “FOMC: October 28–29 schedule”

[13] 2025-10-28: TreasuryDirect.gov: “Upcoming Auctions”

[14] 2025-10-27: MarketScreener.com: “Earnings calendar for Oct 27–31, 2025”