Our sentiment survey was a big winner last week, but it's not doing nearly so well for the year. And we're a bit more bulled up for the new week, which put the system in hold condition (buy).

On another note, the major averages are now approaching the top of the current channel, which could make things interesting again as we approach resistance (assuming the upside momentum isn't over).

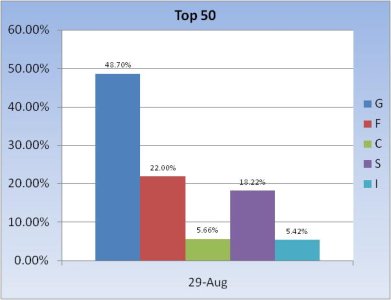

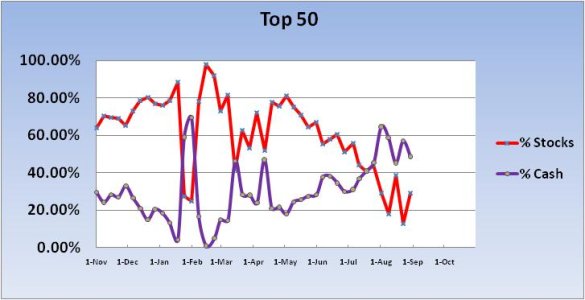

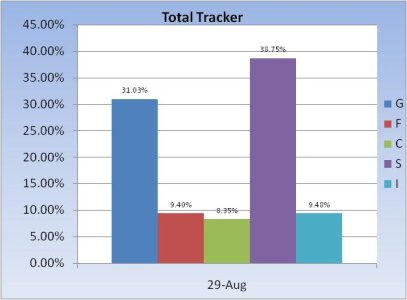

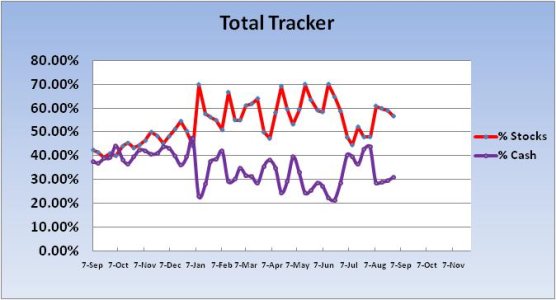

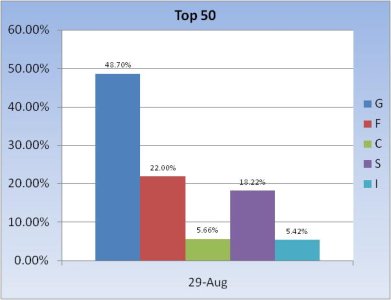

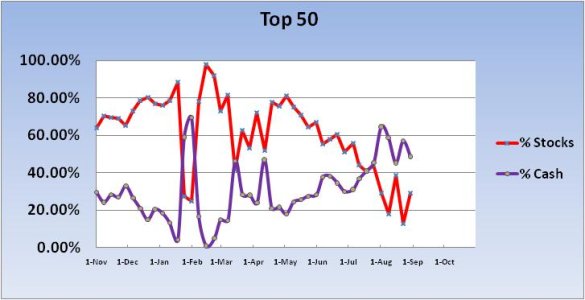

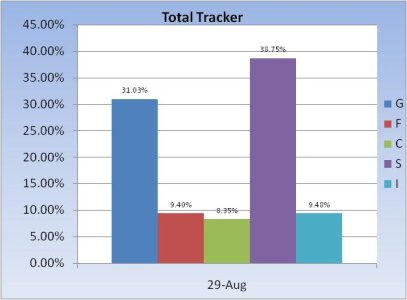

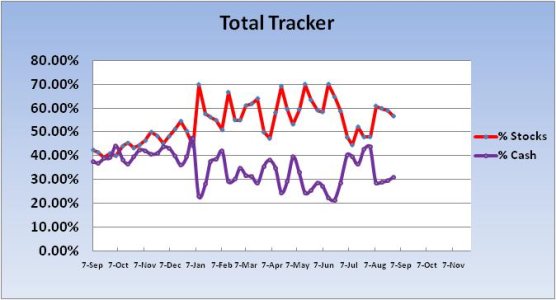

Here's this weeks tracker charts:

The Top 50 did do some buying, but they didn't exactly back up the truck as the the total stock allocation only rose from 13% to 29.3%. Still, that's more than a 16% increase in one week.

The herd (the entire tracker) continues to reduce their stock exposure in small increments as total stock allocations fell for the third straight week by 2.26%. I'm not surprised by the incremental moves. The volatility is keeping many of us either in or out of the market.

I am still very wary of this market as the Seven Sentinels remain in an official sell status. However, there is an unofficial buy signal, but I'm still waiting for NYMO to hit a new 28 day trading high to confirm it.

On another note, the major averages are now approaching the top of the current channel, which could make things interesting again as we approach resistance (assuming the upside momentum isn't over).

Here's this weeks tracker charts:

The Top 50 did do some buying, but they didn't exactly back up the truck as the the total stock allocation only rose from 13% to 29.3%. Still, that's more than a 16% increase in one week.

The herd (the entire tracker) continues to reduce their stock exposure in small increments as total stock allocations fell for the third straight week by 2.26%. I'm not surprised by the incremental moves. The volatility is keeping many of us either in or out of the market.

I am still very wary of this market as the Seven Sentinels remain in an official sell status. However, there is an unofficial buy signal, but I'm still waiting for NYMO to hit a new 28 day trading high to confirm it.