The main news item today, and perhaps the catalyst that held the most sway over the market, was Fitch's downgrade of Spain's debt to AA+ from AAA. It wasn't a surprise, but that didn't stop some market participants from selling. Volume was actually higher than yesterday, which was unusal for pre-holiday trading.

On the market data front, personal income for April increased 0.4%, but personal spending was flat. Core personal consumption bumped up 0.1%, which was expected. Also, the University of Michigan's final Consumer Confidence Survey for May moved higher to 73.6. The Chicago Purchasing Managers Index for May came in a bit weaker than expected at 59.7.

None of these data points seemed to move the market today, but it was still a volatile day, which I continue to expect as part of this perceived bottoming process.

The Seven Sentinels appear closer than ever to flipping to a buy condition, in spite of the selling pressure. In fact, I think the selling helped the chances of a buy signal as yesterday's overbought condition was pretty much neutralized.

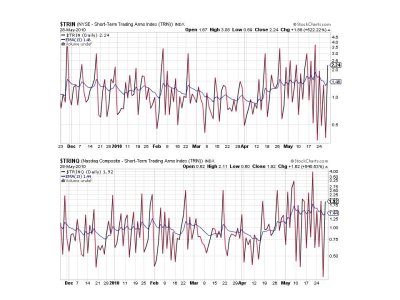

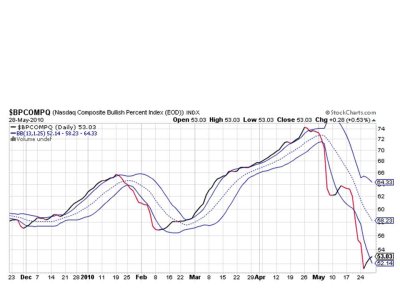

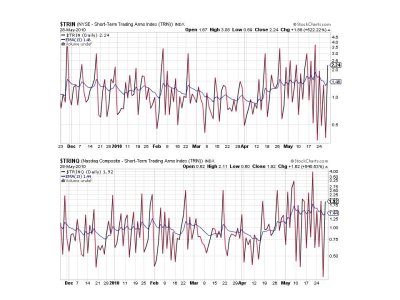

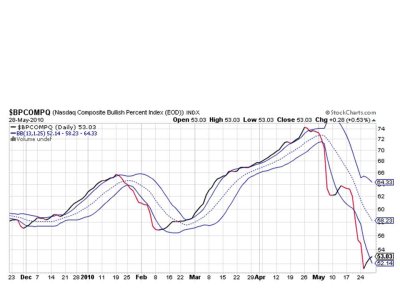

Here's the charts:

A bit of a dip today, but again it's works off the overbought condition from yesterday.

Still on buys here.

Flipped to sells today, but that helps set the system up for a buy signal should the bulls take control next week.

Yesterday, BPCOMPQ was still on a sell. Today it's a buy. So it really looks like we're poised for a turn. If we're up Tuesday, I'll be expecting a buy signal to be triggered as all 7 signals should be flashing buys.

It's possible it doesn't happen that soon, and that's okay as long as things don't fall apart, and at the moment I don't see that happening. Continue to expect volatile action in any event.

I'll be posting Top 50 and Total Tracker charts later this weekend. See you then.

On the market data front, personal income for April increased 0.4%, but personal spending was flat. Core personal consumption bumped up 0.1%, which was expected. Also, the University of Michigan's final Consumer Confidence Survey for May moved higher to 73.6. The Chicago Purchasing Managers Index for May came in a bit weaker than expected at 59.7.

None of these data points seemed to move the market today, but it was still a volatile day, which I continue to expect as part of this perceived bottoming process.

The Seven Sentinels appear closer than ever to flipping to a buy condition, in spite of the selling pressure. In fact, I think the selling helped the chances of a buy signal as yesterday's overbought condition was pretty much neutralized.

Here's the charts:

A bit of a dip today, but again it's works off the overbought condition from yesterday.

Still on buys here.

Flipped to sells today, but that helps set the system up for a buy signal should the bulls take control next week.

Yesterday, BPCOMPQ was still on a sell. Today it's a buy. So it really looks like we're poised for a turn. If we're up Tuesday, I'll be expecting a buy signal to be triggered as all 7 signals should be flashing buys.

It's possible it doesn't happen that soon, and that's okay as long as things don't fall apart, and at the moment I don't see that happening. Continue to expect volatile action in any event.

I'll be posting Top 50 and Total Tracker charts later this weekend. See you then.