___

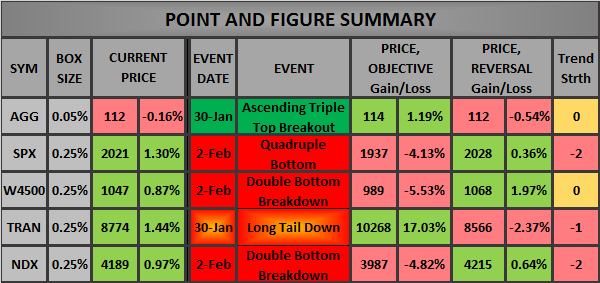

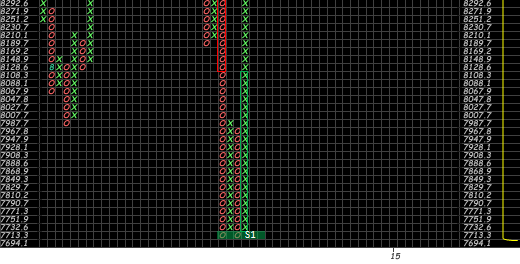

We've generated enough damage to trigger 3 bearish reversals across SPX/W4500/NDX. Meanwhile, AGG holds strong, while the Transports managed to just bounce off an area of previous support. I have no feelings about this price action, this volatility has been whipsawing us, and at this point, it's utterly exhausting to watch, so frankly I just don't care which direction it breaks, I just want a direction...

___

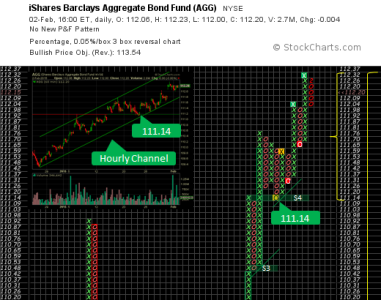

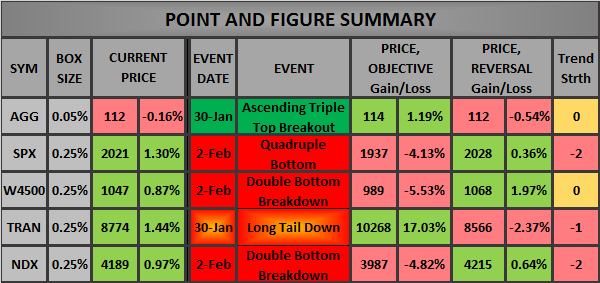

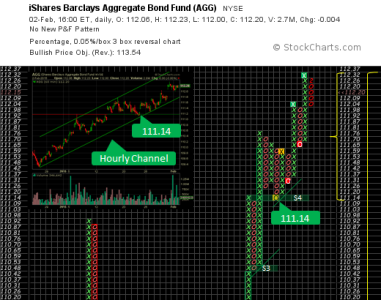

AGG

As of late, the F-Fund has been a consistent performer, taking the top slot in January with a 2.13% return.

___

SPX

___

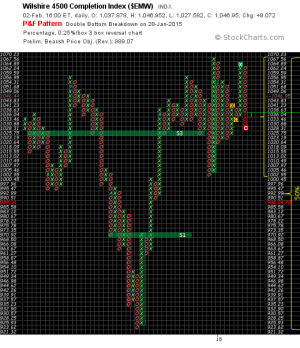

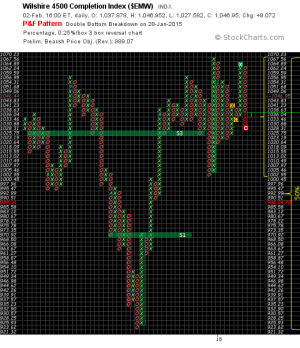

W4500

___

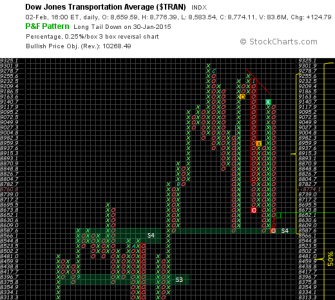

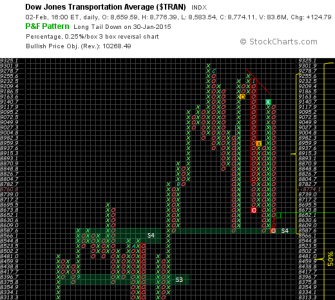

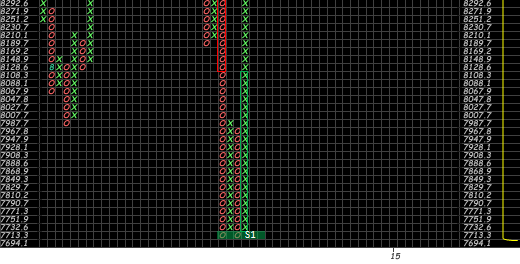

Transports

___

NASDAQ 100

___

If you missed the February report, now's a good time to catch up

Trade Hard...Jason

We've generated enough damage to trigger 3 bearish reversals across SPX/W4500/NDX. Meanwhile, AGG holds strong, while the Transports managed to just bounce off an area of previous support. I have no feelings about this price action, this volatility has been whipsawing us, and at this point, it's utterly exhausting to watch, so frankly I just don't care which direction it breaks, I just want a direction...

___

AGG

As of late, the F-Fund has been a consistent performer, taking the top slot in January with a 2.13% return.

- Going back to the December breakout of the S1 box, AGG has continued its ascension throughout the month of January, creating 4 fresh sets of 52-week highs, with little historical resistance

- S4's 111.14 as an area of key support, this is the diving board from which the triangle-like pattern broke out.

- With 2 higher Xs & Os we are in a uptrend in the short-trend and major uptrend in the long-trend.

- The hourly candlestick channel is 32 days long and has performed very well

___

SPX

- Triggers a Quadruple Bottom Breakdown with a bearish 1937 price objective

- We are .36% from a Bullish Double Top Breakout, we'll probably create a new column of Xs on the open

- 1988 level was breached, yet confirmation was withheld with a large 15-min flush of volume

- There is potential for an inverted Head & Shoulders with a 2064 price objective, to form the right shoulder, we need to pullback to about 2000

- With 1 lower X & O, we have a minor downtrend

___

W4500

- Triggers a Double Bottom Breakdown with a bearish 989 price objective

- With 1 higher X and 1 lower O, we are trendless

___

Transports

- Stopping just short of triggering a Double Bottom Breakdown, Tran maintains its bullish price objective

- At S4 we have 2 Xs and 4 Os this makes 8587 appear to be a strong level

- With 1 higher X and 2 lower Os, we are trendless

___

NASDAQ 100

- Triggers a Double Bottom Breakdown with a bearish 989 price objective, yet we still have support at S5

___

If you missed the February report, now's a good time to catch up

Trade Hard...Jason