___

As it stands now, with the S&P 500, Wilshire 4500, Transports, & NASDAQ 100, only the Transports show a bearish price objective, but all this could change for the worse, very soon.

The S&P 500 (A 20% Bear Market gets signaled 80 boxes below the top)

___

The Wilshire 4500

___

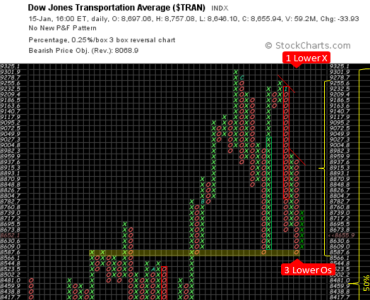

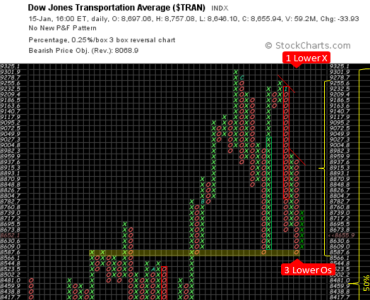

The Transportation Index

___

The NASDAQ 100

___

So what do I make of all this?

This clearly isn't the same market we are dealing with since the late 2014 oil meltdown. I don't see the markets as going down or up, I see them as re-negotiating fair market value. Let's be frank, stocks have been overpriced for some time now, once the price action equalizes, I believe the markets will resume the dominant trend, going back up. If I'm wrong, then the first sign will be a breach of the December low at 1973 (and even more importantly) the October long-tail-down at 1820.

Some of us have chosen to take risk off and that's been the right choice. I did have a window open, but chose to stay in because I believe we are closer to the bottom than the top. If I made the wrong choice, then I'll know it in the next few days and will exit to G/F. If I made the right choice, then I'll make up some of the losses, while others will jump in and reap some excellent gains. I wouldn't be surprised to see some of the market timers get 6% gains this month. Watch the winners, they tend to be the best at capitalizing on what "seems like" dire situations.

Trade hard…Jason

As it stands now, with the S&P 500, Wilshire 4500, Transports, & NASDAQ 100, only the Transports show a bearish price objective, but all this could change for the worse, very soon.

The S&P 500 (A 20% Bear Market gets signaled 80 boxes below the top)

- Is currently 21 boxes down or -5.25% thus far, this is an average pullback under less than average conditions

- Has 1 Lower X, and 1 higher Double O (trendless)

- Another -.23% at 1988 triggers a Double Bottom Breakdown

- We have minor O support at 1973, but it's a key level because it's the December low

- We have major O support at 1930, with 4 previous lows establish at this level

- We also have 1930 as a key level on the candlestick charts from the Oct 2011 to Oct 2014 Long Tail Trendline

___

The Wilshire 4500

- Has 1 lower X, with 1 higher O (trendless)

- Another -.58% at 1018.09 triggers a Double Bottom Breakdown

- We have minor O support at 1002.95 (not much support below)

___

The Transportation Index

- Has a bearish price objective that was triggered on 2 Jan (10 days ago)

- Has 1 lower X, and 3 lower Os (downtrend)

- Resting on an area where 2 previous X-highs and 2 previous O-lows reside (yellow horizontal box at 8587.6)

___

The NASDAQ 100

- Is resting on a Triple Bottom with no identifiable support below

- Another -.22% at 4080.50 triggers a Triple Bottom Breakdown (this is not a common pattern)

___

So what do I make of all this?

This clearly isn't the same market we are dealing with since the late 2014 oil meltdown. I don't see the markets as going down or up, I see them as re-negotiating fair market value. Let's be frank, stocks have been overpriced for some time now, once the price action equalizes, I believe the markets will resume the dominant trend, going back up. If I'm wrong, then the first sign will be a breach of the December low at 1973 (and even more importantly) the October long-tail-down at 1820.

Some of us have chosen to take risk off and that's been the right choice. I did have a window open, but chose to stay in because I believe we are closer to the bottom than the top. If I made the wrong choice, then I'll know it in the next few days and will exit to G/F. If I made the right choice, then I'll make up some of the losses, while others will jump in and reap some excellent gains. I wouldn't be surprised to see some of the market timers get 6% gains this month. Watch the winners, they tend to be the best at capitalizing on what "seems like" dire situations.

Trade hard…Jason