There has been no shortage of potential market moving issues so far this month. Just nine trading days into November and we've seen the election results, followed immediately by the FOMC policy statement. The FOMC policy statement contained the much anticipated QE2 decision and now one week later a potentially contentious G20 meeting. Traders have been sitting on pins and needles wondering how the market will react with each event.

We've seen some decent selling pressure so far this week, but not enough damage has been done to suggest it's been anything but a healthy consolidation period.

Today, the stock market had to contend with disappointing guidance from Cisco. The stock took heavy losses today, which didn't help the cautious mood of traders.

The dollar continued it ascent, this time posting another 0.6% advance. That's five straight trading sessions that the dollar has advanced. This could be a hint the game is about to change. The advance is being blamed on concerns revolving around the debt of Ireland, Portugal, Spain, and Italy.

Given it was Veteran's Day, no economic reports were on tap.

Here's today's charts:

NAMO and NYMO are both flashing sells.

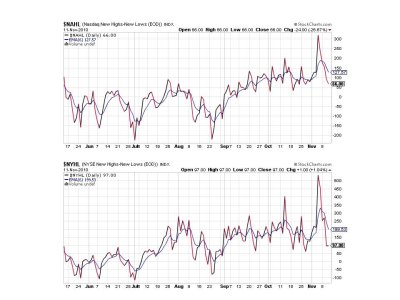

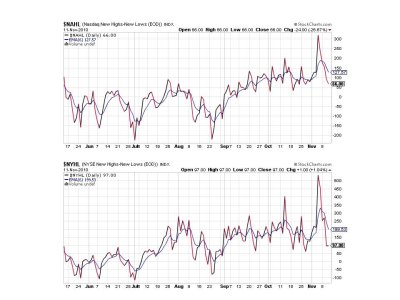

Internals look worse than yesterday as NAHL and NYHL remain on sells.

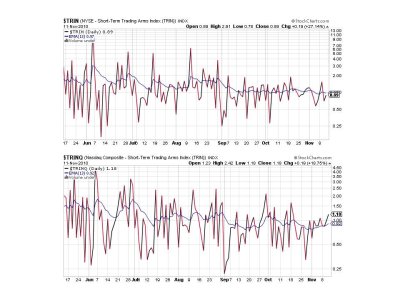

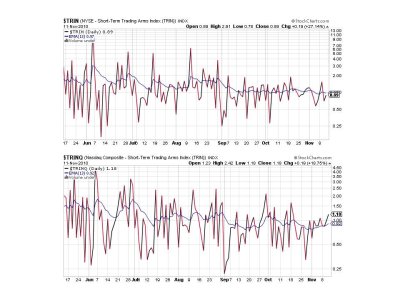

TRIN remains on a buy, but not by much. TRINQ is on a sell. There hasn't been much volatility with these two signals of late.

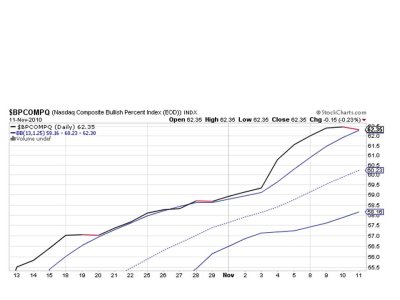

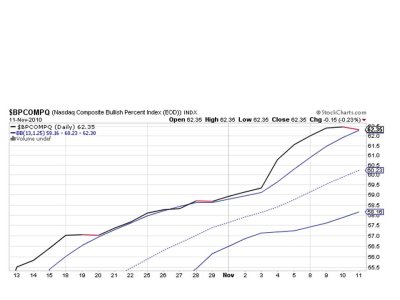

Now we get another teaser reading from BPCOMPQ. It's sitting right on that upper bollinger band and poised to flip to a sell with any further weakness. We've seen this a couple other times as you can see on this chart. Both times the signal was able to shrug off a potential sell and continued its bullish advance higher.

So 2 of 7 signals remain on buys, but only by slim margins. The system remains on a buy for now unless all 7 signals flash sells simultaneously.

At the moment we are in a bull market. Our Sentiment Survey is on a sell and we all know how well that survey has been doing this year. It's going to take a lot of bearish sentiment to get it to flip back to a buy too. We ain't there yet and at the moment the current survey is shaping up to keep it on a sell. The Sentinels, while on a buy, are deteriorating again and not far off a sell signal. But we've seen this happen several times over the past couple of weeks. The dollar has had 5 advances in a row and bonds are looking bearish in recent trading. The market appears to be changing, but how will those changes affect the stock market moving forward?

I'm still sitting on a lot of cash, but buying the next dip is not an automatic check in the box in spite of the averages successfully testing support. Given the Sentinels could potentially signal an end to the Intermediate Term advance with more selling pressure, buying the dip would not make sense.

Looks like I'll be watching from the sidelines for at least one more day.

We've seen some decent selling pressure so far this week, but not enough damage has been done to suggest it's been anything but a healthy consolidation period.

Today, the stock market had to contend with disappointing guidance from Cisco. The stock took heavy losses today, which didn't help the cautious mood of traders.

The dollar continued it ascent, this time posting another 0.6% advance. That's five straight trading sessions that the dollar has advanced. This could be a hint the game is about to change. The advance is being blamed on concerns revolving around the debt of Ireland, Portugal, Spain, and Italy.

Given it was Veteran's Day, no economic reports were on tap.

Here's today's charts:

NAMO and NYMO are both flashing sells.

Internals look worse than yesterday as NAHL and NYHL remain on sells.

TRIN remains on a buy, but not by much. TRINQ is on a sell. There hasn't been much volatility with these two signals of late.

Now we get another teaser reading from BPCOMPQ. It's sitting right on that upper bollinger band and poised to flip to a sell with any further weakness. We've seen this a couple other times as you can see on this chart. Both times the signal was able to shrug off a potential sell and continued its bullish advance higher.

So 2 of 7 signals remain on buys, but only by slim margins. The system remains on a buy for now unless all 7 signals flash sells simultaneously.

At the moment we are in a bull market. Our Sentiment Survey is on a sell and we all know how well that survey has been doing this year. It's going to take a lot of bearish sentiment to get it to flip back to a buy too. We ain't there yet and at the moment the current survey is shaping up to keep it on a sell. The Sentinels, while on a buy, are deteriorating again and not far off a sell signal. But we've seen this happen several times over the past couple of weeks. The dollar has had 5 advances in a row and bonds are looking bearish in recent trading. The market appears to be changing, but how will those changes affect the stock market moving forward?

I'm still sitting on a lot of cash, but buying the next dip is not an automatic check in the box in spite of the averages successfully testing support. Given the Sentinels could potentially signal an end to the Intermediate Term advance with more selling pressure, buying the dip would not make sense.

Looks like I'll be watching from the sidelines for at least one more day.