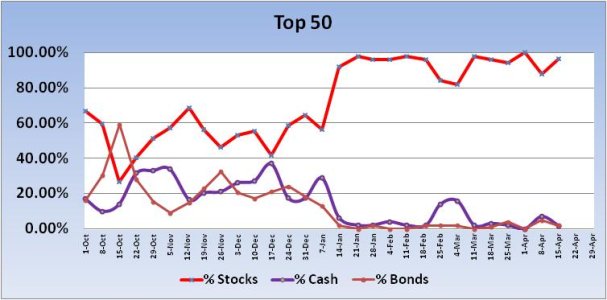

Last week, I said the Top 50 had reigned in their collective stock exposure from 100% to 88% and that last year any drop in stock allocations of more than 10% often resulted in higher prices for the major indexes by the following Friday. Last week followed that same pattern. I said I expected higher prices by week's end as a result of the drop in stock allocations and that's exactly what we got as the C fund rose 2.34% and the S fund rose 2.35%. And if one managed to jump into the I fund, it posted a 3.4% gain.

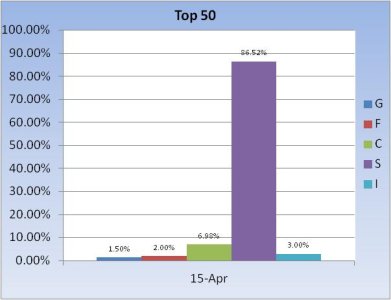

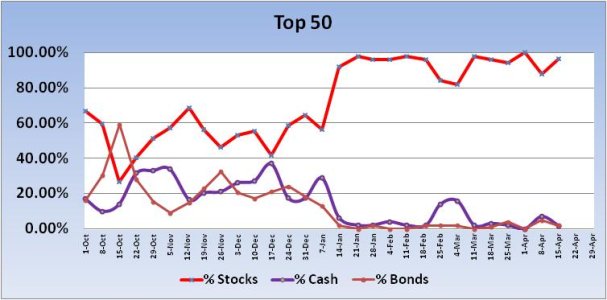

This week? No signal from the Top 50, but they did ramp their stock exposure back up again. Here's the charts:

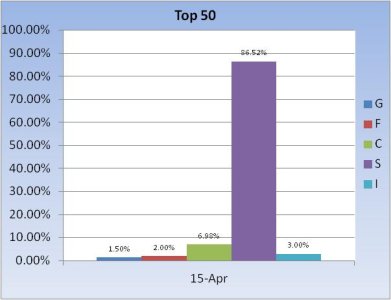

The S fund remains the overwhelming fund of choice. Stock allocations rose 8.5% overall to a total stock allocation of 96.5%.

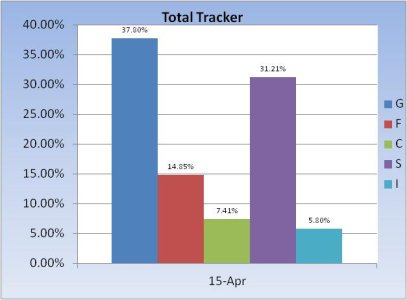

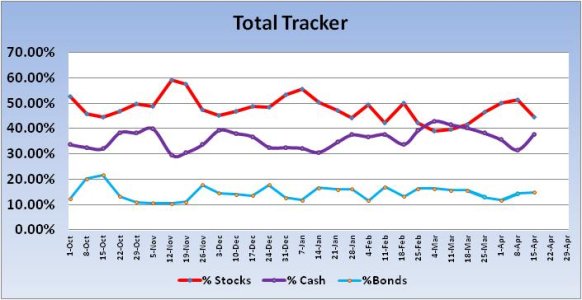

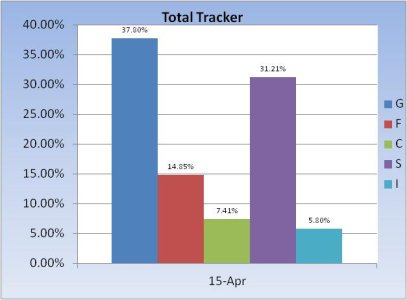

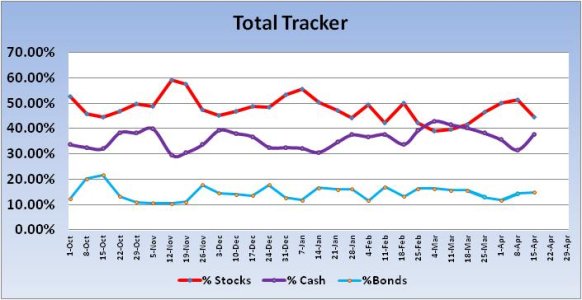

After increasing their collective stock exposure for five straight weeks, the Total Tracker showed a decrease in stock exposure for the new week. That exposure fell 6.89%, from 51.31% to just 44.42%. It was an understandable drop as technical indicators were showing weakness across the major averages the week before last. But this is still a Fed fueled market and liquidity levels are still at very high levels. It's very difficult to get a sustained move lower when fighting all that liquidity. And sentiment is helping too, as bearishness rises quickly on any negativity in this market.

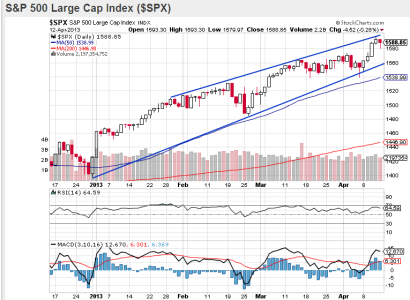

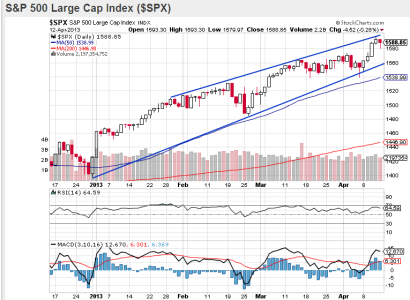

So even though technicals were looking weak by some measures just prior to last week's rally, the chart of the S&P has maintained an upward bias, staying within the boundaries of its rising channel. Price is now sitting just a few points below the upper end of that channel so we could see another pullback soon. RSI did dip a bit on Friday, but it's still giving a strong reading, while MACD dipped as well, but momentum remains decidedly positive.

Our sentiment survey came in at 49% bulls vs 40% bears, so it remains in a buy condition. I also note that the sentiment survey at AAII only had 19.3% bulls vs a whopping 54.5% bears. It's hard to get overly bearish on these numbers.

Our bond fund (AGG) rallied hard on Friday, which put price back near multi-month highs.

Given current sentiment readings, improving technicals and knowing that liquidity remains a formidable obstacle for the bears, it appears this market will remain upwardly biased.

This week? No signal from the Top 50, but they did ramp their stock exposure back up again. Here's the charts:

The S fund remains the overwhelming fund of choice. Stock allocations rose 8.5% overall to a total stock allocation of 96.5%.

After increasing their collective stock exposure for five straight weeks, the Total Tracker showed a decrease in stock exposure for the new week. That exposure fell 6.89%, from 51.31% to just 44.42%. It was an understandable drop as technical indicators were showing weakness across the major averages the week before last. But this is still a Fed fueled market and liquidity levels are still at very high levels. It's very difficult to get a sustained move lower when fighting all that liquidity. And sentiment is helping too, as bearishness rises quickly on any negativity in this market.

So even though technicals were looking weak by some measures just prior to last week's rally, the chart of the S&P has maintained an upward bias, staying within the boundaries of its rising channel. Price is now sitting just a few points below the upper end of that channel so we could see another pullback soon. RSI did dip a bit on Friday, but it's still giving a strong reading, while MACD dipped as well, but momentum remains decidedly positive.

Our sentiment survey came in at 49% bulls vs 40% bears, so it remains in a buy condition. I also note that the sentiment survey at AAII only had 19.3% bulls vs a whopping 54.5% bears. It's hard to get overly bearish on these numbers.

Our bond fund (AGG) rallied hard on Friday, which put price back near multi-month highs.

Given current sentiment readings, improving technicals and knowing that liquidity remains a formidable obstacle for the bears, it appears this market will remain upwardly biased.