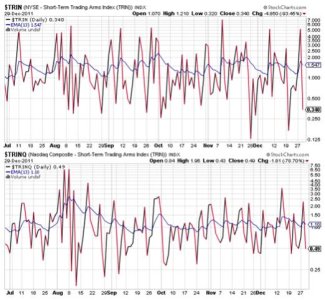

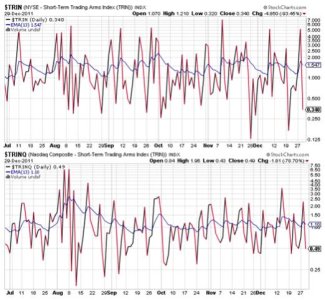

In yesterday's blog I had pointed out the very oversold condition reflected by TRIN and was relatively sure we'd see a snap back rally as a result. The market did just that, although it failed to retrace all of the previous days gains. And I suspect we'll be seeing more downside action tomorrow. But let's review today's events first.

Italy's debt auction was a mixed bag, but the market kept a positive tone in any event.

Here at home, the positive tone was supported by very low volume as only a half billion shares traded on the NYSE. That's about half the usual volume.

In economic data, pending home sales for November were up 7.3%, which was well above estimates looking for a 0.6% increase.

The Chicago PMI for December fell to 62.5 from 62.6 in the prior month. That was still better than estimates calling for a reading of 60.1.

Weekly initial jobless claims rose to 381,000 after last week's 366,000 claims. It was anticipated that 368,000 claims would be filed.

Here's today's charts:

NAMO and NYMO back higher today and crossed back above their 6 day EMAs, which flipped them back to buy conditions.

NAHL and NYHL were not able to reclaim their buy status today and remain on sells.

TRIN and TRINQ both flipped back to buys are are also both suggesting a moderately overbought market. These two signals are why I suspect we'll see selling pressure return tomorrow. I am not as confident of the selling pressure tomorrow as I was of the buying pressure today however, as seasonality helped support today's action and that situation will remain with us until mid-week next week.

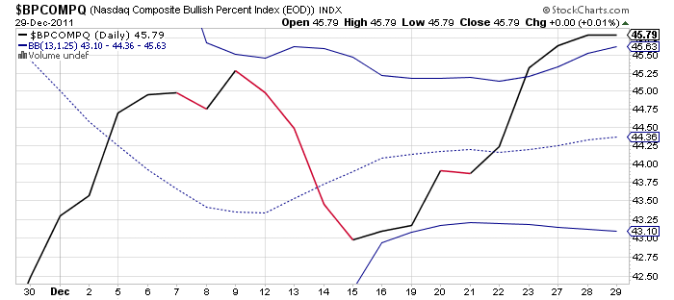

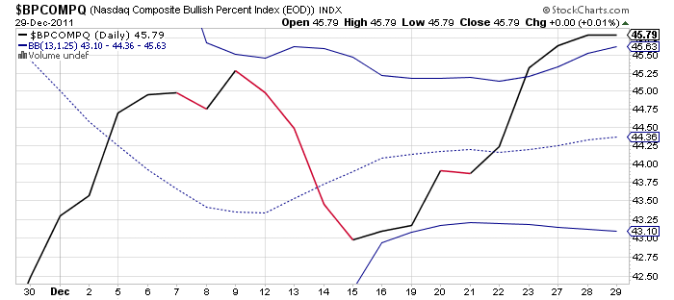

BPCOMPQ was flat today and remains on a buy, but it also seems to be running out of upside momentum. If it crosses back down through that upper bollinger band, it will flip to a sell condition. It's still too early to tell if the market is topping out by this measure, but it bears watching.

So the signals are mixed, but the system remains in a buy condition.

I sold the last of my S fund allocation today, which means I'm now 100% G fund going into the new year. I had said I'd be selling on strength, and that's what I did. I managed to capture some decent gains in December and I'm happy to stand back now and see how the new year begins risk-free. We also get fresh IFTs come Tuesday and that's another reason I was willing to stand aside. But I'm also wary of this market as I expect another shot lower in the days or weeks ahead.

Italy's debt auction was a mixed bag, but the market kept a positive tone in any event.

Here at home, the positive tone was supported by very low volume as only a half billion shares traded on the NYSE. That's about half the usual volume.

In economic data, pending home sales for November were up 7.3%, which was well above estimates looking for a 0.6% increase.

The Chicago PMI for December fell to 62.5 from 62.6 in the prior month. That was still better than estimates calling for a reading of 60.1.

Weekly initial jobless claims rose to 381,000 after last week's 366,000 claims. It was anticipated that 368,000 claims would be filed.

Here's today's charts:

NAMO and NYMO back higher today and crossed back above their 6 day EMAs, which flipped them back to buy conditions.

NAHL and NYHL were not able to reclaim their buy status today and remain on sells.

TRIN and TRINQ both flipped back to buys are are also both suggesting a moderately overbought market. These two signals are why I suspect we'll see selling pressure return tomorrow. I am not as confident of the selling pressure tomorrow as I was of the buying pressure today however, as seasonality helped support today's action and that situation will remain with us until mid-week next week.

BPCOMPQ was flat today and remains on a buy, but it also seems to be running out of upside momentum. If it crosses back down through that upper bollinger band, it will flip to a sell condition. It's still too early to tell if the market is topping out by this measure, but it bears watching.

So the signals are mixed, but the system remains in a buy condition.

I sold the last of my S fund allocation today, which means I'm now 100% G fund going into the new year. I had said I'd be selling on strength, and that's what I did. I managed to capture some decent gains in December and I'm happy to stand back now and see how the new year begins risk-free. We also get fresh IFTs come Tuesday and that's another reason I was willing to stand aside. But I'm also wary of this market as I expect another shot lower in the days or weeks ahead.