The earnings and outlook picture from reporting compaines didn't change today, it's still upbeat. But something else didn't change either, and that's another bad news report from an S&P analyst, which saw Spain's credit rating dropped from AA+ to AA. That annoucement sent stocks lower after a choppy start.

The other big news event was the latest policy statement from the Federal Open Market Committee, which was anti-climatic. But that really wasn't surprising as the Fed did what was expected and left the fed funds target rate unchanged and anticipated it will stay that way for the some time yet.

So the market finished up overall, while bonds saw some selling interest.

Tomorrow we'll get the weekly jobless claims report, which will include intial claims and continuing claims.

Today's action improved the sentinels in some ways, but saw additional weakness in others. Here's the charts:

NAMO and NYMO remain on a sell, but if we can get some follow-through buying interest quickly, these signals could flip back to a buy.

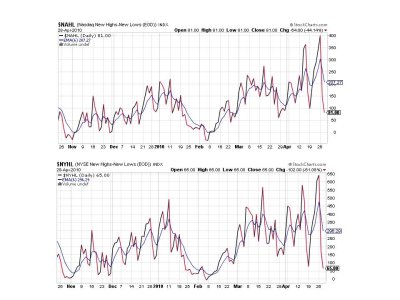

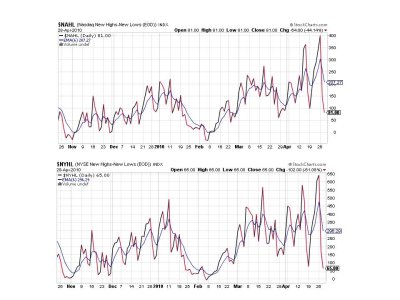

More weakness for NAHL and NYHL, which both remain on a sell.

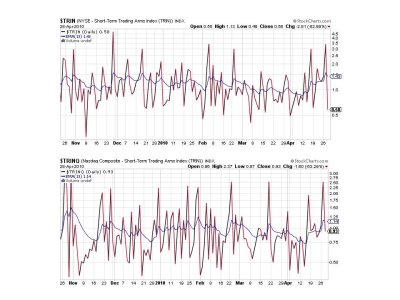

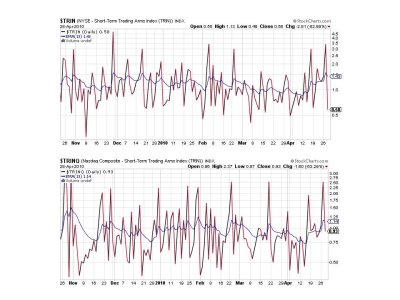

Both TRIN and TRINQ flipped back to a buy today.

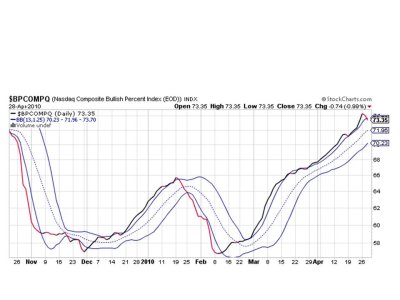

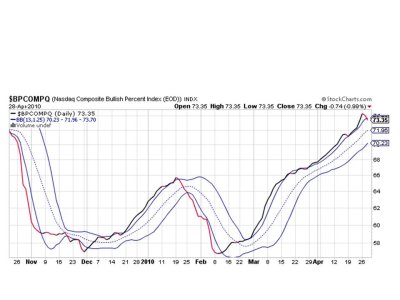

Of particular interest (and concern) was that BPCOMPQ penetrated the upper bollinger band today, which flips it to a sell. If this signal doesn't turn back up soon we have the potential of getting a system sell signal with any additional downside selling pressure.

So we have 5 of 7 signals on a sell, but TRIN and TRINQ kept the system on a buy. The most robust signal (BPCOMPQ) rolled to a sell, which may be a warning, but it could turn back up yet so we'll have to watch the action carefully.

I still believe higher prices are ahead. I'm just not sure when we'll see them. But one consolation is that we are very close to May and two new IFTs, so if the SS issues a sell signal soon we won't have to wait long, if at all, to reenter should the market turn again.

Let's hope for another run soon. See you tomorrow.

The other big news event was the latest policy statement from the Federal Open Market Committee, which was anti-climatic. But that really wasn't surprising as the Fed did what was expected and left the fed funds target rate unchanged and anticipated it will stay that way for the some time yet.

So the market finished up overall, while bonds saw some selling interest.

Tomorrow we'll get the weekly jobless claims report, which will include intial claims and continuing claims.

Today's action improved the sentinels in some ways, but saw additional weakness in others. Here's the charts:

NAMO and NYMO remain on a sell, but if we can get some follow-through buying interest quickly, these signals could flip back to a buy.

More weakness for NAHL and NYHL, which both remain on a sell.

Both TRIN and TRINQ flipped back to a buy today.

Of particular interest (and concern) was that BPCOMPQ penetrated the upper bollinger band today, which flips it to a sell. If this signal doesn't turn back up soon we have the potential of getting a system sell signal with any additional downside selling pressure.

So we have 5 of 7 signals on a sell, but TRIN and TRINQ kept the system on a buy. The most robust signal (BPCOMPQ) rolled to a sell, which may be a warning, but it could turn back up yet so we'll have to watch the action carefully.

I still believe higher prices are ahead. I'm just not sure when we'll see them. But one consolation is that we are very close to May and two new IFTs, so if the SS issues a sell signal soon we won't have to wait long, if at all, to reenter should the market turn again.

Let's hope for another run soon. See you tomorrow.