That was not expected. How do you shake up the market on an abbreviated post holiday trading day? A moderate overseas loan default, that's how. The timing of that announcement was interesting to say the least.

As you know, I've been leaning bearish for almost 2 weeks now, but not overly so. My caution flag was raised after the Seven Sentinels issued their last sell signal on the 16th of this month. I took my profits (for a change) and happily followed that signal (I did front-run it).

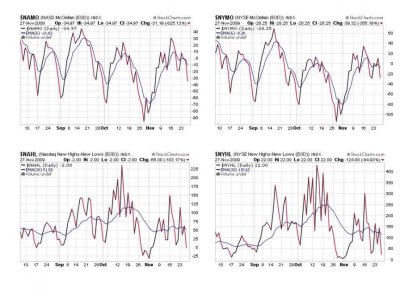

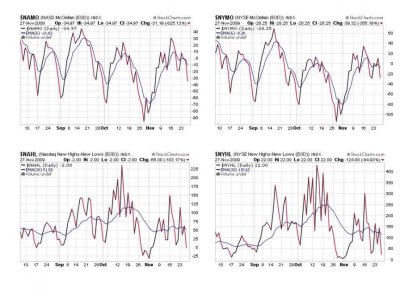

The market came close to flipping the SS to a buy on Monday, but it didn't quite make it. After looking at the charts that day I was a skeptic of any more meaningful rally this week. It was a good read. Looking at NAMO and NYMO we could see those signals did not drop too far from their respective 6 day EMAs and so I felt fairly confident that more selling was in store. I also posted a link in my blog that showed another reason for caution.

Take a look at the Summation index for the NYSE. If you look at the Jan-Feb, and May-Jun timeframes you can see a period of several weeks where the signal moved sideways and then took a dive. Also, the Aug-Oct period shows a more volatile sideways movement, and that turned down as well, but in that case the market eked out some more gains. But internals were not very good in that case. Now take a look at November. It appears the signal may be rolling over again, but this time the market may go with it as happened in the previous two examples.

http://stockcharts.com/charts/indices/McSumNYSE.html

Same story with the Nasdaq (NAMO):

http://stockcharts.com/charts/indices/McSumNASD.html

So if you're bullish, keep an open mind for at least the next week or so. I'm not necessarily calling for a sell-off, but I have reason to expect it. Plus, the Seven Sentinels have not yet issued a buy signal.

Here's the charts:

NAMO and NYMO are finally moving lower, but could easily have further to go here. All four signals are flashing sells.

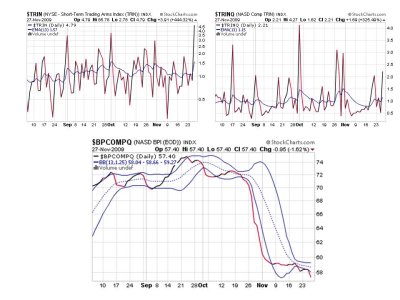

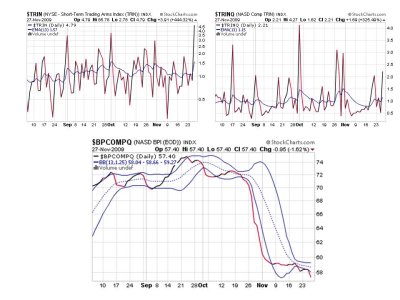

TRIN spiked. All three are an sells here and once again BPCOMPQ moves lower. This is not encouraging.

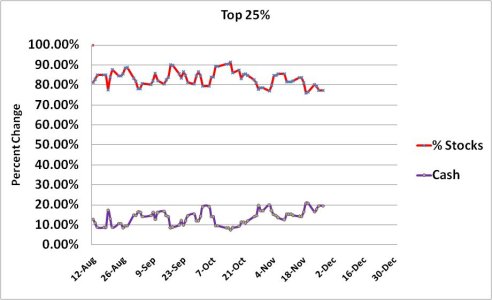

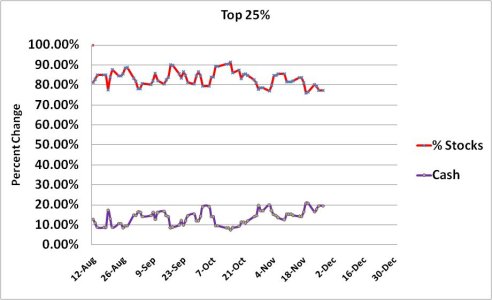

A small up-tick in cash holdings for our top 25%, but still fairly bulled up.

So there you have it. Some believe the Dubai default story was an excuse to take the market down, but the Summation Index on NAMO and NYMO may be telling us otherwise. I think we'll know the answer next week. With four big Monday rallies in a row, the next one will be a big test. Keep in mind if the market does rally out the gate Monday it could easily be a bull trap too. It would make a great set-up for one.

You know how they say bad news comes in threes? Dubai is #1. Just a thought.

Lastly, all Seven Sentinel signals are flashing a sell. See you Monday.

As you know, I've been leaning bearish for almost 2 weeks now, but not overly so. My caution flag was raised after the Seven Sentinels issued their last sell signal on the 16th of this month. I took my profits (for a change) and happily followed that signal (I did front-run it).

The market came close to flipping the SS to a buy on Monday, but it didn't quite make it. After looking at the charts that day I was a skeptic of any more meaningful rally this week. It was a good read. Looking at NAMO and NYMO we could see those signals did not drop too far from their respective 6 day EMAs and so I felt fairly confident that more selling was in store. I also posted a link in my blog that showed another reason for caution.

Take a look at the Summation index for the NYSE. If you look at the Jan-Feb, and May-Jun timeframes you can see a period of several weeks where the signal moved sideways and then took a dive. Also, the Aug-Oct period shows a more volatile sideways movement, and that turned down as well, but in that case the market eked out some more gains. But internals were not very good in that case. Now take a look at November. It appears the signal may be rolling over again, but this time the market may go with it as happened in the previous two examples.

http://stockcharts.com/charts/indices/McSumNYSE.html

Same story with the Nasdaq (NAMO):

http://stockcharts.com/charts/indices/McSumNASD.html

So if you're bullish, keep an open mind for at least the next week or so. I'm not necessarily calling for a sell-off, but I have reason to expect it. Plus, the Seven Sentinels have not yet issued a buy signal.

Here's the charts:

NAMO and NYMO are finally moving lower, but could easily have further to go here. All four signals are flashing sells.

TRIN spiked. All three are an sells here and once again BPCOMPQ moves lower. This is not encouraging.

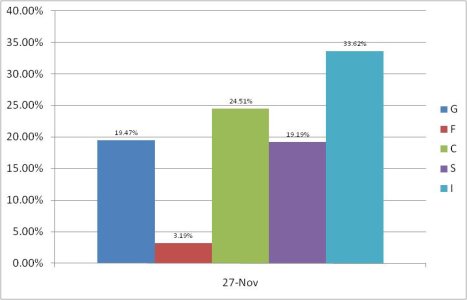

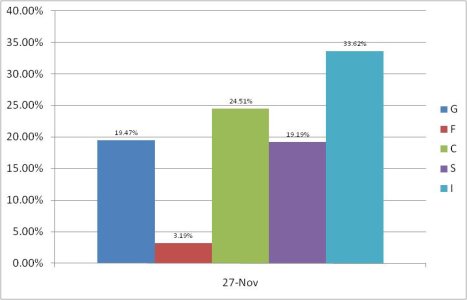

A small up-tick in cash holdings for our top 25%, but still fairly bulled up.

So there you have it. Some believe the Dubai default story was an excuse to take the market down, but the Summation Index on NAMO and NYMO may be telling us otherwise. I think we'll know the answer next week. With four big Monday rallies in a row, the next one will be a big test. Keep in mind if the market does rally out the gate Monday it could easily be a bull trap too. It would make a great set-up for one.

You know how they say bad news comes in threes? Dubai is #1. Just a thought.

Lastly, all Seven Sentinel signals are flashing a sell. See you Monday.