nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Gas low $3.33, high $3.61 average $3.47 around Boiled Peanut GA!

http://www.gasbuddy.com

http://www.gasbuddy.com

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

06/06/2011 - Updated 2:33 AM ET

Oil prices fall through $100 a barrel

By Virginia Harrison, MarketWatch

SYDNEY (MarketWatch) — Crude-oil futures extended losses in electronic trading on Monday, as worries over the strength of the U.S. recovery fueled concern about future energy demand.

Light, sweet crude oil for July delivery declined 24 cents, or 0.2%, to $99.98 a barrel on the New York Mercantile Exchange during Asian trading hours.

Disappointing U.S. economic data prompted a tepid start to the week for Asian markets, and fuelled concerns about global energy demands.

“The news coming out of the U.S. isn’t comforting at all, particularly the jobs and manufacturing data,” said Peter Esho, chief market analyst at City Index in Sydney.

“Those question marks over the U.S. economy — which is still the largest market for oil consumption — can potentially see the price drift down a little more,” Esho said.

Esho said a meeting of the Organization of the Petroleum Exporting Countries (OPEC) will drive energy market this week. http://markets.usatoday.com/custom/...-11E0-AE1C-002128049AD6}&loc=interstitialskip

I do believe that if Oil drops the dollar will be up and stocks will drop and visa versa. It has been that way for a while and I don't see anything indicating that it is reversing. Our ravaged Dollar is driving everything. I hate it!:nuts:You would think that this should be good for stocks. It used to be that oil goes down stocks go up, but lately stocks have been moving in the same direction as oil.

You guys with cheap gas are lucky.

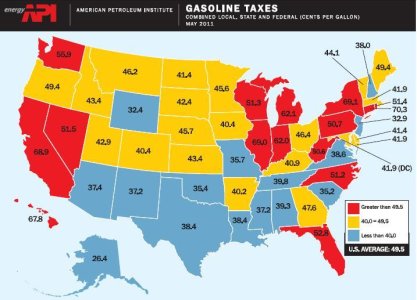

Probably (more likely) lower taxes... It's pretty obvious when you look at the map. IL, CA, NY, et al are high, the southern (SE specifically) are lower.

Taxes are only part of the story. Here is a state-by-state look at the taxes on gasoline:

View attachment 14090

My state (Michigan) has a 20 cent a gallon gas tax, plus a 6% sales tax, plus the federal 20 cents a gallon on gasoline. On the other hand, we don't have any toll roads anywhere- all roads are free. Some states have lower gasoline taxes, but have huge tolls on their highways. I guess it's all in how you want to pay for things.

Why Are California Gasoline Prices More Variable Than Others?

http://www.eia.gov/energyexplained/index.cfm?page=gasoline_regionalCalifornia prices are higher and more variable than prices in other States because there are relatively few supply sources of its unique blend of gasoline outside the State. The State of California’s reformulated gasoline program is more stringent than the Federal government’s. In addition to the higher cost of this cleaner fuel, there is a State sales tax of 2.25% on top of an 18.4 cent-per-gallon Federal excise tax and an 35.30 cent-per-gallon State excise tax. (more)