[h=1]

Oil rig counts just hit a 5-year low [/h] Published: Feb 6, 2015 4:00 p.m. ET

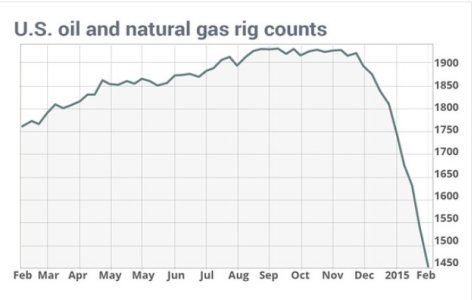

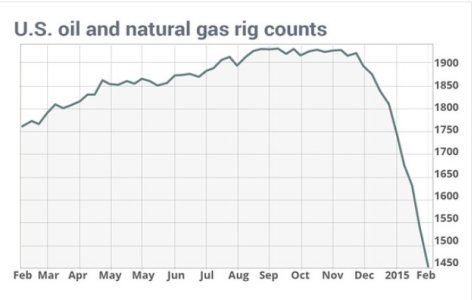

[h=2]Weekly rig count down 24% from December[/h]SAN FRANCISCO (MarketWatch) — The total number of active U.S. oil and natural-gas drilling rigs looks like it has fallen off a cliff.

As of Friday, they reached their lowest weekly level in almost five years, raising hopes that the 24% dive since early December will help remedy the nation’s supply glut.

The number of U.S. rigs actively exploring for or developing oil or natural gas fell to 1,456 as of Friday, according to data from Baker Hughes. A spokesman said that is the lowest since the week of March 26, 2010, when the count was at 1,444.

The latest total is down 5.6% from last week and down 17.8% from a year ago. The U.S. rig count totaled 1,920 back in early December, so the plunge, as illustrated in the included chart, looks dramatic:

The decline could slow oil production and that would be good news, at least to embattled energy companies, given that U.S. crude-oil supplies are at their highest level on record, based on U.S.

Energy Information Administration data dating back to the 1980s.

The supply glut was a big reason for the 46% decline in crude-oil futures prices last year. The price drop has been blamed for

massive job cuts in the energy industry.

There are some signs oil is starting to stabilize. On the New York Mercantile Exchange, light, sweet crude futures for delivery in March

CLH5, +3.68% settled at $51.69 a barrel, up $1.21, or 2.4%, for the session Friday.

“By June, U.S. production will probably stop growing and if prices don’t recover, we could see production declining in the second half of the year,” said James Williams, an energy economist at WTRG Economics.

But not everyone sees it that way.

Oil rig counts just hit a 5-year low - MarketWatch

Oil rig counts just hit a 5-year low - MarketWatch