-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

I don't think we are even close to a bottom, but what do I know?I'm thinking about trying to get in on a little bit of oil while it's in the dumps. Looking at IEO, as it seems to mirror the price of a barrel of crude oil. I guess there are other options out there - any thoughts? Just want to keep it simple. Thanks.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

EIA Petroleum Status Report

[TD="class: econo-releaseinfo"] Released On 11/5/2014 10:30:00 AM For wk10/31, 2014 [/TD]

[TD="class: actual_consensus_box_numbers"]2.1 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] 0.5 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-1.2 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] -1.4 M barrels [/TD]

[TD="class: actual_consensus_box_numbers"]-5.3 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] -0.7 M barrels [/TD]

[/TD]

[/TR]

[/TABLE]

| Economic Calendar - Bloomberg [TABLE="class: actual_consensus_box"] [TR="class: actual_consensus_toprow"] [TD] | Prior | Actual |

| Crude oil inventories (weekly change) | ||

| Gasoline (weekly change) | ||

| Distillates (weekly change) |

[TD="class: econo-releaseinfo"] Released On 11/5/2014 10:30:00 AM For wk10/31, 2014 [/TD]

[TD="class: actual_consensus_box_numbers"]2.1 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] 0.5 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-1.2 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] -1.4 M barrels [/TD]

[TD="class: actual_consensus_box_numbers"]-5.3 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] -0.7 M barrels [/TD]

[/TR]

[/TABLE]

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Energy Seen Getting Biggest Boost From Republican Senate

by Reuters

|

Rodrigo Campos & Ryan Vlastelica

|

Wednesday, November 05, 2014

NEW YORK, Nov 5 (Reuters) - While the Republican Party won't assume its Senate majority until January, U.S. stock investors are already betting the new congressional makeup could lead to faster action on pipelines and trade agreements, sending energy shares higher on Wednesday. Wall Street rose broadly in its first session after midterm elections, but energy and medical device companies - two sectors that could see a more direct impact from legislative measures - had outsized moves.

RIGZONE - Energy Seen Getting Biggest Boost From Republican Senate

by Reuters

|

Rodrigo Campos & Ryan Vlastelica

|

Wednesday, November 05, 2014

NEW YORK, Nov 5 (Reuters) - While the Republican Party won't assume its Senate majority until January, U.S. stock investors are already betting the new congressional makeup could lead to faster action on pipelines and trade agreements, sending energy shares higher on Wednesday. Wall Street rose broadly in its first session after midterm elections, but energy and medical device companies - two sectors that could see a more direct impact from legislative measures - had outsized moves.

RIGZONE - Energy Seen Getting Biggest Boost From Republican Senate

RealMoneyIssues

TSP Legend

- Reaction score

- 101

PessOptimist

Market Veteran

- Reaction score

- 67

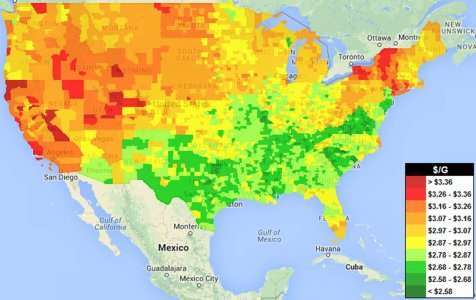

$2.76 today in Valley of the perpetual brown cloud.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

US Oil Production Continues To Rise

by Alex Mills

|

Texas Alliance of Energy Producers

|

Friday, November 07, 2014

This opinion piece presents the opinions of the author.

It does not necessarily reflect the views of Rigzone.

Crude production surpassed another milestone last week, reaching almost 9 million barrels per day (bpd), according to the Energy Information Administration, the numbers section of the Department of Energy.by Alex Mills

|

Texas Alliance of Energy Producers

|

Friday, November 07, 2014

This opinion piece presents the opinions of the author.

It does not necessarily reflect the views of Rigzone.

The EIA’s monthly data shows production at 8.97 million bpd, the highest since 1986.

In Texas, crude oil production surpassed 3 million bpd, and the Texas Petro Index set another record last month.

US crude production continues to grow, U.S. inventories climbed by 2.06 million barrels to 379.7 million barrels last week, according to the EIA report.

Crude imports dropped 5% last week to 7.1 million bpd, down 4.8% from a year ago.

The surge in production has helped push oil prices down 20% this year.

- See more at: RIGZONE - US Oil Production Continues To Rise

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

US Oil Hits Longest Weekly Losing Streak Since 1998

by Reuters

|

Sam N. Adams

|

Friday, November 07, 2014

- See more at: RIGZONE - US Oil Hits Longest Weekly Losing Streak Since 1998

by Reuters

|

Sam N. Adams

|

Friday, November 07, 2014

- See more at: RIGZONE - US Oil Hits Longest Weekly Losing Streak Since 1998

PessOptimist

Market Veteran

- Reaction score

- 67

FWIW and not much. Gas is up about $.10 here this week.

Buster

TSP Talk Royalty

- Reaction score

- 109

With oil at it's lowest since the 90's..gas should be nearer to $2.00/gal....But Noooooooooooooooo.

[TABLE="class: wsod_dataTable wsod_dataTableBig"]

[TR]

[TD="class: wsod_firstCol wsod_bold"]Light Crude

[/TD]

[TD="class: wsod_aRight"]74.80

[/TD]

[TD="class: wsod_aRight"] -3.08% today

[/TD]

[/TR]

[/TABLE]

[TABLE="class: wsod_dataTable wsod_dataTableBig"]

[TR]

[TD="class: wsod_firstCol wsod_bold"]Light Crude

[/TD]

[TD="class: wsod_aRight"]74.80

[/TD]

[TD="class: wsod_aRight"] -3.08% today

[/TD]

[/TR]

[/TABLE]