-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Dollar GAINS again! BUT may be turning around right now.

Dec. 15, 2011, 11:39 a.m. EST

Dollar gains on IMF reports; Swiss franc rallies

Swissie jumps after central bank maintains floor

By Deborah Levine and Polya Lesova, MarketWatch

NEW YORK (MarketWatch) — The dollar pared losses versus the euro on Thursday after reports that International Monetary Fund chief Christine Lagarde said the organization would seek aid from countries outside the euro-zone to help with the region’s debt crisis.

The euro was aided earlier by better data in Europe and the U.S. and a solid Spanish debt sale.

The biggest gainer among major currencies, however, was the Swiss franc, which rallied after the Swiss National Bank maintained the minimum exchange rate of 1.2 francs per euro.

The dollar index /quotes/zigman/1652083 DXY -0.32% , which measures the greenback against a basket of six major currencies including the franc, traded at 80.381, up from 80.176 earlier but still off compared to 80.538 in late North American trading on Wednesday.

http://www.marketwatch.com/story/dollar-index-edges-down-after-big-gains-2011-12-15

Dec. 15, 2011, 11:39 a.m. EST

Dollar gains on IMF reports; Swiss franc rallies

Swissie jumps after central bank maintains floor

By Deborah Levine and Polya Lesova, MarketWatch

NEW YORK (MarketWatch) — The dollar pared losses versus the euro on Thursday after reports that International Monetary Fund chief Christine Lagarde said the organization would seek aid from countries outside the euro-zone to help with the region’s debt crisis.

The euro was aided earlier by better data in Europe and the U.S. and a solid Spanish debt sale.

The biggest gainer among major currencies, however, was the Swiss franc, which rallied after the Swiss National Bank maintained the minimum exchange rate of 1.2 francs per euro.

The dollar index /quotes/zigman/1652083 DXY -0.32% , which measures the greenback against a basket of six major currencies including the franc, traded at 80.381, up from 80.176 earlier but still off compared to 80.538 in late North American trading on Wednesday.

http://www.marketwatch.com/story/dollar-index-edges-down-after-big-gains-2011-12-15

jkenjohnson

Market Veteran

- Reaction score

- 24

Dollar GAINS again! BUT may be turning around right now.

Dec. 15, 2011, 11:39 a.m. EST

Dollar gains on IMF reports; Swiss franc rallies

Swissie jumps after central bank maintains floor

By Deborah Levine and Polya Lesova, MarketWatch

NEW YORK (MarketWatch) — The dollar pared losses versus the euro on Thursday after reports that International Monetary Fund chief Christine Lagarde said the organization would seek aid from countries outside the euro-zone to help with the region’s debt crisis.

The euro was aided earlier by better data in Europe and the U.S. and a solid Spanish debt sale.

The biggest gainer among major currencies, however, was the Swiss franc, which rallied after the Swiss National Bank maintained the minimum exchange rate of 1.2 francs per euro.

The dollar index /quotes/zigman/1652083 DXY -0.32% , which measures the greenback against a basket of six major currencies including the franc, traded at 80.381, up from 80.176 earlier but still off compared to 80.538 in late North American trading on Wednesday.

http://www.marketwatch.com/story/dollar-index-edges-down-after-big-gains-2011-12-15

What do the peanut futues look like?

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

jkenjohnson

Market Veteran

- Reaction score

- 24

Boy you are a Busy Bee today!

View attachment 16597Peanuts:

http://agfax.com/2011/12/12/peanut-price-highlights-2/

I wanted to blanket the board once like Real money did. I have too much time on my hands right now.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

jkenjohnson

Market Veteran

- Reaction score

- 24

I'd best keep an eye on you, you could catch me anytime if you keep going like this!View attachment 16598

Don't think I can catch a boiled peanuT eating Hall of FAMER.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

I wanted to blanket the board once like Real money did. I have too much time on my hands right now.

I wasn't the first and I am sure that I won't be the last...

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

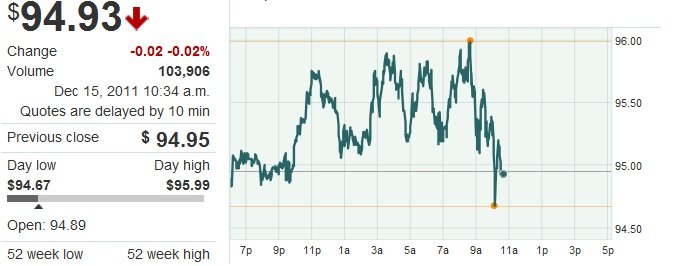

Crude Oil - Electronic (NYMEX) Jan 2012http://www.tsptalk.com/mb/attachment.php?attachmentid=16590

$94.34 -0.61 -0.64%

Dec 15, 2011 2:12 p.m.

http://www.marketwatch.com/investing/future/CRUDE OIL - ELECTRONIC

$94.34 -0.61 -0.64%

Dec 15, 2011 2:12 p.m.

http://www.marketwatch.com/investing/future/CRUDE OIL - ELECTRONIC

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Dec. 15, 2011, 2:59 p.m. EST

Oil closes at lowest since early November

http://www.marketwatch.com/story/oi...-november-2011-12-15?link=MW_home_latest_news

Oil closes at lowest since early November

http://www.marketwatch.com/story/oi...-november-2011-12-15?link=MW_home_latest_news

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Crude Oil - Electronic (NYMEX) Jan 2012

$94.37 +$0.50 +0.53%

Dec 16, 2011 7:47 a.m.

http://www.marketwatch.com/investing/future/CRUDE OIL - ELECTRONIC

$94.37 +$0.50 +0.53%

Dec 16, 2011 7:47 a.m.

http://www.marketwatch.com/investing/future/CRUDE OIL - ELECTRONIC

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Crude Oil - Electronic (NYMEX) Jan 2012http://www.tsptalk.com/mb/attachment.php?attachmentid=16607

$93.17 -$0.70 -0.75%

Dec 16, 2011 11:59 a.m.

http://www.marketwatch.com/investing/future/CRUDE OIL - ELECTRONIC

$93.17 -$0.70 -0.75%

Dec 16, 2011 11:59 a.m.

http://www.marketwatch.com/investing/future/CRUDE OIL - ELECTRONIC

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Oil seesaws between gains and losses

By Claudia Assis, MarketWatch

SAN FRANCISCO (MarketWatch) — Crude-oil futures seesawed between small gains and losses Friday, trying to snap a two-session decline amid dollar weakness and higher U.S. stocks.

http://www.marketwatch.com/story/oil-veers-in-and-out-of-the-red-tries-to-hold-94-2011-12-16

By Claudia Assis, MarketWatch

SAN FRANCISCO (MarketWatch) — Crude-oil futures seesawed between small gains and losses Friday, trying to snap a two-session decline amid dollar weakness and higher U.S. stocks.

http://www.marketwatch.com/story/oil-veers-in-and-out-of-the-red-tries-to-hold-94-2011-12-16

James48843

TSP Talk Royalty

- Reaction score

- 905

Shell Arctic drilling conditionally approved

http://finance.yahoo.com/news/shell-arctic-drilling-conditionally-approved-231429531.html

http://finance.yahoo.com/news/shell-arctic-drilling-conditionally-approved-231429531.html

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Not that great, read the conditions.Shell Arctic drilling conditionally approved

http://finance.yahoo.com/news/shell-arctic-drilling-conditionally-approved-231429531.html

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Crude Ends Slightly Lower, Capping Down Week

by Dan Strumpf

|

Dow Jones Newswires

|

Friday, December 16, 2011

https://www.rigzone.com/news/article.asp?a_id=113448&hmpn=1

by Dan Strumpf

|

Dow Jones Newswires

|

Friday, December 16, 2011

| NEW YORK (Dow Jones Newswires), Dec. 16, 2011 Crude-oil futures edged lower Friday, capping a week of steep declines spurred by growing worries about slowing oil demand. The decline marks the third straight downward session for benchmark U.S. crude and its lowest finish in six weeks. Futures fell 5.9% this week alone. Light, sweet crude for January delivery settled down 34 cents, or 0.4%, to $93.53 a barrel on the New York Mercantile Exchange. Brent crude on ICE Futures Europe recently traded up 36 cents, or 0.3%, to $103.96 a barrel. Crude-oil futures spent the week buffeted by signs that the anemic global recovery is weighing on crude-oil demand. A report showing weak gasoline demand in the U.S. spurred a steep sell-off on Wednesday that continued for two straight days. Meanwhile, concerns about Europe's sovereign debt crisis remain at the forefront of traders' minds. "It's nothing but bad news out there," said Ray Carbone, president of the oil options brokerage Paramount Options in New York. |

PessOptimist

Market Veteran

- Reaction score

- 67

Geez, it's gone up 10 cents here.