JTH

TSP Legend

- Reaction score

- 1,221

Nvidia passes Microsoft in market cap to become most valuable public company

The relentless climb of Nvidia has now put it at the top. Year-to-date it is up more than 180% and it now has the largest market cap of any company. Today it is more valuable than Microsoft. Does this chip maker really deserve this much value? Any thoughts?

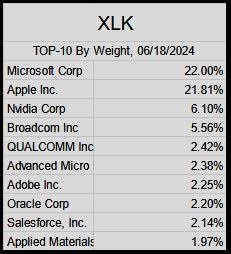

Future XLK Tech Sector Adjustments

Summary Prospectus-January 31, 2024: Modifications may be made to the market capitalization weights of single stock concentrations in order to conform to the requirements of the Internal Revenue Code of 1986

9:50 Paraphrasing: Because of Nvidia, Microsoft, & Apple, the Tech Sector XLK can't have too many stocks making up 50% of the ETF, so they will have to underweight instead of weighing by market cap. Nvidia & Microsoft will likely become the biggest weights probably 20% to 25% with a big gap down to Apple which will be in the single digits.