Tuesday I made the comment that because of the holiday, I may miss my best opportunity to sell, and while I don't know what the next day or two of trading has in store for us, I'm starting to think I may have been correct.

It's difficult to say what may happen next, but we've bounced off resistance at the upper end of the channel, and with today's decline the bears are probably thinking we're on the way back down again. And maybe we are, but that may depend on how beared up things get.

The Seven Sentinels are showing weakness now, but all in all it's not terrible...yet. And once again we see how difficult it is to pick a good exit.

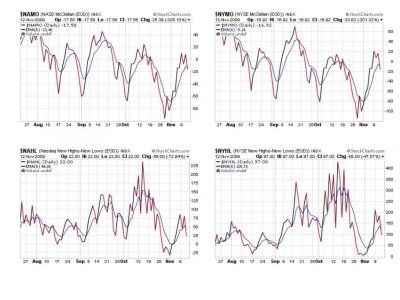

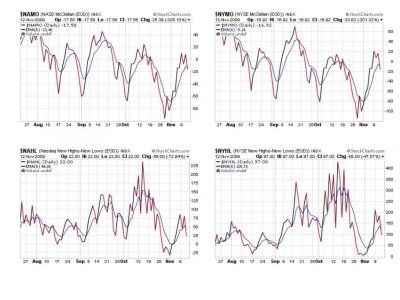

Here's the charts:

Just like that, all four signals are flashing sells here. But they are all still close to their respective 6 day ema's, which means they could flip back to buys easily.

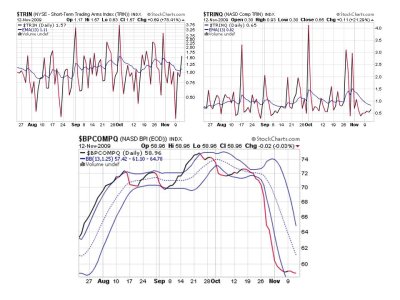

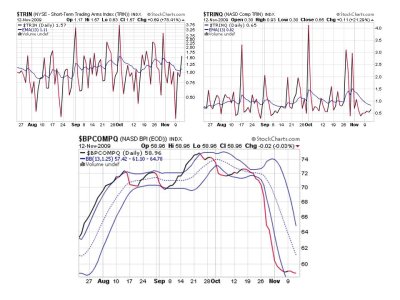

TRIN is not flashing a sell, while TRINQ holds its buy position. BPCOMPQ remains on a buy as well, but this signal has been weak all along.

So we have 5 out of 7 signals on sells with only two showing buys. This keeps the system on a buy, but it could go either way right now. With more than 2 weeks to go until November, and knowing how volatile this market is, one needs to decide how willing they are to hold their position if the selling takes hold again (and the SS issues a sell). This is one tough market.

Our top 25% could not initiate IFTs yesterday, so nothing has changed allocation wise.

I am hoping for some whipsaw action in the days ahead, and not another hard sell-off. That would give me a chance to hold some gains by selling into strength. But da boyz are bound and determined to shake off bulls and bears alike with their programmed trading. It's really tough to compete with that.

It's difficult to say what may happen next, but we've bounced off resistance at the upper end of the channel, and with today's decline the bears are probably thinking we're on the way back down again. And maybe we are, but that may depend on how beared up things get.

The Seven Sentinels are showing weakness now, but all in all it's not terrible...yet. And once again we see how difficult it is to pick a good exit.

Here's the charts:

Just like that, all four signals are flashing sells here. But they are all still close to their respective 6 day ema's, which means they could flip back to buys easily.

TRIN is not flashing a sell, while TRINQ holds its buy position. BPCOMPQ remains on a buy as well, but this signal has been weak all along.

So we have 5 out of 7 signals on sells with only two showing buys. This keeps the system on a buy, but it could go either way right now. With more than 2 weeks to go until November, and knowing how volatile this market is, one needs to decide how willing they are to hold their position if the selling takes hold again (and the SS issues a sell). This is one tough market.

Our top 25% could not initiate IFTs yesterday, so nothing has changed allocation wise.

I am hoping for some whipsaw action in the days ahead, and not another hard sell-off. That would give me a chance to hold some gains by selling into strength. But da boyz are bound and determined to shake off bulls and bears alike with their programmed trading. It's really tough to compete with that.