The day began with a stronger euro as Greece received an infusion of euros to keep it out of default. But it didn't last long as the selling took hold again, and got worse upon news that Germany will ban naked short selling of certain financial stocks, credit default swaps, and government bonds. It was another dismal day for the euro as it shed 1.5% and hit a 4-year low. The dollar rallied 1.1%

As the euro declines the selling of US equities continues and the major averages closed not far off their lows of the day. Unlike yesterday there was no real buying interest to turn things around.

I am of the opinion now that the last SS buy signal was a false signal due to extreme volatility and unwinding currencies. Where do we go from here? Let's look at the charts:

Deeper in the red here and foundering around multi-month lows.

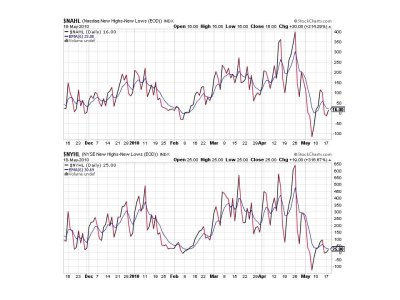

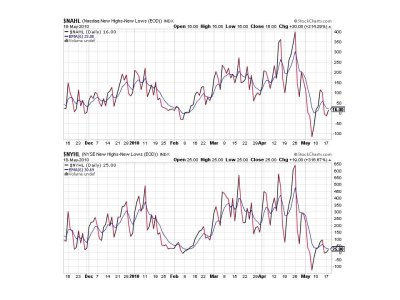

This was a bit odd, both NAHL and NYHL ticked modestly higher today in spite of the selling pressure. And they are very close to flipping to buys as their respective 6 day EMAs are dropping.

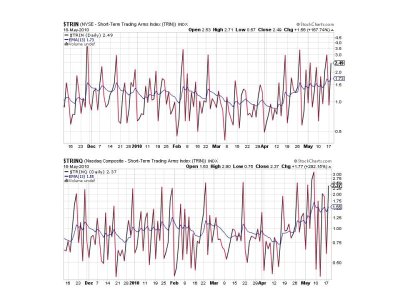

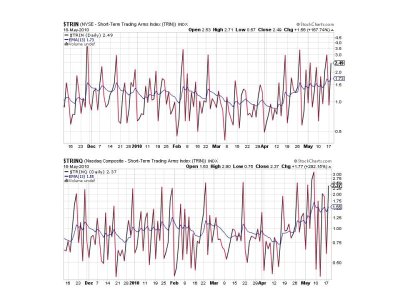

TRIN and TRINQ flipped back to sells.

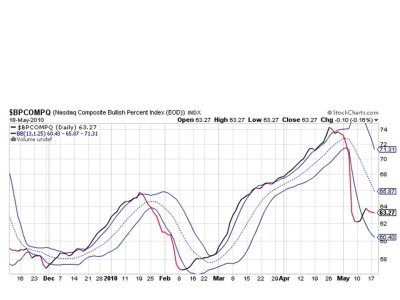

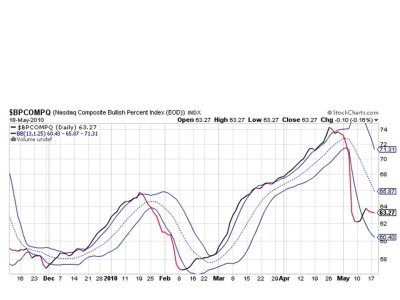

BPCOMPQ, while slightly negative today, is moving sideways and is away from a sell signal.

So we have 6 of 7 signals on a sell with BPCOMPQ the only buy. At this point I believe the last buy signal was false. I would not expect to see this much selling pressure right after a buy signal, so I am looking to lighten up, but I'm not sure exactly when. We are certainly due for a relief rally, but with the euro showing no signs of reversing its decline that rally could come at much lower levels. Sentiment is much more bearish, but that's not propping up the market either. At least not yet.

Our sentiment survey is still on a buy (neutral really), and I can't imagine it going to a sell by this Thursday's survey. I don't see a lot of activity on the tracker either, so folks appear to be holding their breath.

Have a plan in the event this market continues to deteriorate. Especially if you're in stocks. See you tomorrow.

As the euro declines the selling of US equities continues and the major averages closed not far off their lows of the day. Unlike yesterday there was no real buying interest to turn things around.

I am of the opinion now that the last SS buy signal was a false signal due to extreme volatility and unwinding currencies. Where do we go from here? Let's look at the charts:

Deeper in the red here and foundering around multi-month lows.

This was a bit odd, both NAHL and NYHL ticked modestly higher today in spite of the selling pressure. And they are very close to flipping to buys as their respective 6 day EMAs are dropping.

TRIN and TRINQ flipped back to sells.

BPCOMPQ, while slightly negative today, is moving sideways and is away from a sell signal.

So we have 6 of 7 signals on a sell with BPCOMPQ the only buy. At this point I believe the last buy signal was false. I would not expect to see this much selling pressure right after a buy signal, so I am looking to lighten up, but I'm not sure exactly when. We are certainly due for a relief rally, but with the euro showing no signs of reversing its decline that rally could come at much lower levels. Sentiment is much more bearish, but that's not propping up the market either. At least not yet.

Our sentiment survey is still on a buy (neutral really), and I can't imagine it going to a sell by this Thursday's survey. I don't see a lot of activity on the tracker either, so folks appear to be holding their breath.

Have a plan in the event this market continues to deteriorate. Especially if you're in stocks. See you tomorrow.