If I was a bear, I'd think twice about shorting this market about now given the significant strength this market showed today. Especially if this market follows its past form where big reversals typically see significant follow through.

I might ordinarily be inclined to think we could test the lows again very soon given the depth of the decline, but today's action seemed to suggest the bulls were making a statement. And it wasn't just our own market rallying hard, as overseas market saw some serious strength too.

In the news today, China increased its reserve requirement ratio by 50 basis points, which was expected, while the central bank of Japan announced a new lending facility to stimulate growth.

On the domestic front, Produce Prices and Core Producer Prices rose 0.2% each in May, which was in line with estimates.

May retail sales fell 0.2%, but compared to economist's forecast of a 0.7% slide, it was welcome news. Excluding autos, retail sales were actually up by 0.3%, which was greater than forecast.

The last time the Fed Chairman spoke to the media, the market (which was already in decline) continued to fall as Bernanke failed to spell out what the Fed would specifically do once QE2 expired. Today, Bernanke spoke to our politicians that a failure to raise the debt ceiling in a timely matter could result in severe market disruptions, but the market didn't seem to be fazed by that stance, which really wasn't new anyway.

Treasuries took a hit today amid the bullish stock frenzy, which saw the benchmark 10-year Note's yield rise to 3.10% for a 10-day high.

Let's take a look at the charts:

NAMO and NYMO both spiked higher today, easily crossing their respective 6 day EMAs.

NAHL and NYHL also flipped to buys.

TRIN and TRINQ remain on a buy from yesterday, but both suggest a short term overbought condition.

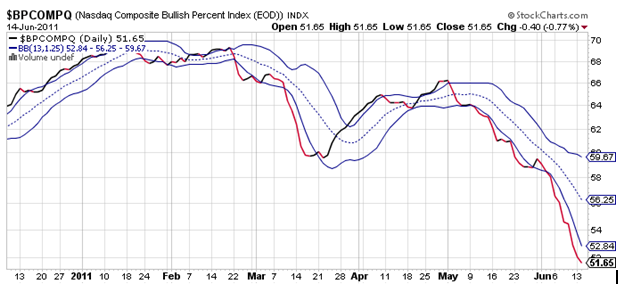

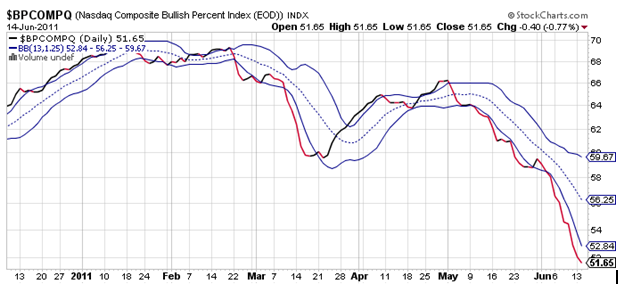

BPCOMPQ actually dipped a bit more today, but I'm not too surprised by that. It sometimes takes more than one day of action to turn this signal. A decent pop to the upside tomorrow could conceivably flip this back to a buy, but I don't want to get too far ahead of myself just yet.

So all but one signal are now in buy conditions, but BPCOMPQ remains the holdout and keeps the system on a sell. But I'd also need a 28 day trading high on NYMO to officially flip the system to a buy condition even if BPCOMPQ turns.

Here's my hunch for the next week. The bulls came out in force today after yesterday's relatively neutral action. That's a big plus for the bulls. It is also OPEX week, which has typically seen monthly lows occur around this time for the past several months. But I'm sure the market is also aware of this, so I wouldn't be surprised if the low is already in to just to throw off those folks who look for such things. Also, the FOMC makes a rate announcement next week, so a rally leading up to that event (especially after so much selling pressure) would not surprise me.

I might ordinarily be inclined to think we could test the lows again very soon given the depth of the decline, but today's action seemed to suggest the bulls were making a statement. And it wasn't just our own market rallying hard, as overseas market saw some serious strength too.

In the news today, China increased its reserve requirement ratio by 50 basis points, which was expected, while the central bank of Japan announced a new lending facility to stimulate growth.

On the domestic front, Produce Prices and Core Producer Prices rose 0.2% each in May, which was in line with estimates.

May retail sales fell 0.2%, but compared to economist's forecast of a 0.7% slide, it was welcome news. Excluding autos, retail sales were actually up by 0.3%, which was greater than forecast.

The last time the Fed Chairman spoke to the media, the market (which was already in decline) continued to fall as Bernanke failed to spell out what the Fed would specifically do once QE2 expired. Today, Bernanke spoke to our politicians that a failure to raise the debt ceiling in a timely matter could result in severe market disruptions, but the market didn't seem to be fazed by that stance, which really wasn't new anyway.

Treasuries took a hit today amid the bullish stock frenzy, which saw the benchmark 10-year Note's yield rise to 3.10% for a 10-day high.

Let's take a look at the charts:

NAMO and NYMO both spiked higher today, easily crossing their respective 6 day EMAs.

NAHL and NYHL also flipped to buys.

TRIN and TRINQ remain on a buy from yesterday, but both suggest a short term overbought condition.

BPCOMPQ actually dipped a bit more today, but I'm not too surprised by that. It sometimes takes more than one day of action to turn this signal. A decent pop to the upside tomorrow could conceivably flip this back to a buy, but I don't want to get too far ahead of myself just yet.

So all but one signal are now in buy conditions, but BPCOMPQ remains the holdout and keeps the system on a sell. But I'd also need a 28 day trading high on NYMO to officially flip the system to a buy condition even if BPCOMPQ turns.

Here's my hunch for the next week. The bulls came out in force today after yesterday's relatively neutral action. That's a big plus for the bulls. It is also OPEX week, which has typically seen monthly lows occur around this time for the past several months. But I'm sure the market is also aware of this, so I wouldn't be surprised if the low is already in to just to throw off those folks who look for such things. Also, the FOMC makes a rate announcement next week, so a rally leading up to that event (especially after so much selling pressure) would not surprise me.