- Reaction score

- 2,450

I'm not big on using the L-funds due to the nature of my investment approach, but I do have to deal with them by incorporating them in the AutoTracker.

It was news to me that there was a new fund starting today, the 2070-L fund. One of our members (thanks quabit!) let me know and I've updated the AutoTracker program so it's up and running.

Please report any issues you may find. Thanks!

From tsp.gov:

It was news to me that there was a new fund starting today, the 2070-L fund. One of our members (thanks quabit!) let me know and I've updated the AutoTracker program so it's up and running.

Please report any issues you may find. Thanks!

From tsp.gov:

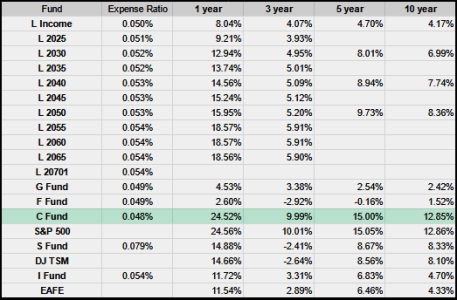

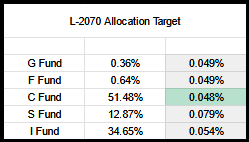

A new Lifecycle Fund is now available | The Thrift Savings Plan (TSP)A new Lifecycle Fund is now available — As of July 26, 2024, you have eleven Lifecycle Funds (L Funds) to choose from instead of the ten previously available. We added one additional L Fund, the L 2070. You can consider investing in the L 2070 Fund if you plan to begin withdrawing from your TSP account in 2068 or later, or if you were born after 2004. Each of the eleven L Funds allows you to target the time when you think you’ll need your money.