- Reaction score

- 521

From TSP.gov:

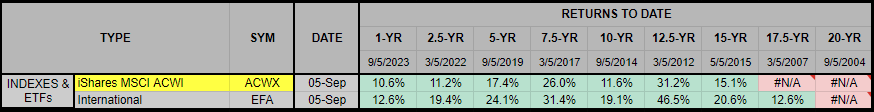

I Fund tracking new benchmark index — The I Fund information now reflects the MSCI All Country World Investable Market Index ex USA ex China ex Hong Kong Index (MSCI ACWI IMI ex USA ex China ex Hong Kong Index).

I Fund tracking new benchmark index — The I Fund information now reflects the MSCI All Country World Investable Market Index ex USA ex China ex Hong Kong Index (MSCI ACWI IMI ex USA ex China ex Hong Kong Index).