___

Eight days counting, since 30 December's Double Top Breakout, AGG maintains its bullish price objective

___

Fifteen days counting, since 18 December's Double Top Breakout, SPX maintains its bullish price objective

___

Fourteen days counting, since 19 December's Double Top Breakout, W4500 maintains its bullish price objective

___

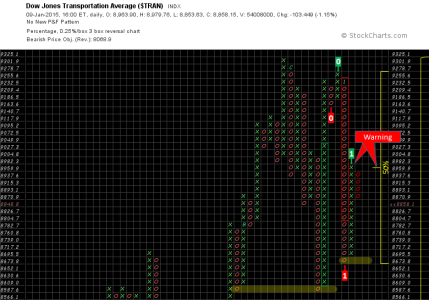

Six days counting, since 2 January's Double Bottom Breakdown, Transports maintain their bearish price objective

___

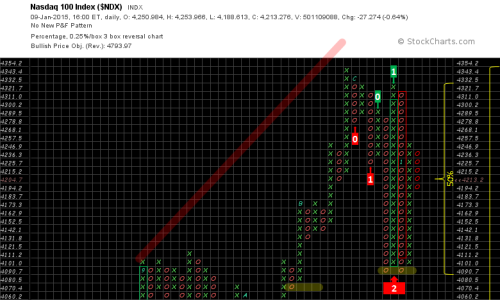

Fourteen days counting, since 19 December's Double Top Breakout, the NASDAQ 100 maintains its bullish price objective

___

Random thoughts

Trade hard…Jason

Eight days counting, since 30 December's Double Top Breakout, AGG maintains its bullish price objective

- On Tuesdays, last 8 of 11 closed up

- On Fridays, last 10 of 11 closed up

- With 1 higher X & O, AGG is in the beginning of an uptrend

- Over each of the past 8 trading days, it has traded inverse to the S&P 500

- The F-Fund is the best performing fund over the past 5 & 10 day timeframe

- From current close, a -.40% drop to 110.59 triggers a Double Bottom Breakdown

___

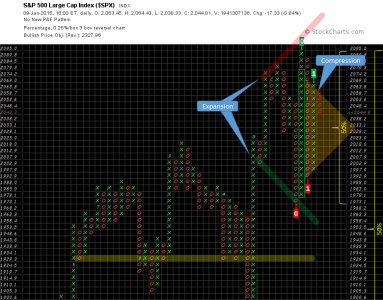

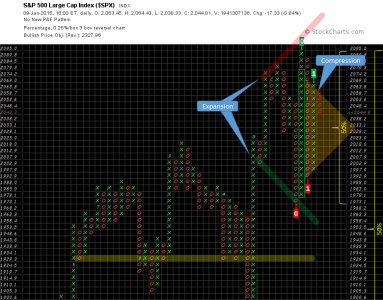

Fifteen days counting, since 18 December's Double Top Breakout, SPX maintains its bullish price objective

- Last 11 Mon/Tue/Wed dip to 45% winning ratio (concerning)

- On Thursdays last 10 of 11 closed up (amazing)

- Watch the 2030 area as a line in the sand between buyers & sellers

- With 1 lower X & 1 higher O, the S&P 500 has transitioned from expansion to compression (trendless)

___

Fourteen days counting, since 19 December's Double Top Breakout, W4500 maintains its bullish price objective

- On Monday, the Russell 2000 has a dismal 36% winning ratio with the last 7 of 11 closing down with 4 strong down days

- On Thursday, the Russell 2000 has an outstanding 82% winning ratio with the last 9 of 11 closing up with 6 strong up days

- Watch the w4500's 1035 area as a line in the sand between buyers & sellers

- With 1 lower X & 1 higher O, the Wilshire 4500 has transitioned from expansion to compression (trendless)

___

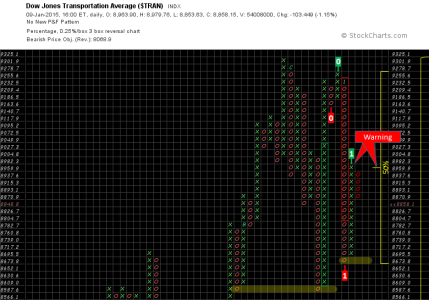

Six days counting, since 2 January's Double Bottom Breakdown, Transports maintain their bearish price objective

- With 1 lower X & 1 lower O, the Transports are in the beginning of a downtrend

- Trading below 50% of the O,1 & X,1 columns (SPX/W4500 trading above those levels) (weakest of the 4 indexes)

___

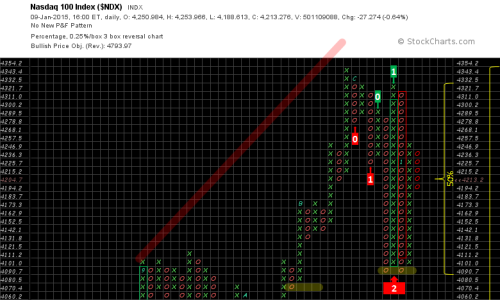

Fourteen days counting, since 19 December's Double Top Breakout, the NASDAQ 100 maintains its bullish price objective

- With 1 lower X & 2 lower Os (the 2nd O is a double bottom) the NASDAQ 100 is in a downtrend

- Trading below 50% of the O,2 & X,1 columns (SPX/W4500 trading above those levels) (2nd weakest of the 4 indexes)

___

Random thoughts

- I didn't post this because I hadn't prepared the stats, but the previous week the Down Monday/Friday indicator was triggered. The last time I posted analysis on this phenomenon it had a decent track record of showing that lower prices will be seen later in the week (and this last event proved to be the case) This last Friday closed down, so I'll be watching this Monday.

- While the S&P 500's 1st quarter has the 2nd best winning ratio, the 1st month ranks in a 5-way tie at 6th, something I like to call the mushy middle. Here's what I really don't like, the 2nd week of January ranks 26th for a 55% winning ratio, 39th for average gains of -.17% and week 3 is significantly worse (ranking in the bottom 50 of a 52 week range)

- Here's a cautionary perspective on stats, they don't work if you add too much data, it will smooth it out too much. They also don't work well if your timeframe isn't aligned with your trading style. Right now this is a timer's market, not a trender's market, so the timers have the edge and should perform better until this volatility subsides.

Trade hard…Jason