Market Quilt Monday

18 Jan 2010

18 Jan 2010

Here are the updated Quilts. As you can see, the Big 3 Golden Cross remains on a buy for all 3 time frames. But continued weakness could send the Transport's 15 minute chart into a sell, with the NASADAQ not far behind.

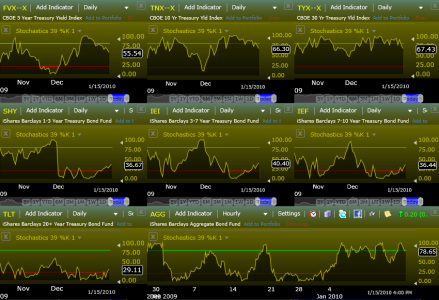

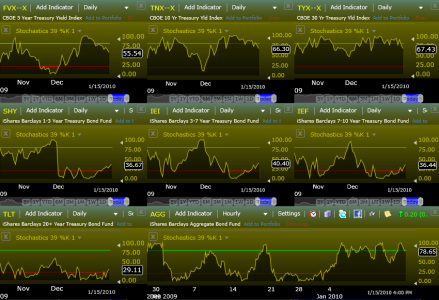

Still all yellow for the bond quilt, while they continue turning over into a buy. Amazing enough both bonds and stocks have done rather well this year, contradicting their typical inverse relationship.

As expected, the American market quilt lost some strength from Friday's action but still held up rather well.

The declining dollar continues to trade within it's descending price channel. Over the previous week the Yen and British Pound gained while the Euro faltered a bit.

The overseas I-Fund markets ended the week mixed, but the signals are still strong and we could have another great week with some combined weakness from the dollar.

Still all yellow for the bond quilt, while they continue turning over into a buy. Amazing enough both bonds and stocks have done rather well this year, contradicting their typical inverse relationship.

As expected, the American market quilt lost some strength from Friday's action but still held up rather well.

The declining dollar continues to trade within it's descending price channel. Over the previous week the Yen and British Pound gained while the Euro faltered a bit.

The overseas I-Fund markets ended the week mixed, but the signals are still strong and we could have another great week with some combined weakness from the dollar.