Retail investors see this POMO stuff as a safety net to take risks while the mutual fund machine recommends that investors buy high quality stocks. Incredibly, investors are repeating the same mistakes that have happened time and time again in believing that they have some kind of edge after reading the QE2 headline talk. "It's a guarantee that the dollar will go down." The advance-decline index which is heavily subscribed, still supports the bull case, but a look under the market's hood is looking even worse than it was in our last checkup.

As one of the lone bears out there, I've put together a few more charts that show the true waning breadth as the distribution of equities continues.

All charts courtesy of stockcharts.com

I've blacked out the names of the first two charts below, but I'd like the chart wizards to answer the Following two questions: "Which chart below would you buy? Which would you sell?"

Chart 1

Chart 2

Chart #1 is NYSE Down Volume 10 DMA and Chart #2 is NYSE Up Volume 10 DMA. I'd say that chart #1 is looking a bit more healthy than #2.

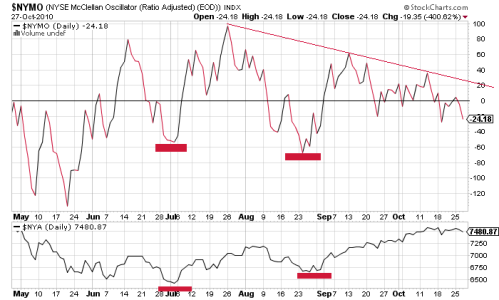

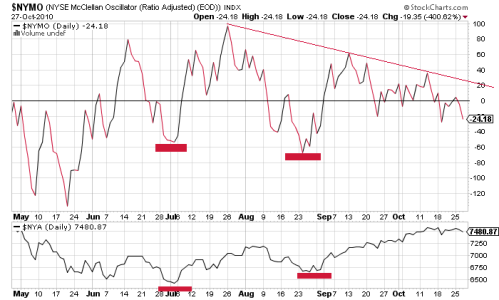

Next up, McClellan Oscillator which is back below the zero line and failed to make a higher high. Notice the two divergences with the key low points in the NYSE and the declining tops in NYMO.

More bear food here in the $BKX. Is that break of the pennant a head fake or is it a break?

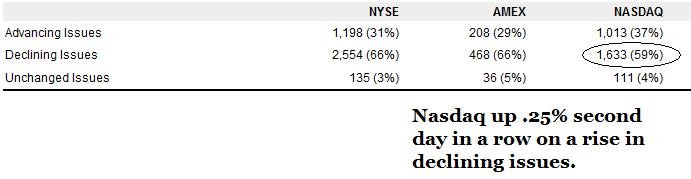

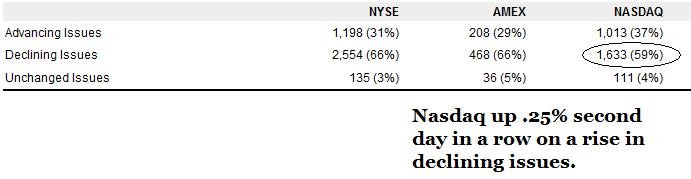

One more fun image courtesy of yahoo finance. Once again, the Nasdaq rallies on more decliners than advancers.

That's all for one night. I'm thinking that next time we'll take a look at the heartbreak taking place in the steel sector which is a better indicator than consumer discretionary AAPL iPhones.

As one of the lone bears out there, I've put together a few more charts that show the true waning breadth as the distribution of equities continues.

All charts courtesy of stockcharts.com

I've blacked out the names of the first two charts below, but I'd like the chart wizards to answer the Following two questions: "Which chart below would you buy? Which would you sell?"

Chart 1

Chart 2

Chart #1 is NYSE Down Volume 10 DMA and Chart #2 is NYSE Up Volume 10 DMA. I'd say that chart #1 is looking a bit more healthy than #2.

Next up, McClellan Oscillator which is back below the zero line and failed to make a higher high. Notice the two divergences with the key low points in the NYSE and the declining tops in NYMO.

More bear food here in the $BKX. Is that break of the pennant a head fake or is it a break?

One more fun image courtesy of yahoo finance. Once again, the Nasdaq rallies on more decliners than advancers.

That's all for one night. I'm thinking that next time we'll take a look at the heartbreak taking place in the steel sector which is a better indicator than consumer discretionary AAPL iPhones.