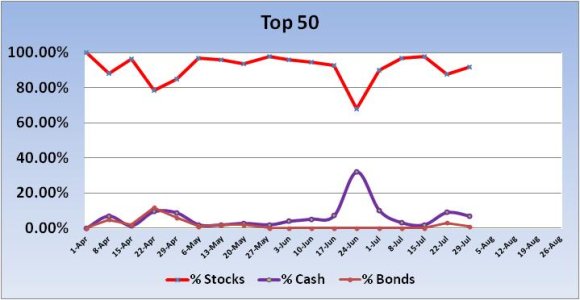

Last week I was looking higher given I had two buy signals; one from the Top 50 and one from the Total Tracker. The market ended the week mixed though, with the C and S funds dropped very modestly and the I fund posting a small gain. So while the buy signals didn't yield big gains the market remains very resilient and that counts too.

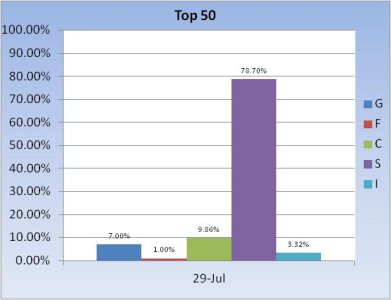

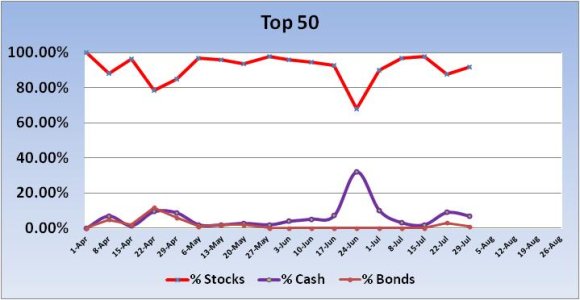

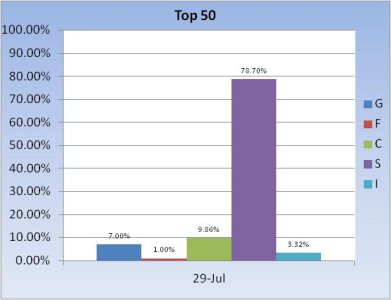

There are no signals for the new week as stock allocations only rose by 4%. I view this as bullish overall.*

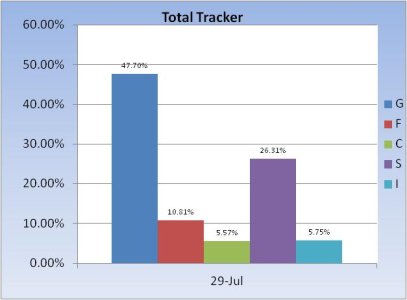

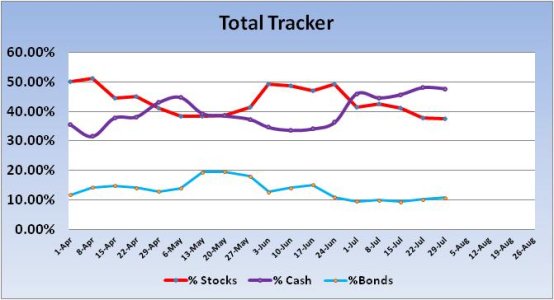

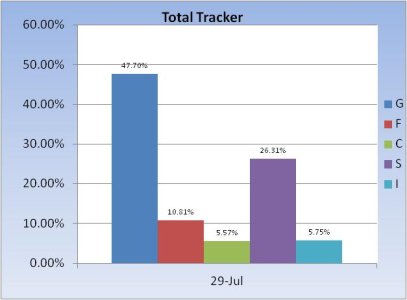

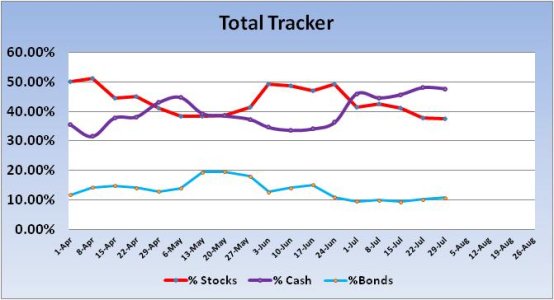

Last week, stock allocations fell by 3.58%, which was away from signal. For this week, overall stocks allocations decreased 0.04% to a total stock allocation of 37.63%. No signal as far as a one week shift in allocations go, however stock allocations remain below 40% and that’s a buy signal.*

Six gaps remains below current price. I am not expecting them to get filled in the short term. At least not the lower ones. I’ve drawn both longer term and intermediate term support lines as points of reference. Price touched the longer term support line on Friday and bounced off it. I also note the 21 day moving average crossed above the 50 day moving average. MACD had a negative signal cross this week and has been weakening overall, but the relative strength indicator remains very positive. I view this chart as modestly bullish.

Our sentiment survey came in at 42% bulls to 50% bears vs. 55% bulls to 34% bears the previous week. That’s much fewer bulls and a lot more bears. This is modestly bullish for the market.

So I'm looking higher for the week, but the market could continue to consolidate gains too. In any event, the downside should remain limited.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/.

There are no signals for the new week as stock allocations only rose by 4%. I view this as bullish overall.*

Last week, stock allocations fell by 3.58%, which was away from signal. For this week, overall stocks allocations decreased 0.04% to a total stock allocation of 37.63%. No signal as far as a one week shift in allocations go, however stock allocations remain below 40% and that’s a buy signal.*

Six gaps remains below current price. I am not expecting them to get filled in the short term. At least not the lower ones. I’ve drawn both longer term and intermediate term support lines as points of reference. Price touched the longer term support line on Friday and bounced off it. I also note the 21 day moving average crossed above the 50 day moving average. MACD had a negative signal cross this week and has been weakening overall, but the relative strength indicator remains very positive. I view this chart as modestly bullish.

Our sentiment survey came in at 42% bulls to 50% bears vs. 55% bulls to 34% bears the previous week. That’s much fewer bulls and a lot more bears. This is modestly bullish for the market.

So I'm looking higher for the week, but the market could continue to consolidate gains too. In any event, the downside should remain limited.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/.