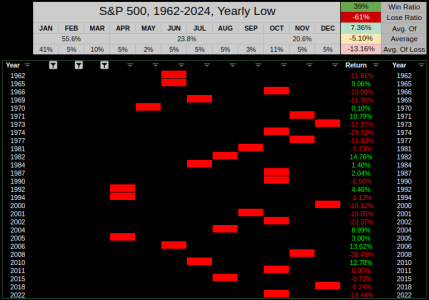

We have a new Yearly Low in March.

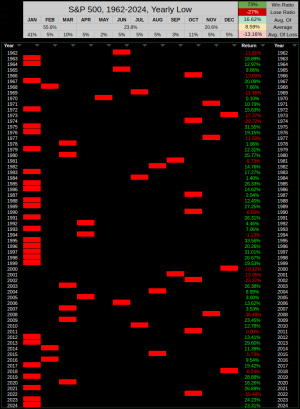

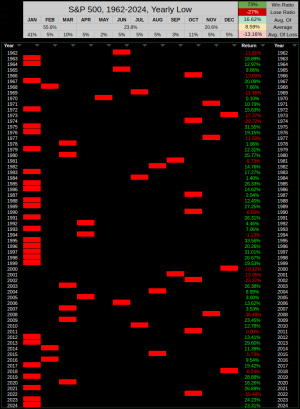

Typically the 63-Year win ratio stands at 73%

__55.6% of yearly lows fell within, the 1st Quarter, 10% in March.

__The chart below highlights the months where our yearly lows fell within.

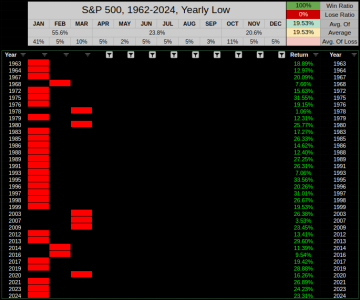

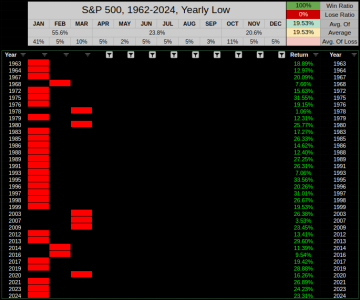

Same chart, filtered to show only the years where the yearly low fell within the 1st quarter.

__Here we have a 100% yearly win ratio, while these statistics are manipulated, it does represent 35 of 63 years or 55.6%

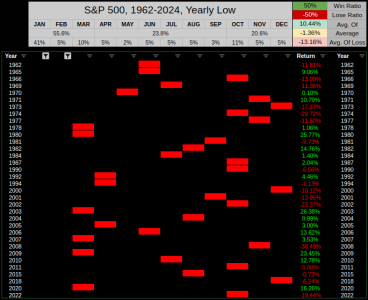

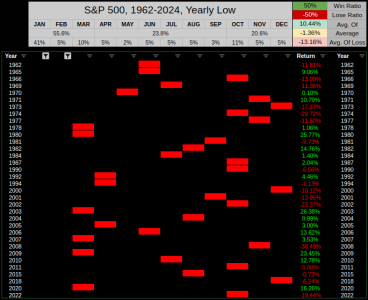

Same chart, filtered to show the years where (as with 2025) January & February were not the yearly low.

__Here we have a 50% yearly win ratio, while these statistics are cherry-picked, it does represent our current 2025 scenario.

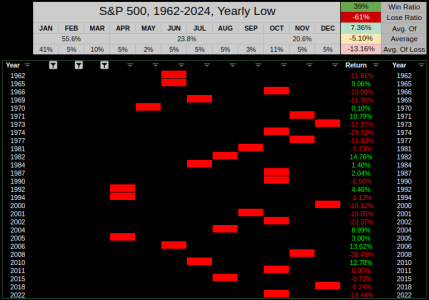

Same chart, filtered to show the years where January, February & March were not the yearly low.

__This would imply a scenario where we go lower sometime from April-December

__ Here we have a 39% yearly win ratio, it's still a bit too far out to use these stats, but the potential does exist.

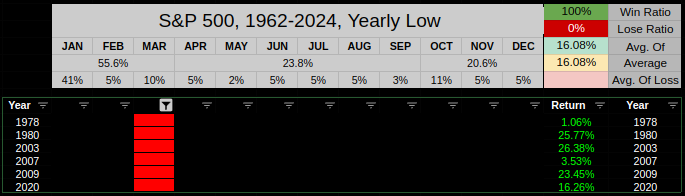

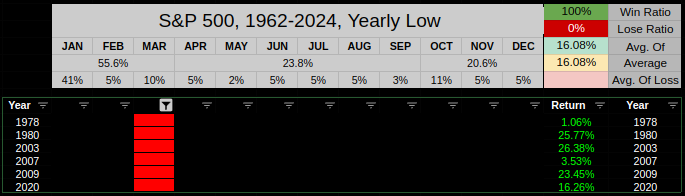

Same chart, filtered to show the years where March was the yearly low.

__This is a very limited set of data, it's only happened 6 of 63 times, but each of those 6 years did close positive.

__ Here we have a 100% yearly win ratio, of those years listed.

______March 1980 lost -10.18%, but earned 25.77% for the year.

______March 2009 earned 8.54% this was the peak low of the 2007-2009 Financial Crisis.

______March 2020 lost -12.51%, but earned 16.26% for the year.

Aside from this, we have a lot of volatile news out there, it's possible we won't bottom till mid-month, here's a few upcoming events.

___DJT state of the nation

___Steel and aluminum tariffs are set to go into effect March 12.

___US Congress nowhere close to deal to avert shutdown ahead of March 14 deadline.

Thanks for reading... Jason

Typically the 63-Year win ratio stands at 73%

__55.6% of yearly lows fell within, the 1st Quarter, 10% in March.

__The chart below highlights the months where our yearly lows fell within.

Same chart, filtered to show only the years where the yearly low fell within the 1st quarter.

__Here we have a 100% yearly win ratio, while these statistics are manipulated, it does represent 35 of 63 years or 55.6%

Same chart, filtered to show the years where (as with 2025) January & February were not the yearly low.

__Here we have a 50% yearly win ratio, while these statistics are cherry-picked, it does represent our current 2025 scenario.

Same chart, filtered to show the years where January, February & March were not the yearly low.

__This would imply a scenario where we go lower sometime from April-December

__ Here we have a 39% yearly win ratio, it's still a bit too far out to use these stats, but the potential does exist.

Same chart, filtered to show the years where March was the yearly low.

__This is a very limited set of data, it's only happened 6 of 63 times, but each of those 6 years did close positive.

__ Here we have a 100% yearly win ratio, of those years listed.

______March 1980 lost -10.18%, but earned 25.77% for the year.

______March 2009 earned 8.54% this was the peak low of the 2007-2009 Financial Crisis.

______March 2020 lost -12.51%, but earned 16.26% for the year.

Aside from this, we have a lot of volatile news out there, it's possible we won't bottom till mid-month, here's a few upcoming events.

___DJT state of the nation

___Steel and aluminum tariffs are set to go into effect March 12.

___US Congress nowhere close to deal to avert shutdown ahead of March 14 deadline.

Thanks for reading... Jason