- Reaction score

- 578

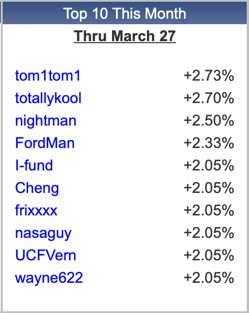

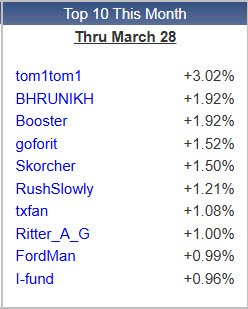

Halfway through March, I-fund heavy investors have stretched their returns further than any other TSP funds have offered. The average I-fund allocation among the top 30 returns of March is 78.5%. That includes 18 members holding 100% I-fund through the month, and nine of them have held 100% for all of 2025.

Only three of these top 30 members in March hold 0% I-fund. That includes Booster, the only member with a better return than the I-fund in March. Booster is outpacing the I-fund by 0.01%. Their 1.57% March return has come from time in the G-fund, then the S-fund, and now the F-fund. Their market maneuvering has kept them in pace with the I-fund without touching the fund.

This month has also favored those who have not participated in this market. Members who have held 100% G-fund all month are tied for the 44th-best return in March, which includes 18 members who are within the Top 50 best returns for 2025.

Keep an eye on when these top members begin to re-enter stocks with the Last Look Report.

Other members either jumped back into the U.S. stocks too early or have never abandoned their stock holdings through the sell-off.

Betting on the market to bounce back has not been the short-term approach, but investors who have a long-term bullish outlook on the market are happy to pay the current prices for the C and S-funds. This can include investors who are continuously contributing income to their TSPs. They should want to buy these funds at a lower price. Investors who have already accumulated a healthy sum in their TSP are likely in protection mode until the market proves itself.

Only three of these top 30 members in March hold 0% I-fund. That includes Booster, the only member with a better return than the I-fund in March. Booster is outpacing the I-fund by 0.01%. Their 1.57% March return has come from time in the G-fund, then the S-fund, and now the F-fund. Their market maneuvering has kept them in pace with the I-fund without touching the fund.

This month has also favored those who have not participated in this market. Members who have held 100% G-fund all month are tied for the 44th-best return in March, which includes 18 members who are within the Top 50 best returns for 2025.

Keep an eye on when these top members begin to re-enter stocks with the Last Look Report.

Other members either jumped back into the U.S. stocks too early or have never abandoned their stock holdings through the sell-off.

Betting on the market to bounce back has not been the short-term approach, but investors who have a long-term bullish outlook on the market are happy to pay the current prices for the C and S-funds. This can include investors who are continuously contributing income to their TSPs. They should want to buy these funds at a lower price. Investors who have already accumulated a healthy sum in their TSP are likely in protection mode until the market proves itself.