Interesting article, I've noticed this for some time and know quite a few people who make good salaries and are in a similar position.

A lot can be blamed on the 2008-09 meltdown. Not only did some nest-eggs go from healthy amounts to near nothing, but then cash strapped families in bad mortgages as well as the millions who lost their jobs (there were millions of jobs lost) had to dip into their 401K'a to survive, many totally depleting them.

Another longer term symptom...401K's are not what they used to be. Back in the 90's they had much more generous matching than TSP...I knew a few folks who had 8% matching.

Today, nearly a third of companies who offer 401K offer NO Matching. For those who match, average matching is much lower than the 1990s also, near 4%.

And lets face it...we are poor savers, Its the human condition. Especially in our consumer economy where every commercial urges you to use your credit card to keep up with the Jones's.

Make no mistake, this is a huge crisis. And a big part of wage stagnation and no inflation. With an ever increasing senior population, we have a bigger and bigger portion of America that can't afford to pay higher prices for anything. That affects the costs of products, which stays the same, and the salaries/wages that produce those products then stay the same. In the very short term, I guess that is good for us. But not for long.

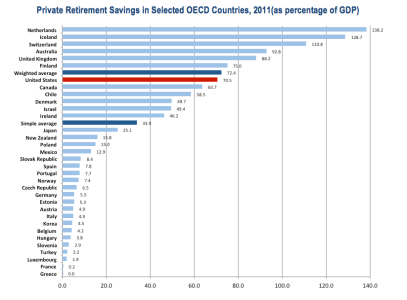

We need 401K laws like other nations have. Mandatory contributions from your paycheck of at least 3%. Mandatory matching of at least 5%.

And a lockbox...no dipping into your fund is allowed. Australia has this. Some might say this is too much Big Gov't, but we as a nation have proven we can't save for our retirement without the nanny to spank us once in a while. And the crisis they are creating is affecting as all.