There was wasn't much news to drive the market today and volume fell off sharply as a result. Perhaps the biggest event was the new austerity measures that Italy approved. And their bonds are still attracting buyers, although that didn't prevent the market from dropping.

I suppose it was notable that there wasn't much volume behind the selling pressure, which isn't encouraging if one is bearish.

Here's tonight's charts:

Back to sells for NAMO and NYMO.

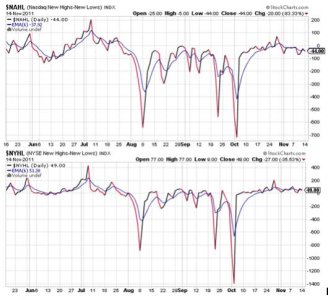

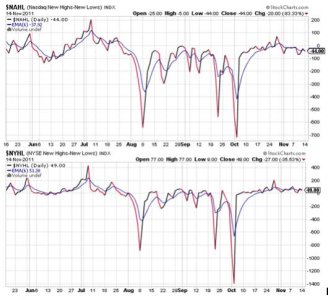

NAHL and NYHL also flipped back to sells.

TRIN and TRINQ moved higher, pushing them back to sells too, although they are largely neutral after today.

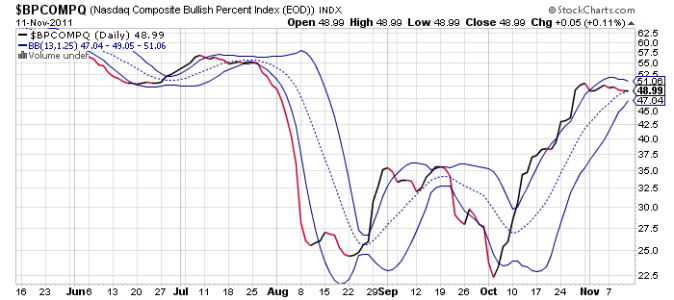

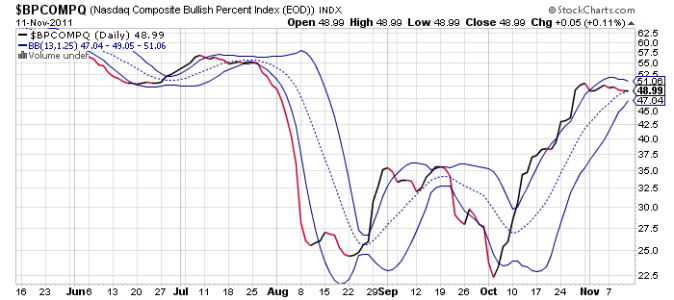

BPCOMPQ moved just a bit lower in its mostly sideways movement, while the bollinger bands continue to collapse around the signal. It also remains in a sell condition.

So all signals are back to sells, which means I have a third unconfirmed sell signal in as many trading weeks.

I suspect this market is setting up for a larger move, but I can't be sure which way it will be. The Seven Sentinels do remain in a buy condition, but three unconfirmed sell signals in three weeks makes me cautious, although not overly bearish given seasonality. It's possible the market is building up some pressure for a launch through resistance, and it could come from lower. But support has been holding too, so it's now a waiting game to see which one breaks first.

I suppose it was notable that there wasn't much volume behind the selling pressure, which isn't encouraging if one is bearish.

Here's tonight's charts:

Back to sells for NAMO and NYMO.

NAHL and NYHL also flipped back to sells.

TRIN and TRINQ moved higher, pushing them back to sells too, although they are largely neutral after today.

BPCOMPQ moved just a bit lower in its mostly sideways movement, while the bollinger bands continue to collapse around the signal. It also remains in a sell condition.

So all signals are back to sells, which means I have a third unconfirmed sell signal in as many trading weeks.

I suspect this market is setting up for a larger move, but I can't be sure which way it will be. The Seven Sentinels do remain in a buy condition, but three unconfirmed sell signals in three weeks makes me cautious, although not overly bearish given seasonality. It's possible the market is building up some pressure for a launch through resistance, and it could come from lower. But support has been holding too, so it's now a waiting game to see which one breaks first.