Neither the Top 50 or the Total Tracker charts revealed much change in allocations going into the new trading week.

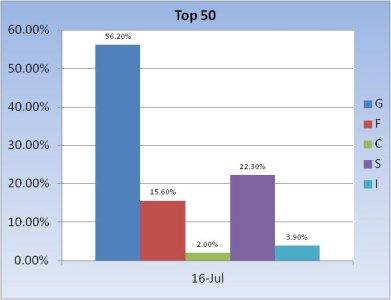

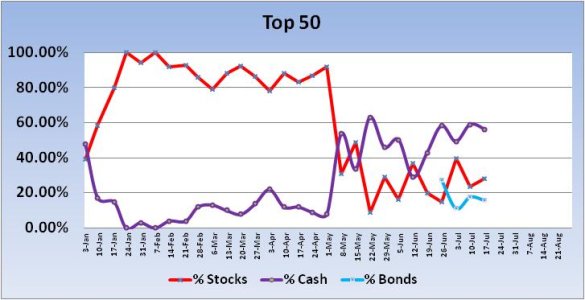

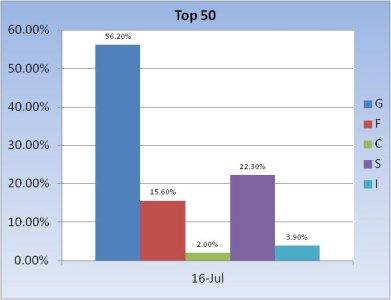

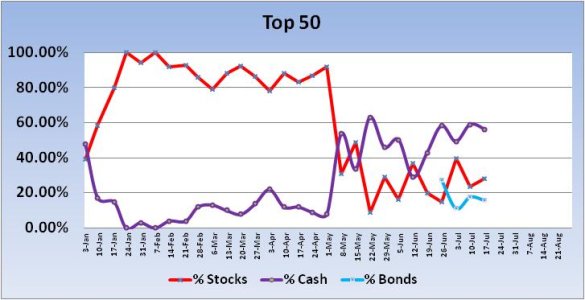

The Top 50 did increase their total stock allocation by 4.8%, although that only brought their collective stock holdings to 28.2%. The end of week rally may have enticed a bit of buying given the S&P held its 50 dma on Thursday, with significant follow through to the upside on Friday. But again, with only a 28.2% total allocation, this group remains quite bearish.

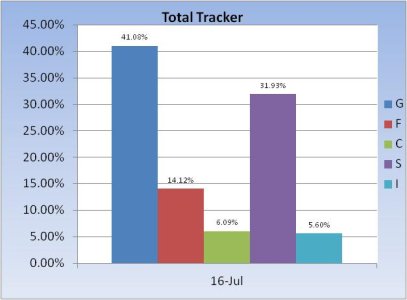

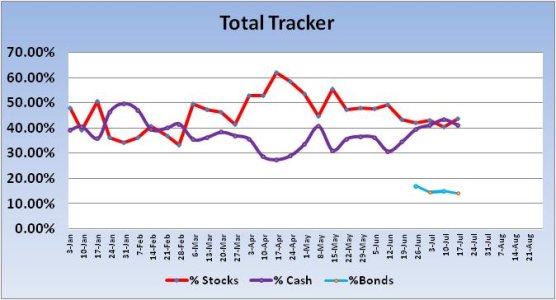

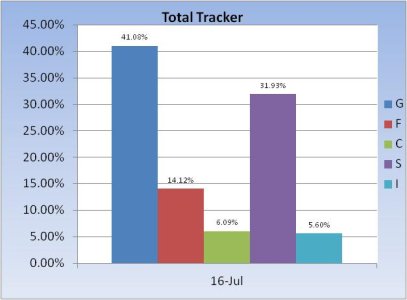

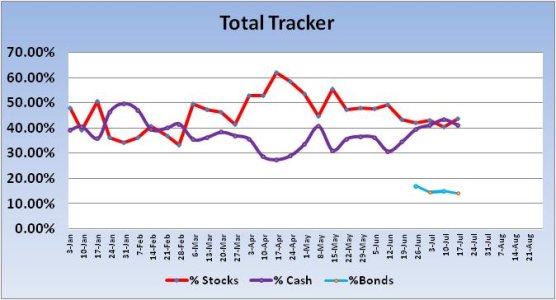

The Total Tracker also showed a bit of buying as this group increased their total stock allocation by 3.15% for a total allocation of 43.62%.

So both groups remain decidedly bearish, which once again was reflected in our sentiment survey. That remained in a buy condition for the 13th straight week.

The Top 50 did increase their total stock allocation by 4.8%, although that only brought their collective stock holdings to 28.2%. The end of week rally may have enticed a bit of buying given the S&P held its 50 dma on Thursday, with significant follow through to the upside on Friday. But again, with only a 28.2% total allocation, this group remains quite bearish.

The Total Tracker also showed a bit of buying as this group increased their total stock allocation by 3.15% for a total allocation of 43.62%.

So both groups remain decidedly bearish, which once again was reflected in our sentiment survey. That remained in a buy condition for the 13th straight week.