The major averages didn't stray too far from the neutral line for a good part of the trading day today as market participants waited for the release of the latest FOMC Policy Statement. When the statement came it showed that FOMC board members had voted unanimously to keep the fed funds target between 0.00% to 0.25% and reiterated that low levels will continue for an extended period of time. The Fed also plans to complete its $600 billion purchase of longer-term Treasuries by the end of June.

Stocks didn't waver too much after the announcement, but Ben Bernanke also had a press conference scheduled following the FOMC policy release. In that conference he stated that the Fed is now looking for the 2011 GDP to be in the range of 2.7% to 2.9%, which is lower than their April expectation of 3.1% to 3.3%. The Chair also stated that unemployment for 2011 is now expected to range from 8.6% to 8.9%, which was revised up from their previous expectation of 8.4% to 8.7%. Core inflation for 2011 had previously been expected to range between 1.3% and 1.6%, but was revised higher to 1.5% to 1.8%.

In the final hour of trade after the press conference concluded, stocks rolled over to moderate losses.

Let's take a look at the charts:

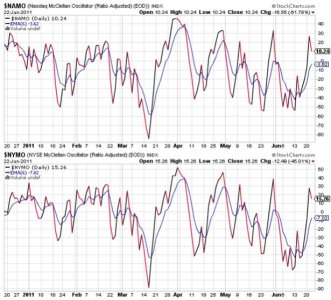

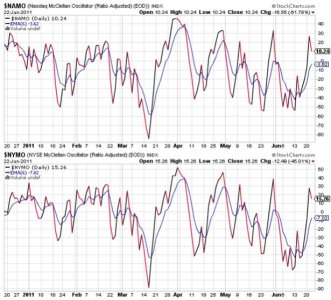

NAMO and NYMO both dipped a bit today, but remain in positive territory and in buy conditions.

NAHL and NYHL had only subtle movement and also remain in a buy condition.

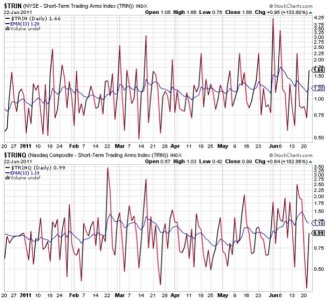

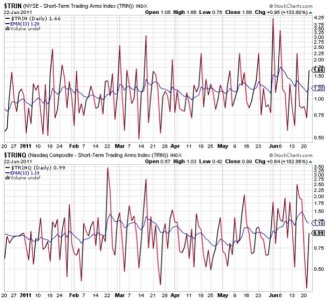

Yesterday, TRIN and TRINQ were screaming "overbought market" and highly suggested weakness would come in the short term. Obviously it did, and now that overbought condition is gone. Both are relatively neutral now, but TRIN flipped to a sell as a result of today's selling pressure.

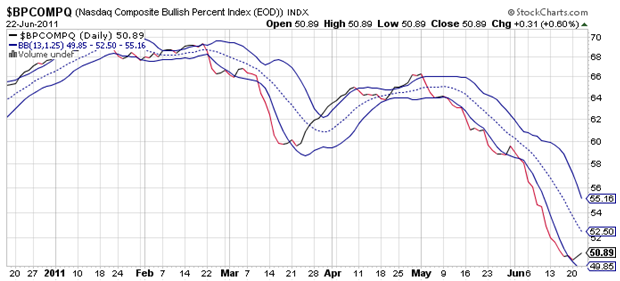

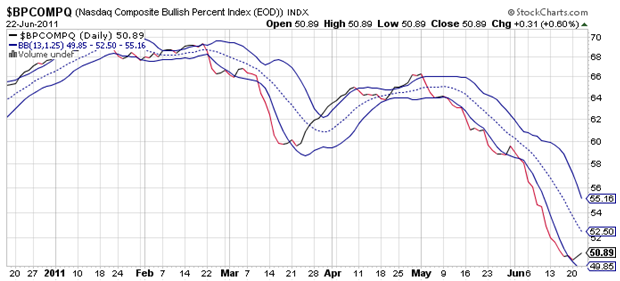

BPCOMPQ lifted upward a bit more today and is making these charts appear more bullish. It remains in a buy condition.

So all but one signal are in a buy status, which keeps the system is in an "UNCONFIRMED" buy condition. But officially, it remains in a sell condition as NYMO has not tagged a fresh 28 day trading high.

So far, the market has survived Greece's financial scare and today's FOMC announcement (and press conference) didn't do any real damage to the short term rally (thus far). I'm thinking that given this is the end of the quarter, window dressing could be at play for a few days yet. That's been the end-of-month theme of late and this month may or may not be any different. But it's something to be aware of if one is holding a heavy stock position. I do not think we are out of the woods yet and officially the Seven Sentinels remain on an intermediate term sell.

Currently, I am 100% S fund and looking to lighten up on any further strength as I cannot be sure the current rally will continue nor can I be sure the Sentinels will flip to a new intermediate term buy condition.

Stocks didn't waver too much after the announcement, but Ben Bernanke also had a press conference scheduled following the FOMC policy release. In that conference he stated that the Fed is now looking for the 2011 GDP to be in the range of 2.7% to 2.9%, which is lower than their April expectation of 3.1% to 3.3%. The Chair also stated that unemployment for 2011 is now expected to range from 8.6% to 8.9%, which was revised up from their previous expectation of 8.4% to 8.7%. Core inflation for 2011 had previously been expected to range between 1.3% and 1.6%, but was revised higher to 1.5% to 1.8%.

In the final hour of trade after the press conference concluded, stocks rolled over to moderate losses.

Let's take a look at the charts:

NAMO and NYMO both dipped a bit today, but remain in positive territory and in buy conditions.

NAHL and NYHL had only subtle movement and also remain in a buy condition.

Yesterday, TRIN and TRINQ were screaming "overbought market" and highly suggested weakness would come in the short term. Obviously it did, and now that overbought condition is gone. Both are relatively neutral now, but TRIN flipped to a sell as a result of today's selling pressure.

BPCOMPQ lifted upward a bit more today and is making these charts appear more bullish. It remains in a buy condition.

So all but one signal are in a buy status, which keeps the system is in an "UNCONFIRMED" buy condition. But officially, it remains in a sell condition as NYMO has not tagged a fresh 28 day trading high.

So far, the market has survived Greece's financial scare and today's FOMC announcement (and press conference) didn't do any real damage to the short term rally (thus far). I'm thinking that given this is the end of the quarter, window dressing could be at play for a few days yet. That's been the end-of-month theme of late and this month may or may not be any different. But it's something to be aware of if one is holding a heavy stock position. I do not think we are out of the woods yet and officially the Seven Sentinels remain on an intermediate term sell.

Currently, I am 100% S fund and looking to lighten up on any further strength as I cannot be sure the current rally will continue nor can I be sure the Sentinels will flip to a new intermediate term buy condition.