So what is going on with the Banks? Fed injecting money? Why?? Liquidity squeeze?

I just saw

Year end sees record borrowing from Fed's Standing Repo Facility

By

Michael S. Derby

December 31, 20254:23 PM ESTUpdated 8 hours ago

A man passes by the Federal Reserve Bank of New York in New York City, U.S., March 13, 2023. REUTERS/Brendan McDermid/File Photo

Purchase Licensing Rights, opens new tab

- Summary

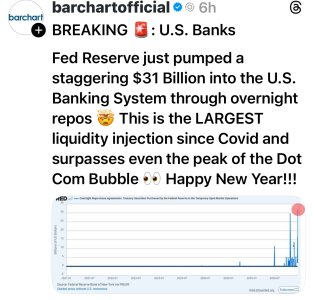

- Financial firms borrowed $74.6 billion from SRF on final trading day of 2025

- Year-end liquidity needs drive record borrowing from New York Fed's SRF

- SRF usage unlikely to signal market trouble

Dec 31 (Reuters) - The Federal Reserve Bank of New York's Standing Repo Facility, or SRF, loaned a record amount of cash Wednesday to eligible financial firms, as these companies managed liquidity needs on the final trading day of 2025.

The firms borrowed $74.6 billion from the central bank, in loans collateralized with $31.5 billion in Treasury bonds and $43.1 billion in mortgage-backed securities. The borrowing on Wednesday compared to the

prior peak of $50.35 billion seen on October 31, which was a quarter-end.