Well, our sentiment survey for this coming week came in at 63% bears and 29% bulls, which put the system in a buy condition after being in a hold condition four weeks in a row. Typically, I would expect a rally with a reading like that. And we may get one this week barring any significant negative news events.

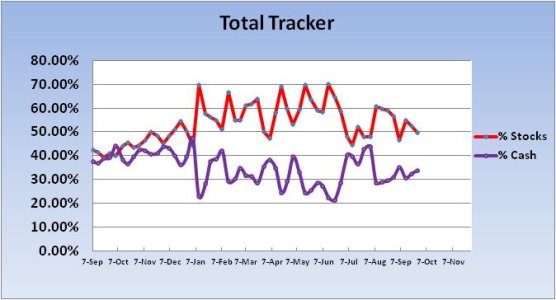

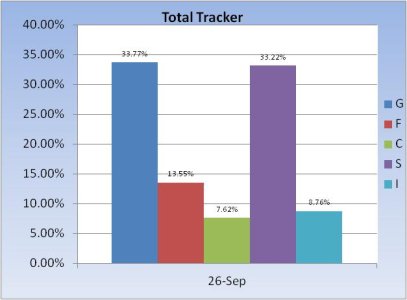

Here's this week's charts:

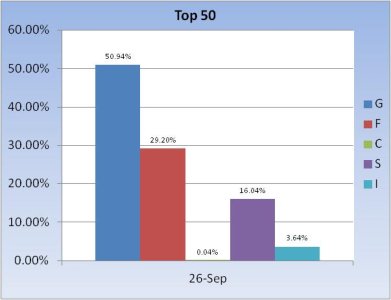

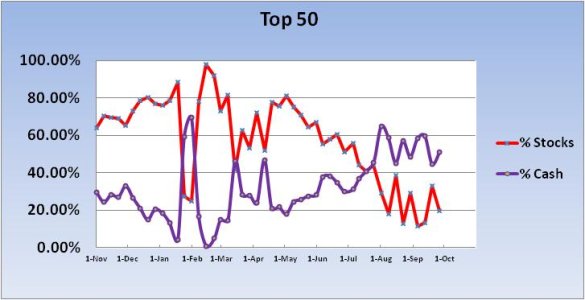

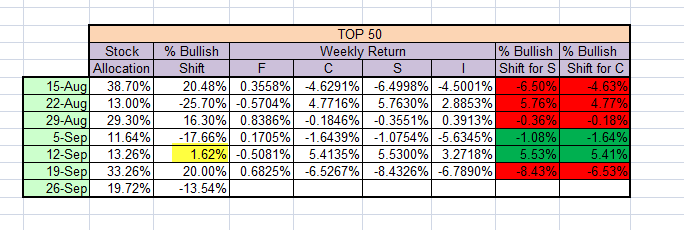

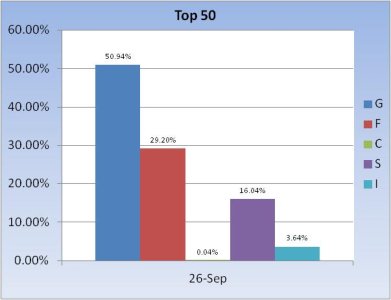

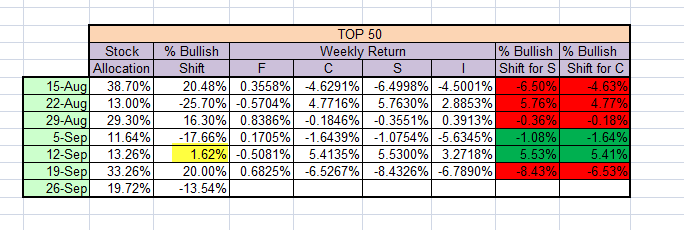

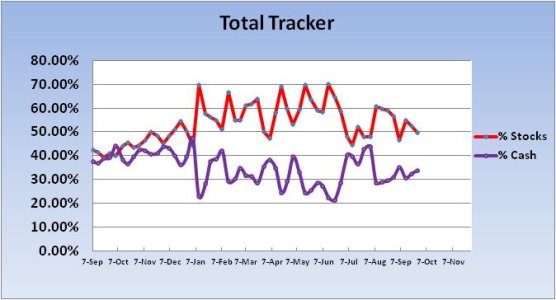

The Top 50 have not been fairing well with their allocation shifts since mid-August. But they have been well under a 40% stock allocation during that time and that counts for a lot given how much this market has dropped this then. Here's a snapshot of how they have been getting whipsawed.

The week of 15Aug they increased their stock allocations by a collective 20.48% and the S fund dropped -6.5% that week.

The week of 22Aug they decreased their stock allocation by -25.7% and the S fund was up 5.76%.

The week of 29Aug they increased their stock allocations by 16.3% and the S fund was down marginally by -.36%

The week of 5Sep they decreased the allocation by -17.66% and the S fund was down -1.08%.

The week of 12Sep they increased their allocation by just 1.62% and the S fund was up big, 5.53%. (Unfortunately, they only had a total allocation of 13.26% that week, so they largely missed out on those gains.)

Last week they ramped up their allocation by 20% and the S fund was hammered for -8.43%.

So again, what they got right was being out of the market in very large measure. But some of them are getting caught in those whipsaws.

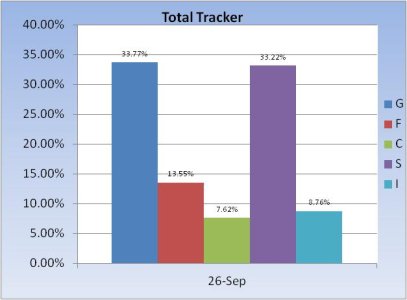

The herd dropped their stock exposure just a bit for the second week in a row. I can't show another chart, but this group has been having a tough time with whipsaws too, although not nearly as much as the Top 50. The big difference however, is they are holding a much larger stock allocation and that's driving many further down the list on the tracker.

So as I mentioned at the beginning, our sentiment survey is on a buy and that would normally mean we can expect some measure of a rally next week. But headline risk is alive and well too, and while we could get that rally it may come from lower levels. Fact is, I'm not sure how it's going play out, but I'm bearish for the short term and not overly eager to make any big moves. But I am willing to take some stock exposure on any further selling pressure. The nice thing for me is that I have one more IFT to work with and the following week it's October and two more IFTs will be available. I'm mostly looking to get positioned for another bear market rally, so buying a little here and there on the way down appeals to me. Especially given how fast this market can turn.

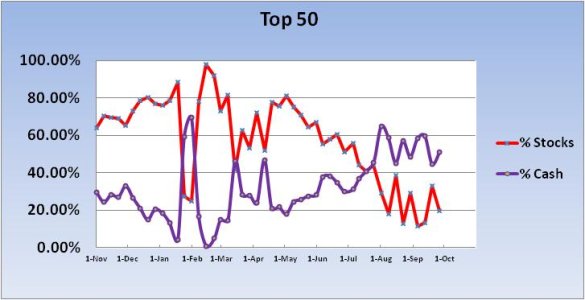

Here's this week's charts:

The Top 50 have not been fairing well with their allocation shifts since mid-August. But they have been well under a 40% stock allocation during that time and that counts for a lot given how much this market has dropped this then. Here's a snapshot of how they have been getting whipsawed.

The week of 15Aug they increased their stock allocations by a collective 20.48% and the S fund dropped -6.5% that week.

The week of 22Aug they decreased their stock allocation by -25.7% and the S fund was up 5.76%.

The week of 29Aug they increased their stock allocations by 16.3% and the S fund was down marginally by -.36%

The week of 5Sep they decreased the allocation by -17.66% and the S fund was down -1.08%.

The week of 12Sep they increased their allocation by just 1.62% and the S fund was up big, 5.53%. (Unfortunately, they only had a total allocation of 13.26% that week, so they largely missed out on those gains.)

Last week they ramped up their allocation by 20% and the S fund was hammered for -8.43%.

So again, what they got right was being out of the market in very large measure. But some of them are getting caught in those whipsaws.

The herd dropped their stock exposure just a bit for the second week in a row. I can't show another chart, but this group has been having a tough time with whipsaws too, although not nearly as much as the Top 50. The big difference however, is they are holding a much larger stock allocation and that's driving many further down the list on the tracker.

So as I mentioned at the beginning, our sentiment survey is on a buy and that would normally mean we can expect some measure of a rally next week. But headline risk is alive and well too, and while we could get that rally it may come from lower levels. Fact is, I'm not sure how it's going play out, but I'm bearish for the short term and not overly eager to make any big moves. But I am willing to take some stock exposure on any further selling pressure. The nice thing for me is that I have one more IFT to work with and the following week it's October and two more IFTs will be available. I'm mostly looking to get positioned for another bear market rally, so buying a little here and there on the way down appeals to me. Especially given how fast this market can turn.