konakathy

Market Veteran

- Reaction score

- 41

Never mind...I'm being spastic tonight.

Do you need someone to walk you over to the PUI Thread?

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Never mind...I'm being spastic tonight.

Happy Columbus Day Off !

Tomorrow's going to suck.

Only consolation is that I'm a green rotation - Wednesday off. Leave it for the T6! :laugh:

S&P breakout confirmed

By Colin Twiggs

January 23rd, 2012 3:00 a.m. ET (7:00 p.m. AET)

The S&P 500 breakout above 1300 suggests a primary advance to 1450*. Rising 13-week Twiggs Money Flow indicates buying pressure.

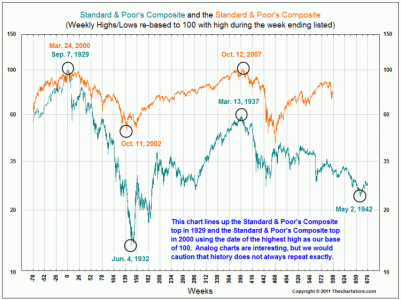

Of the 14 major market tops, between 1929 and 2000, inclusive, when the Dow Jones Industrial Average reached its absolute peak, the average percentage of stocks also making new highs on that day was 5.98%.

Stocks that are Above their Falling 200d SMA (AF) are in early uptrends (spring) while stocks Above their Rising 200d SMA (AR) are in confirmed uptrends (summer). Stocks that are Below their Rising 200d SMA (BR) are in early downtrends (fall) and stocks Below their Falling 200d SMA are in a confirmed downtrend (winter). Healthy bull markets are characterized by a high percentage of stocks that are above their 200d SMAs (uptrends) while bear markets show the opposite (downtrends).

Despite recent weakness in the market over the past two days, the overall bullish trend shows no sign of deterioration based on the collective behavior of the major market sectors highlighted below. Most importantly, given the current broad-based participation, there is no evidence the stock market is putting in a major top

Jim is pleased to welcome back award-winning technician Louise Yamada this week. Louise sees the possibility of a new secular bull market in stocks, driven by massive liquidity from the Federal Reserve. She is not concerned about the VIX index, as long as it stays below 20. Louise sees the industrials and energy sectors leading as the market advance broadens. She also sees the bond market as a major source of concern, with high risks to investors. Also in this segment, Ryan Puplava has his Wrap-Up of the markets this week, Erik Townsend covers commodities, and Rob Bernard has the Fixed Income Report. Jim also answers some of your Q-Calls in this segment.

The U.S. equity market continues to look very bullish right now, but it’s also starting to enter into a territory a technical analyst would call “extended” and “overbought”. So I did some work today to determine how extended and how overbought the equity market might be. But before I do, let me quickly explain the difference between trending and trading markets. This will help define how important such an “overbought” and “extended” call may or may not be.

Market’s Bill of Health – Short Term Top Avoided as Bearish Divergences Resolved