The market opened with a gap down and within about 30 minutes hit its lows of the day. From there it was a roller coaster up into positive territory and then back down into the red. And with just 40 minutes left to the trading day and the market seemingly poised to push lower into the close, a massive short covering rally developed that saw the S&P 500 move at least 4% in those last minutes. Our S fund was even more impressive with more than a 5% reversal into the close.

In some ways it was an uneven day as the DOW was down over 100 points at the same time the Nasdaq was sporting gains of 1.5%.

So what triggered the end-of-day rally? There were media reports that officials in the European Union were evaluating a plan to recapitalize banks, but I personally don't see how that could be a valid reason to spark this kind of reversal.

My take is that bearish sentiment got overdone too quickly and far too many traders were embracing a waterfall decline. And who can blame them? But that's why the market can be treacherous. It often doesn't do what we think it should do.

The question now is "have we bottomed?"

Let's see what the charts can tell us:

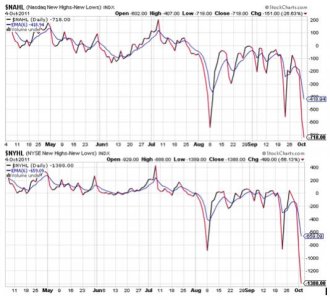

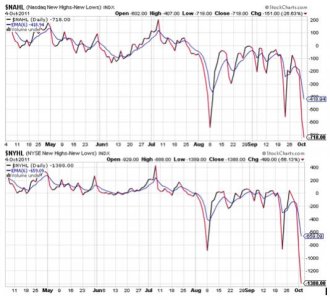

NAMO moved up and barely flipped to a buy condition. NYMO also rose, but fell short of triggering a buy. Both remain in negative territory.

Here's something interesting. Internals look awful in spite of the huge end-of-day rally. Both signals are deep in sell territory. If this market manages to follow through to the upside, these signals can rise quickly. But they sure do look bearish at the moment.

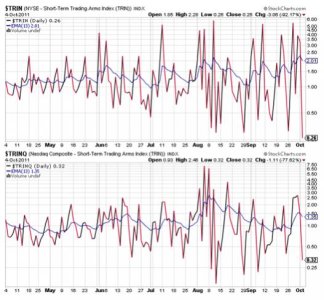

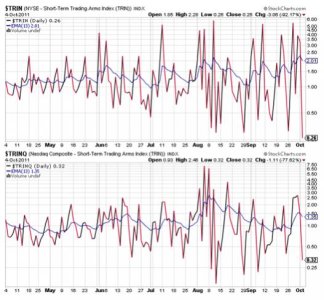

TRIN is showing an extremely overbought market. TRINQ is also overbought, but only moderately so. Unless we've just bottomed and the market is about to stage another one of its bear market rallies, I'd expect to see some selling pressure return tomorrow based on these two signals.

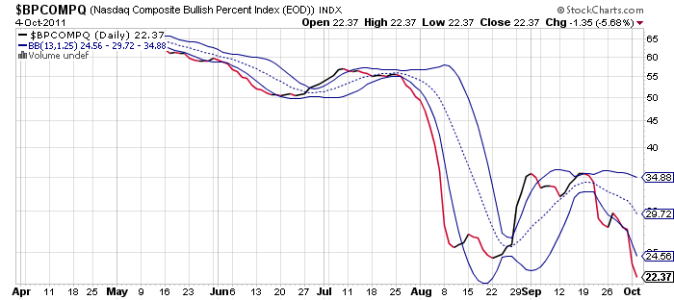

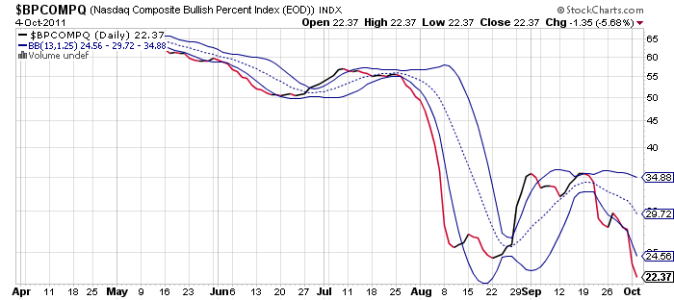

BPCOMPQ dipped even lower today and remains on a sell.

So we have mixed signals and some extreme readings on some of the charts. The system remains on an intermediate term sell though and I have to believe that we'll resume the down trend before a buy signal can be triggered.

There isn't much we can do in this volatility given our limitations. If we do get some follow through to the upside tomorrow, we could find the market quite a ways above its intraday lows from today before we can get invested. And it's not a comfortable situation given how quickly this market gets both oversold and overbought. Simply put, it's gambling to simply take a shot in the dark in this environment. Eventually we'll be trained to the point where risk will only be an afterthought as the pain of missing out on so many opportunities begins to take its toll. For those who bought this market Friday thinking they were buying support, Monday's fresh lows quickly put them in a hole. Today gets them largely back to neutral.

The whipsaws come very easily indeed.

Let me close by saying that while the end of day rally has the appearance of a start back up towards 1200 (or further) on the S&P 500, risk has not diminished. But at the same time, I've got a feeling that's where we're headed. But I won't be chasing it. It turns too fast for me. Not only are the lows hard for us to buy, but selling the tops are darn difficult too. What does that leave for us in the middle? Is the risk worth the potential reward? Just something to consider.

In some ways it was an uneven day as the DOW was down over 100 points at the same time the Nasdaq was sporting gains of 1.5%.

So what triggered the end-of-day rally? There were media reports that officials in the European Union were evaluating a plan to recapitalize banks, but I personally don't see how that could be a valid reason to spark this kind of reversal.

My take is that bearish sentiment got overdone too quickly and far too many traders were embracing a waterfall decline. And who can blame them? But that's why the market can be treacherous. It often doesn't do what we think it should do.

The question now is "have we bottomed?"

Let's see what the charts can tell us:

NAMO moved up and barely flipped to a buy condition. NYMO also rose, but fell short of triggering a buy. Both remain in negative territory.

Here's something interesting. Internals look awful in spite of the huge end-of-day rally. Both signals are deep in sell territory. If this market manages to follow through to the upside, these signals can rise quickly. But they sure do look bearish at the moment.

TRIN is showing an extremely overbought market. TRINQ is also overbought, but only moderately so. Unless we've just bottomed and the market is about to stage another one of its bear market rallies, I'd expect to see some selling pressure return tomorrow based on these two signals.

BPCOMPQ dipped even lower today and remains on a sell.

So we have mixed signals and some extreme readings on some of the charts. The system remains on an intermediate term sell though and I have to believe that we'll resume the down trend before a buy signal can be triggered.

There isn't much we can do in this volatility given our limitations. If we do get some follow through to the upside tomorrow, we could find the market quite a ways above its intraday lows from today before we can get invested. And it's not a comfortable situation given how quickly this market gets both oversold and overbought. Simply put, it's gambling to simply take a shot in the dark in this environment. Eventually we'll be trained to the point where risk will only be an afterthought as the pain of missing out on so many opportunities begins to take its toll. For those who bought this market Friday thinking they were buying support, Monday's fresh lows quickly put them in a hole. Today gets them largely back to neutral.

The whipsaws come very easily indeed.

Let me close by saying that while the end of day rally has the appearance of a start back up towards 1200 (or further) on the S&P 500, risk has not diminished. But at the same time, I've got a feeling that's where we're headed. But I won't be chasing it. It turns too fast for me. Not only are the lows hard for us to buy, but selling the tops are darn difficult too. What does that leave for us in the middle? Is the risk worth the potential reward? Just something to consider.