It was a bit of wild ride last week as the S&P 500 was sitting near its 50 day moving average to start the week last week, but then posted three consecutive gains through Wednesday to find itself right back at resistance. Thursday saw a modest pullback and then Friday the bulls got hammered. By the close, the S&P was once again near its 50 day moving average. And while the major averages did manage a weekly gain, it sure didn't feel good. I'm sure most of you are also aware of the failed triple top too. That's bearish. But it's also obvious.

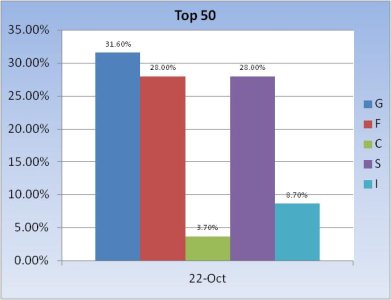

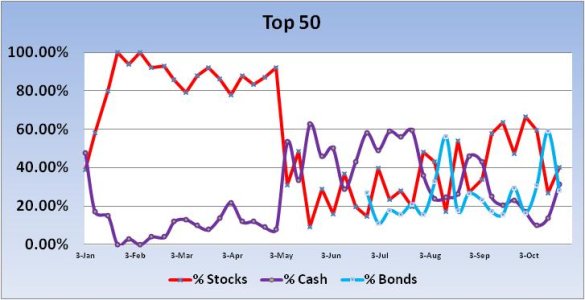

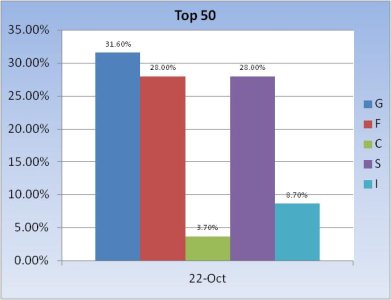

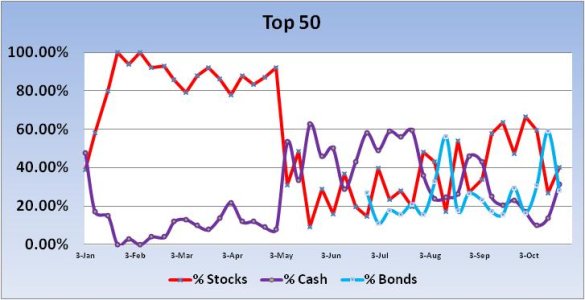

How did our TSPers fare last week and how did they re-position themselves to begin the new week? Here's the charts:

The Top 50 had scaled back their stock holdings last week by almost 33% to a total allocation of just 26.8%. In the process they spiked their bond holdings from about 30% to more than 59%. Well, the C and S funds posted weekly 0.34% and 0.51% gains respectively, while the F fund fell almost 0.19%.

This week, stock allocations rose 13.6% to a total allocation of 40.4%. Their bond allocation dropped significantly, from 59.6% to 28%.

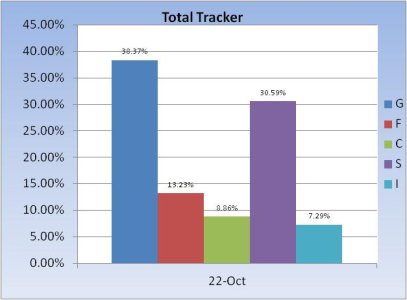

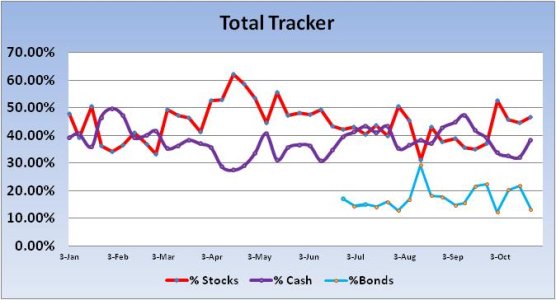

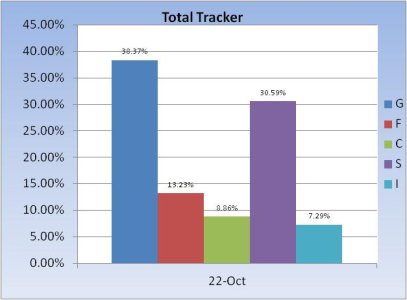

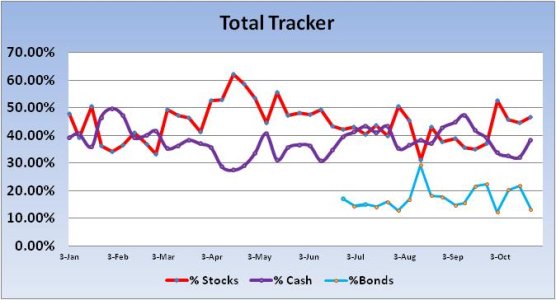

The Total Tracker showed only a modest change again as stock allocations rose 2.24% to a total allocation of 46.75%.

The chart of the S&P 500 shows the triple top formation as well as lower highs and lower lows, although Friday's action didn't quite put in a lower low as yet. But it is sitting on its 50 dma. It looks bearish and emotionally it probably feels that way for a lot of traders too, but we haven't fallen off the cliff yet.

Our sentiment survey remains on a buy and I suspect Friday's action may bring the bears out again, which could mean yet another reversal. We'll know soon enough. Grab your popcorn, tomorrow could be interesting.

How did our TSPers fare last week and how did they re-position themselves to begin the new week? Here's the charts:

The Top 50 had scaled back their stock holdings last week by almost 33% to a total allocation of just 26.8%. In the process they spiked their bond holdings from about 30% to more than 59%. Well, the C and S funds posted weekly 0.34% and 0.51% gains respectively, while the F fund fell almost 0.19%.

This week, stock allocations rose 13.6% to a total allocation of 40.4%. Their bond allocation dropped significantly, from 59.6% to 28%.

The Total Tracker showed only a modest change again as stock allocations rose 2.24% to a total allocation of 46.75%.

The chart of the S&P 500 shows the triple top formation as well as lower highs and lower lows, although Friday's action didn't quite put in a lower low as yet. But it is sitting on its 50 dma. It looks bearish and emotionally it probably feels that way for a lot of traders too, but we haven't fallen off the cliff yet.

Our sentiment survey remains on a buy and I suspect Friday's action may bring the bears out again, which could mean yet another reversal. We'll know soon enough. Grab your popcorn, tomorrow could be interesting.