Back on the 1st of March the market sold off hard. In fact, the S&P dropped 1.57%, while the Wilshire 4500 fell 1.82%. It was out of character for a market that had typically rallied on the 1st of any month since September.

That was an early warning. And this was well before Japan's catastrophic events.

For the most part, all these events we've witnessed these past few weeks have been convenient excuses for the big money to take the market down. Why? So they can reload and take it higher at the expense of fearful traders and investors. That's nothing new, but it sure hurts when we're exposed to stocks.

Has our economy changed? No. It's still slowly improving in spite of today's disappointing data points. News driven events are much shorter lived.

So aside from the news headlines today, we had a February housing starts report that revealed a 22.5% drop to an annualized rate of 479,000 homes. That's significantly less than the 575,000 that were forecast. February building permits dropped 8.2% to an annualized rate of 517,000, which was much lower than earlier predications.

PPI spiked 1.6% in February, but that was largely attributable to soaring food and energy costs. If we exclude those elements the rise was a much more modest 0.2%. Still, that core number was somewhat of a shock.

I had anticipated that this market would bounce by now, and after the Nikkei's +5.68 gain yesterday, I had though we might be ready to turn too.

But that didn't happen.

In my Sunday blog I had pointed out that our Top 50 cut their collective stock exposure by close to half. I had wondered if that was smart money talking. Especially since our sentiment survey was on a decisive buy.

At this point they sure appear smart to me. Even with two more days to go this week, they've sidestepped a lot of pain.

So let's see where the charts are now.

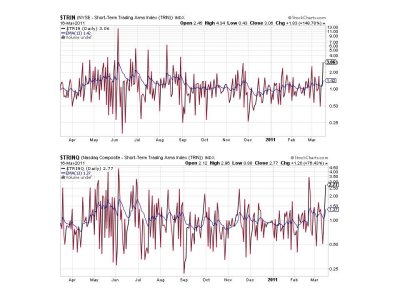

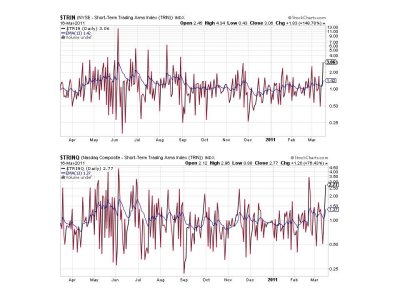

I've expanded this evening's charts from 6 months to 1 year for a better perspective. In this case, NAMO and NYMO show they are approaching lows not seen since late last Spring.

NAHL and NYHL actually improved a bit today, but remain on sells.

TRIN and TRINQ are on sells and both are highly suggestive of an oversold market.

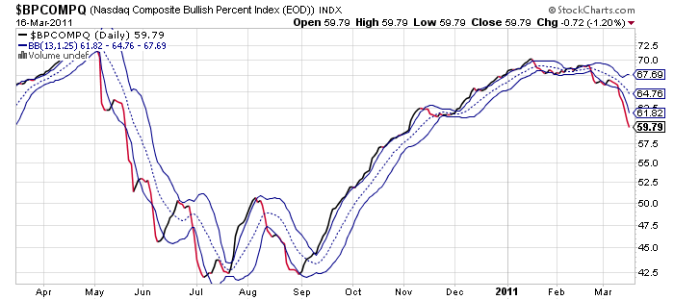

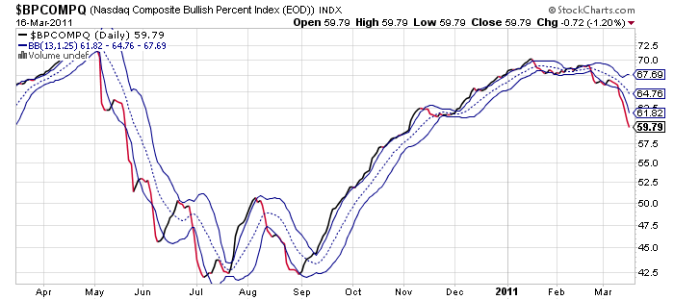

BPCOMPQ stayed true to recent form and continues to fall.

So all signals remain on sells, which keeps the system on a sell.

I've known for some time that when the market gets exceptionally volatile, the seven sentinels probably won't react fast enough to major market moves for us to avoid big losses or grab big gains between the time of the signal and our closing trade. That's why I try to provide some measure of risk assessment in my outlooks rather than relying exclusively on the signals themselves. We all have varying degrees of risk tolerance and different time horizons. What may be a prudent trade for one, may not be for another.

So the Sentinels say we are in an intermediate term decline, which is to say that as far as we've fallen so far, we could go lower. But there are reasons to expect a bottom too, which is what I've spoken to the past few blogs. But my expectations are only interpretations of what I think may happen. It's an attempt to assess market risk in general with the hope of making better decisions as a result.

The market will come back. The only question is when.

That was an early warning. And this was well before Japan's catastrophic events.

For the most part, all these events we've witnessed these past few weeks have been convenient excuses for the big money to take the market down. Why? So they can reload and take it higher at the expense of fearful traders and investors. That's nothing new, but it sure hurts when we're exposed to stocks.

Has our economy changed? No. It's still slowly improving in spite of today's disappointing data points. News driven events are much shorter lived.

So aside from the news headlines today, we had a February housing starts report that revealed a 22.5% drop to an annualized rate of 479,000 homes. That's significantly less than the 575,000 that were forecast. February building permits dropped 8.2% to an annualized rate of 517,000, which was much lower than earlier predications.

PPI spiked 1.6% in February, but that was largely attributable to soaring food and energy costs. If we exclude those elements the rise was a much more modest 0.2%. Still, that core number was somewhat of a shock.

I had anticipated that this market would bounce by now, and after the Nikkei's +5.68 gain yesterday, I had though we might be ready to turn too.

But that didn't happen.

In my Sunday blog I had pointed out that our Top 50 cut their collective stock exposure by close to half. I had wondered if that was smart money talking. Especially since our sentiment survey was on a decisive buy.

At this point they sure appear smart to me. Even with two more days to go this week, they've sidestepped a lot of pain.

So let's see where the charts are now.

I've expanded this evening's charts from 6 months to 1 year for a better perspective. In this case, NAMO and NYMO show they are approaching lows not seen since late last Spring.

NAHL and NYHL actually improved a bit today, but remain on sells.

TRIN and TRINQ are on sells and both are highly suggestive of an oversold market.

BPCOMPQ stayed true to recent form and continues to fall.

So all signals remain on sells, which keeps the system on a sell.

I've known for some time that when the market gets exceptionally volatile, the seven sentinels probably won't react fast enough to major market moves for us to avoid big losses or grab big gains between the time of the signal and our closing trade. That's why I try to provide some measure of risk assessment in my outlooks rather than relying exclusively on the signals themselves. We all have varying degrees of risk tolerance and different time horizons. What may be a prudent trade for one, may not be for another.

So the Sentinels say we are in an intermediate term decline, which is to say that as far as we've fallen so far, we could go lower. But there are reasons to expect a bottom too, which is what I've spoken to the past few blogs. But my expectations are only interpretations of what I think may happen. It's an attempt to assess market risk in general with the hope of making better decisions as a result.

The market will come back. The only question is when.