It was a somewhat mixed market today as the DOW managed a 0.18% gain, while the Russell (-1.6%), S&P 400 (-1.1%) and Nasdaq (-0.38) all closed in the red. Our C fund, which tracks the S&P 500 was only modestly lower with a 0.13% loss, while the S fund was down much more significantly at -1.03%. The I fund, which tracks the EAFE was down a relatively mild 0.31%, which was due in large measure to the dollar's 0.3% gain.

Market data released today included November factory orders, which were up 0.7% (-0.3% was expected).

Finally, this afternoon saw the release of the FOMC minutes, which revealed some committee members are still worried about downside risk, especially due to the housing market, but are encouraged that economic activity continues to increase at a moderate rate.

Let's be honest, the market was due for a pullback after last month's run, and that doesn't even take into consideration the significant gains from the previous 3 months. Sentiment continues to ring alarm bells, but today's relatively moderate decline is set against a backdrop of an obvious bull market run. It's going to take a lot more than that to turn this trend around, and I'm not convinced that's about to happen at all.

Here's today's charts:

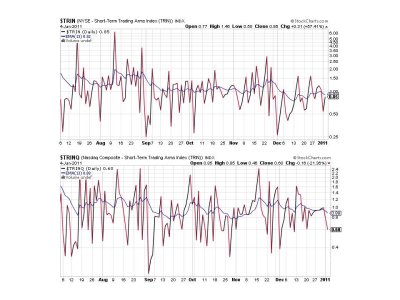

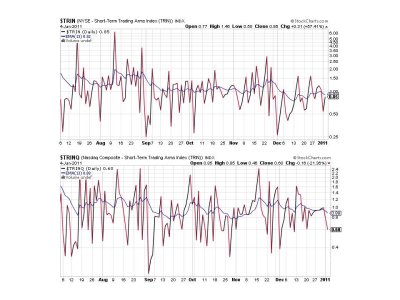

Back to sells here, but nothing dramatic.

Same with NAHL and NYHL.

TRIN and TRINQ remain on buys.

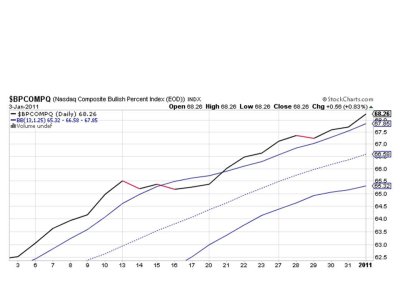

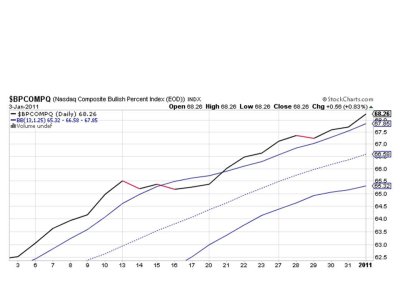

BPCOMPQ continues to rise and remains on a buy as well.

So 3 of 7 signals are flashing buys, which keeps the system on a buy.

We may have more weakness in store in the very near term, but so far nothing to indicate the trend has changed. This could be a buying opportunity right now, which I'm watching carefully in the event I decide to get invested.

Market data released today included November factory orders, which were up 0.7% (-0.3% was expected).

Finally, this afternoon saw the release of the FOMC minutes, which revealed some committee members are still worried about downside risk, especially due to the housing market, but are encouraged that economic activity continues to increase at a moderate rate.

Let's be honest, the market was due for a pullback after last month's run, and that doesn't even take into consideration the significant gains from the previous 3 months. Sentiment continues to ring alarm bells, but today's relatively moderate decline is set against a backdrop of an obvious bull market run. It's going to take a lot more than that to turn this trend around, and I'm not convinced that's about to happen at all.

Here's today's charts:

Back to sells here, but nothing dramatic.

Same with NAHL and NYHL.

TRIN and TRINQ remain on buys.

BPCOMPQ continues to rise and remains on a buy as well.

So 3 of 7 signals are flashing buys, which keeps the system on a buy.

We may have more weakness in store in the very near term, but so far nothing to indicate the trend has changed. This could be a buying opportunity right now, which I'm watching carefully in the event I decide to get invested.