- Reaction score

- 604

As of June 17th, the S-fund leads all TSP funds in June with a return of 1.46%.

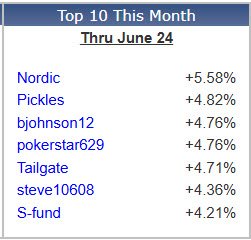

Twenty AutoTracker members and a Premium Service have outperformed the S-fund so far this month, and six of them are boasting June gains of over 3%.

Here are the current top ten returns of June:

The top 20 AutoTracker members for June (excluding Intrepid_Timer) hold an average allocation of 62.5% in the G-fund.

Many have outpaced the S-fund’s 1.46% return by tactically locking in gains before the fund began its recent decline. This disciplined profit-taking has proven to be a winning strategy for much of the month.

There are, however, some exceptions. The current leader, Nordic, briefly exited the S-fund in the second week of June, reallocating fully into the G-fund for four trading days. They returned to 100% S-fund at the start of the third week and have accumulated a gain of 3.54% over the last 12 trading days. That return could grow further, as the S-fund's corresponding index, the DWCPF, is showing signs of strength early this morning.

While many of June’s top performers leaned defensive to protect earlier gains, a few like Nordic have re-entered the market demonstrating that both caution and conviction can lead in this volatile environment.

Eight trading days remain in the month of June.

Twenty AutoTracker members and a Premium Service have outperformed the S-fund so far this month, and six of them are boasting June gains of over 3%.

Here are the current top ten returns of June:

The top 20 AutoTracker members for June (excluding Intrepid_Timer) hold an average allocation of 62.5% in the G-fund.

Many have outpaced the S-fund’s 1.46% return by tactically locking in gains before the fund began its recent decline. This disciplined profit-taking has proven to be a winning strategy for much of the month.

There are, however, some exceptions. The current leader, Nordic, briefly exited the S-fund in the second week of June, reallocating fully into the G-fund for four trading days. They returned to 100% S-fund at the start of the third week and have accumulated a gain of 3.54% over the last 12 trading days. That return could grow further, as the S-fund's corresponding index, the DWCPF, is showing signs of strength early this morning.

While many of June’s top performers leaned defensive to protect earlier gains, a few like Nordic have re-entered the market demonstrating that both caution and conviction can lead in this volatile environment.

Eight trading days remain in the month of June.