Investors lose their discipline at market peaks. They become convinced that valuations are irrelevant. They become convinced that investment returns are somehow independent of the price one pays. As a rule, the more extreme valuations become, the longer it has taken to get to those extremes, the longer value investors appear to have been “proven” wrong, and the more evidence there seems to be that passive investing is a “sure thing.” Attending to market internals can certainly improve the situation, but in the end, there’s really no distinction between:

- the observation that market valuations are at record highs, and

- the opinion that value investing is obsolete and passive investing is for winners.

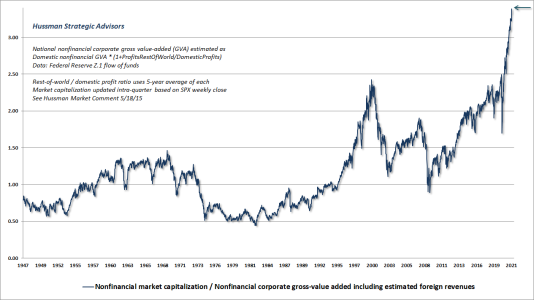

Reality sets in later. The arithmetic is straightforward. Over the past 10, 20, and 30 years, both nonfinancial corporate revenues and nominal GDP have grown at an average annual rate of about 4.5%, which includes the impact of the recent bout of inflation. Meanwhile, the dividend yield of the S&P 500 currently stands at 1.4%. Assuming that valuations remain at a “permanently high plateau,” prices would grow at the same annual pace as fundamentals. Add the dividend yield, and estimated long-term S&P 500 total returns – assuming permanently elevated valuations – come to about 5.9% annually.