First the Good News. It's OPEX week, so today's decline may not be reflective of the true character of the market. One might also contend that holiday bias should become more positive as we move forward.

The Bad News is that the Seven Sentinels flashed a sell today. It's bad news because I know a lot of folks are looking for a Santa Claus rally.

I don't like betting against the Seven Sentinels.

But I've been warning the MB that I felt there may be too much bullishness to expect too much. I did think we'd get more rally than we have so far, but yesterday I also said we're in the second half of the month now and a there has been no breakout rally forthcoming. Even after waiting 2 weeks since the last buy signal was triggered.

Yes, it might be early yet. Yes, we could reverse and still come out smelling like roses by the end of the month. But given the bullish sentiment I'm seeing and now getting a Seven Sentinels sell signal tells me risk just went higher.

I can only call them as I see them. I do think we'll bounce, but when and how volatile will the action be?

In hind sight, my exit yesterday was a good decision. I was definitely feeling some pressure and I wasn't particularly happy with how the SS were sitting.

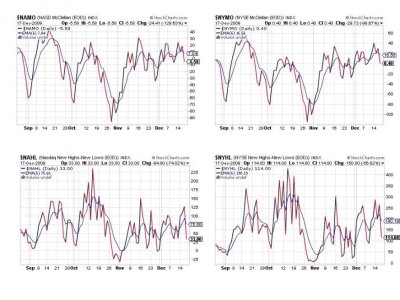

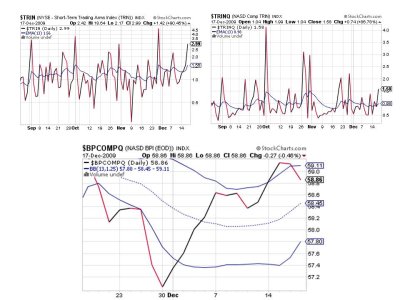

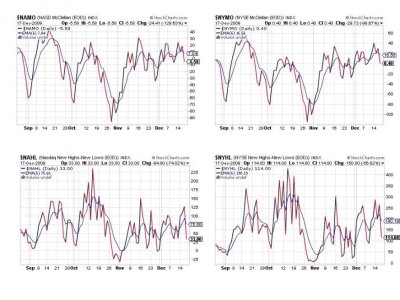

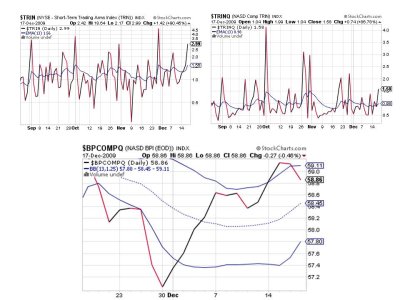

Here's the charts:

No close ones here. All sells.

Same here. All sells.

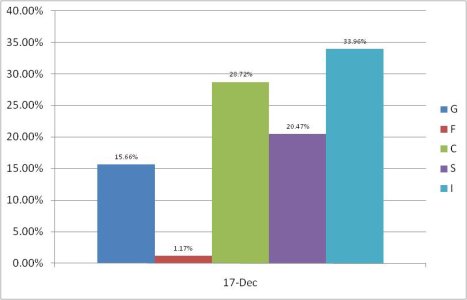

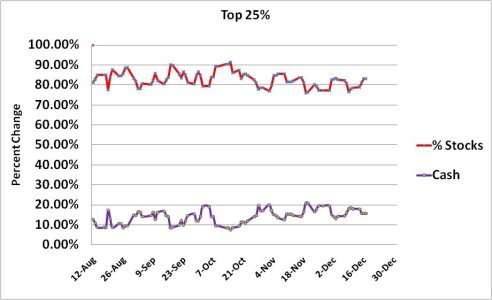

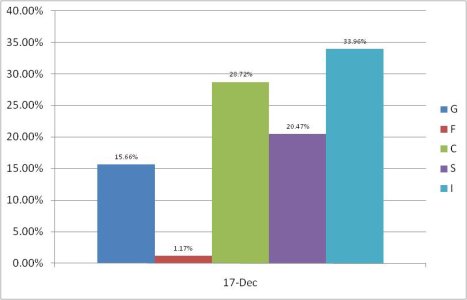

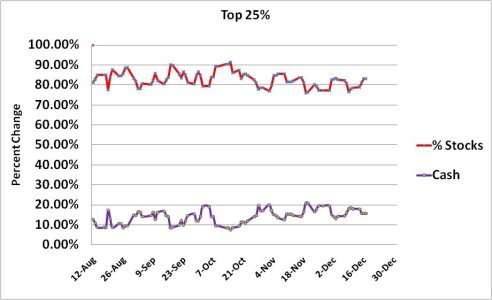

Our Top 25% were positioned for today's trading much like Wednesday.

So 7 of 7 signals are flashing sells putting the system in a sell condition. But holiday bias and OPEX may influence trading in the final two weeks. Sell signals have not been very strong in the past few months and we are in the last quarter of the month, so window dressing could still be applied. But I still don't like the odds. Higher bullishness (at the moment anyway), and a SSSS could spell trouble. Especially if bullishness continues to rise while prices fall. Good luck everyone. See you tomorrow.

The Bad News is that the Seven Sentinels flashed a sell today. It's bad news because I know a lot of folks are looking for a Santa Claus rally.

I don't like betting against the Seven Sentinels.

But I've been warning the MB that I felt there may be too much bullishness to expect too much. I did think we'd get more rally than we have so far, but yesterday I also said we're in the second half of the month now and a there has been no breakout rally forthcoming. Even after waiting 2 weeks since the last buy signal was triggered.

Yes, it might be early yet. Yes, we could reverse and still come out smelling like roses by the end of the month. But given the bullish sentiment I'm seeing and now getting a Seven Sentinels sell signal tells me risk just went higher.

I can only call them as I see them. I do think we'll bounce, but when and how volatile will the action be?

In hind sight, my exit yesterday was a good decision. I was definitely feeling some pressure and I wasn't particularly happy with how the SS were sitting.

Here's the charts:

No close ones here. All sells.

Same here. All sells.

Our Top 25% were positioned for today's trading much like Wednesday.

So 7 of 7 signals are flashing sells putting the system in a sell condition. But holiday bias and OPEX may influence trading in the final two weeks. Sell signals have not been very strong in the past few months and we are in the last quarter of the month, so window dressing could still be applied. But I still don't like the odds. Higher bullishness (at the moment anyway), and a SSSS could spell trouble. Especially if bullishness continues to rise while prices fall. Good luck everyone. See you tomorrow.