The S&P managed to close out the days trading activity with a slight gain, but 1150 is acting as resistance as the index traded well below that level for a good part of the day.

A 0.5% gain in the dollar contributed to the I fund's overall weak performance today as it closed lower than either the C or S funds.

Interestingly, today's overall volume was low going into the FOMC announcement tomorrow, but there was a spike in up volume to close out today's session.

Industrial production for February was released today and it showed an increase of 0.1%, which was barely above what had been expected. Capacity utilization offered no surprises either. The Empire Manufacturing Index for March was a bit higher at 22.9 than the forecased reading of 22.0, but none of this data stirred much buying interest.

Senator Dodd made headlines today with a proposal for financial reform this afternoon, but even this did little to spook the market for long.

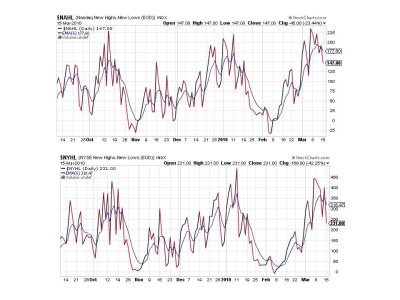

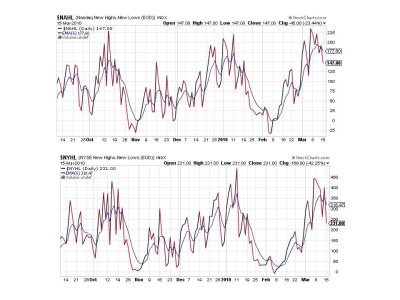

The Seven Sentinels are beginning to show signs of fatigue in the market, although I wouldn't say a sell signal is necessarily imminent. Tomorrow's FOMC annoucement could either revive a bid under the market and extend gains, or it could provide the catalyst for more weak trading. Here's the charts for today:

These two signals sure look ready to begin a new down leg, but I'm not quite ready to make that call.

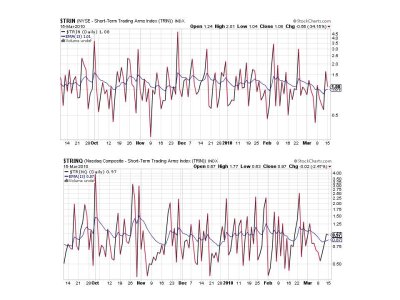

Same thing here.

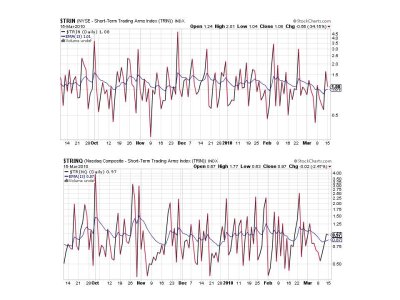

TRIN and TRINQ are both flashing sells just like the all the above signals, but are very close to their 13 day EMAs and could go either way.

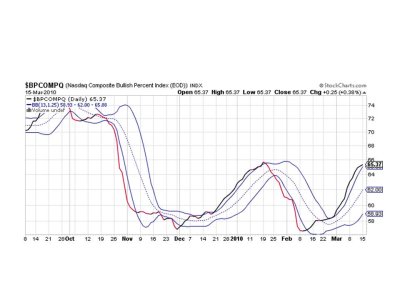

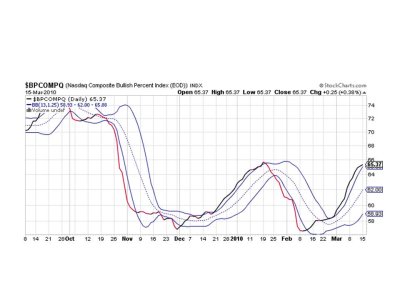

BPCOMPQ, while still on a buy, could easily drop below the upper bollinger band and trigger a sell signal with enough selling pressure in the market. This could happen any day with downside follow through.

Overall, I'd say the system could flip to a sell condition tomorrow if we close the trading session down significantly. But the FOMC announcement makes it impossible for me to front-run a sell signal as there's no telling how the market will react. My guess is that there will be no surprises and hence we should move back up again, which should keep the system on a buy. While OPEX week can be volatile, I wouldn't expect any major technical damage this week. Next week gets trickier as post-OPEX is often weak, but we're getting close to the end of the quarter and window dressing may push the markets higher regardless.

So unless I get a clear sell signal from the Seven Sentinels I think it may be a good play to hold stocks for now. Once the FOMC announcement is past we'll know more about the very short term market condition, but until then there's reason to continue to be bullish.

A 0.5% gain in the dollar contributed to the I fund's overall weak performance today as it closed lower than either the C or S funds.

Interestingly, today's overall volume was low going into the FOMC announcement tomorrow, but there was a spike in up volume to close out today's session.

Industrial production for February was released today and it showed an increase of 0.1%, which was barely above what had been expected. Capacity utilization offered no surprises either. The Empire Manufacturing Index for March was a bit higher at 22.9 than the forecased reading of 22.0, but none of this data stirred much buying interest.

Senator Dodd made headlines today with a proposal for financial reform this afternoon, but even this did little to spook the market for long.

The Seven Sentinels are beginning to show signs of fatigue in the market, although I wouldn't say a sell signal is necessarily imminent. Tomorrow's FOMC annoucement could either revive a bid under the market and extend gains, or it could provide the catalyst for more weak trading. Here's the charts for today:

These two signals sure look ready to begin a new down leg, but I'm not quite ready to make that call.

Same thing here.

TRIN and TRINQ are both flashing sells just like the all the above signals, but are very close to their 13 day EMAs and could go either way.

BPCOMPQ, while still on a buy, could easily drop below the upper bollinger band and trigger a sell signal with enough selling pressure in the market. This could happen any day with downside follow through.

Overall, I'd say the system could flip to a sell condition tomorrow if we close the trading session down significantly. But the FOMC announcement makes it impossible for me to front-run a sell signal as there's no telling how the market will react. My guess is that there will be no surprises and hence we should move back up again, which should keep the system on a buy. While OPEX week can be volatile, I wouldn't expect any major technical damage this week. Next week gets trickier as post-OPEX is often weak, but we're getting close to the end of the quarter and window dressing may push the markets higher regardless.

So unless I get a clear sell signal from the Seven Sentinels I think it may be a good play to hold stocks for now. Once the FOMC announcement is past we'll know more about the very short term market condition, but until then there's reason to continue to be bullish.