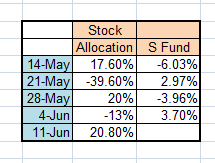

The major averages have seen some robust swings the past few weeks and I've noticed the Top 50 as a whole have not been able to effectively capitalize on the volatility. For instance:

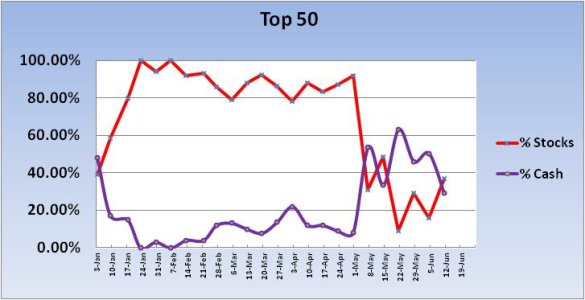

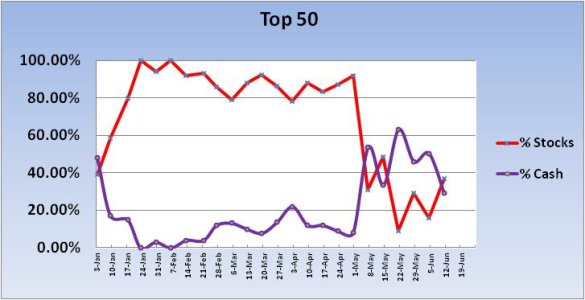

For the past four weeks, the Top 50 have been out of synch (on a weekly basis) with market direction. When this group has cut their stock allocation, the market has rallied. When their stock allocations rose, the market tanked. This week, the Top 50's stock allocation is up almost 21%. Is it time for another dip?

Here's the weekly charts:

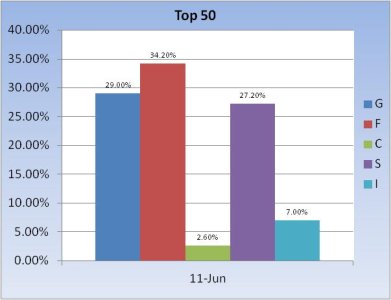

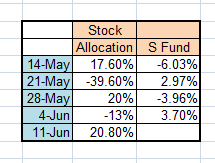

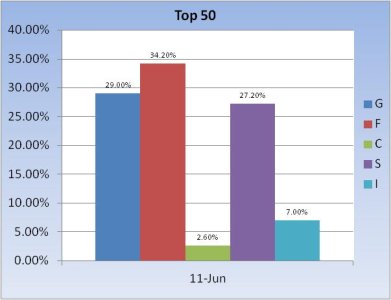

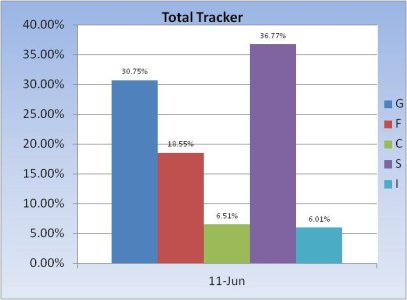

As I mentioned above, stock allocations for the Top 50 are up 20.8% going into the new week. However, their total total stock allocation is still quite conservative at 36.8%. Interestingly, this group's bond exposure (F fund) is greater than their cash (G fund) exposure right now. That's not typical, although bonds have been finding more favor in the past few weeks. And that makes me wonder if "something wicked this way comes" ( RIP - Ray Bradbury).

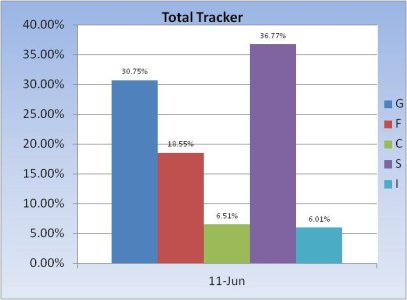

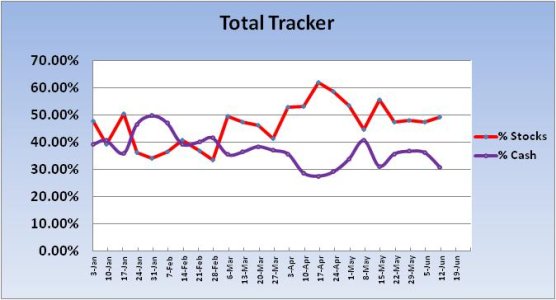

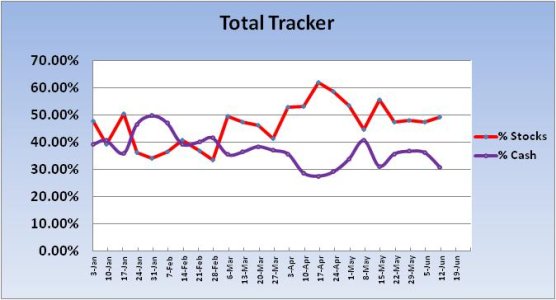

By contrast, the total tracker has seen only very small changes in total stock exposure for the past 3 weeks. Going into the new week, this group's stock exposure ticked higher by 1.83%. Total stock allocations are now 49.29%. Bond exposure for this group is a bit more than half that of the Top 50.

Our sentiment survey remains on a buy for the 6th consecutive week. Eight weeks if we count the one "hold" week we had.

The Seven Sentinels remain on a buy, but this market may be nearing at least a short term top as NAMO and NYMO are at or near multi-month highs. Of course this market could break out to the upside here too. Especially if some good news comes out of Europe. This week is OPEX, so volatility is likely to continue.

For the past four weeks, the Top 50 have been out of synch (on a weekly basis) with market direction. When this group has cut their stock allocation, the market has rallied. When their stock allocations rose, the market tanked. This week, the Top 50's stock allocation is up almost 21%. Is it time for another dip?

Here's the weekly charts:

As I mentioned above, stock allocations for the Top 50 are up 20.8% going into the new week. However, their total total stock allocation is still quite conservative at 36.8%. Interestingly, this group's bond exposure (F fund) is greater than their cash (G fund) exposure right now. That's not typical, although bonds have been finding more favor in the past few weeks. And that makes me wonder if "something wicked this way comes" ( RIP - Ray Bradbury).

By contrast, the total tracker has seen only very small changes in total stock exposure for the past 3 weeks. Going into the new week, this group's stock exposure ticked higher by 1.83%. Total stock allocations are now 49.29%. Bond exposure for this group is a bit more than half that of the Top 50.

Our sentiment survey remains on a buy for the 6th consecutive week. Eight weeks if we count the one "hold" week we had.

The Seven Sentinels remain on a buy, but this market may be nearing at least a short term top as NAMO and NYMO are at or near multi-month highs. Of course this market could break out to the upside here too. Especially if some good news comes out of Europe. This week is OPEX, so volatility is likely to continue.