09/26/25

Stocks took another downturn yesterday, making it three days in a row, but so far we've seen a successful test of key support on some charts. The indices did close off their lows after the support held, but stronger than expected economic data made future interest rate cuts slightly less certain, and that caused concern. Yields and the dollar moved up putting pressure on equities once again.

We get the PCE Prices and the Personal Income and Spending reports tomorrow. This inflation data was going to be key to the outlook on interest rates, but yesterday's data did a number on that as well.

The GDP, Durable Goods, and Initial Jobless claims all came in better than expected, and that put a little fear into investors that the number of interest rates cuts that we get this year may not be what we thought just a couple of days ago.

The chances if getting two more cuts by the December FOMC meeting went from 82% a week ago, to 73% on Wednesday, and now, after the recent economic data, it has moved down to 61%. That's still a pretty good chance but it makes today's inflation data that much more compelling.

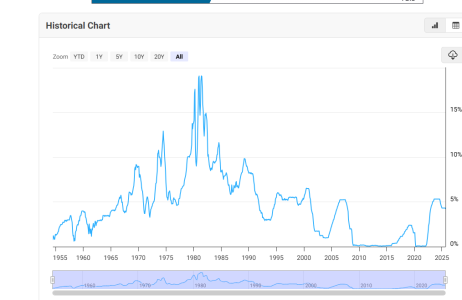

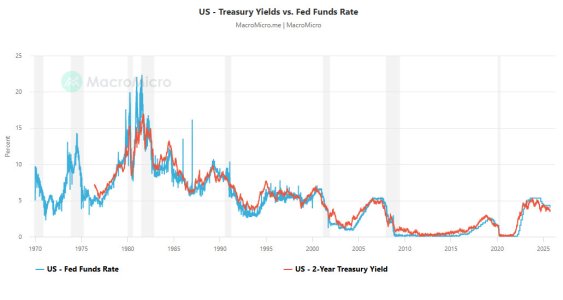

The 10-year Treasury Yield moved up to 4.2% on that data yesterday before hitting strong resistance and pulling back a bit. Don't you love how charts work? 4.2% was a wall of resistance.

The dollar also made a big move higher and here it is again flirting with its 200-day average - something that has held firmly twice in the past several months.

The S&P 500 / C-fund tested one of the lower ends of its ascending trading channel, which was just one layer of support between 6500 and about 6600. So far so good, but yesterday's push off the lows may have only been an attempt to fill the gap that was opened in the morning.

It's interesting that better than expected economic data helped send stocks lower but it goes to show us that the most important catalyst for the stock market is cheap, easy money. The M2 Money Supply is still flowing, but if the Fed gives any indication that rates won't be coming down two more times this year, we may see more damage being done.

The DWCPF (S-fund) fell through one layer of support yesterday, but it bounced back to close above it, and there were two support lines that were recaptured. If that support does fail, a test and hold near 2400 may be a good time to consider buying, if you've been waiting, but if interest rate cuts are in jeopardy, that may not hold.

ACWX (I-fund) pulled back sharply, and the 0.69% rally in the dollar makes me think that the 0.65% loss in this index may have been generous. It could have fallen further, but we did see some support near 64 hold yesterday. I may be interested closer to 63 if falls down there and holds.

BND (bonds / F-fund) finally fell inside the open gap and it did close back near the top of the gap but it has not been filled yet. I would think that 74 needs to get tested before this regains its footing.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

Stocks took another downturn yesterday, making it three days in a row, but so far we've seen a successful test of key support on some charts. The indices did close off their lows after the support held, but stronger than expected economic data made future interest rate cuts slightly less certain, and that caused concern. Yields and the dollar moved up putting pressure on equities once again.

| Daily TSP Funds Return

More returns |

We get the PCE Prices and the Personal Income and Spending reports tomorrow. This inflation data was going to be key to the outlook on interest rates, but yesterday's data did a number on that as well.

The GDP, Durable Goods, and Initial Jobless claims all came in better than expected, and that put a little fear into investors that the number of interest rates cuts that we get this year may not be what we thought just a couple of days ago.

The chances if getting two more cuts by the December FOMC meeting went from 82% a week ago, to 73% on Wednesday, and now, after the recent economic data, it has moved down to 61%. That's still a pretty good chance but it makes today's inflation data that much more compelling.

The 10-year Treasury Yield moved up to 4.2% on that data yesterday before hitting strong resistance and pulling back a bit. Don't you love how charts work? 4.2% was a wall of resistance.

The dollar also made a big move higher and here it is again flirting with its 200-day average - something that has held firmly twice in the past several months.

The S&P 500 / C-fund tested one of the lower ends of its ascending trading channel, which was just one layer of support between 6500 and about 6600. So far so good, but yesterday's push off the lows may have only been an attempt to fill the gap that was opened in the morning.

It's interesting that better than expected economic data helped send stocks lower but it goes to show us that the most important catalyst for the stock market is cheap, easy money. The M2 Money Supply is still flowing, but if the Fed gives any indication that rates won't be coming down two more times this year, we may see more damage being done.

The DWCPF (S-fund) fell through one layer of support yesterday, but it bounced back to close above it, and there were two support lines that were recaptured. If that support does fail, a test and hold near 2400 may be a good time to consider buying, if you've been waiting, but if interest rate cuts are in jeopardy, that may not hold.

ACWX (I-fund) pulled back sharply, and the 0.69% rally in the dollar makes me think that the 0.65% loss in this index may have been generous. It could have fallen further, but we did see some support near 64 hold yesterday. I may be interested closer to 63 if falls down there and holds.

BND (bonds / F-fund) finally fell inside the open gap and it did close back near the top of the gap but it has not been filled yet. I would think that 74 needs to get tested before this regains its footing.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.