The market spent most of the day moderately in the red and about a half hour prior to the close it was looking as though the major averages would be near or at their lows of the day at the closing bell. But the last half hour of trade saw a upward move that brought those averages to a mixed close on the day.

The selling pressure was attributed to news that Moody's had downgraded the debt ratings of several countries around the eurozone. France, Austria, and the U.K. were given negative outlooks to boot. I'm not so sure these events are "news" in the sense that no one saw them coming though.

On the domestic front, January retail sales were up 0.4%, but that was half the expected reading economists were looking for. Minus autos, retail sales came in at 0.7%, which bested an anticipated reading of 0.5%.

Share volume continues to be quite anemic. At the end of the day less than 750 million shares had been traded, but what's interesting is that about a third of that volume came in the final half hour of trade. End of day action like that often means a continuation can be expected the following day.

Here's today's charts:

NAMO and NYMO remain on sells.

NAHL and NYHL are also on sells.

TRIN and TRINQ are both on buys.

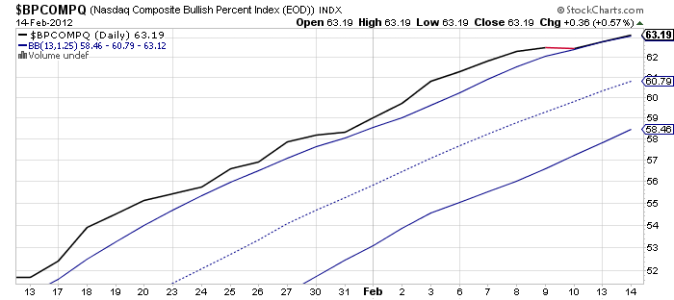

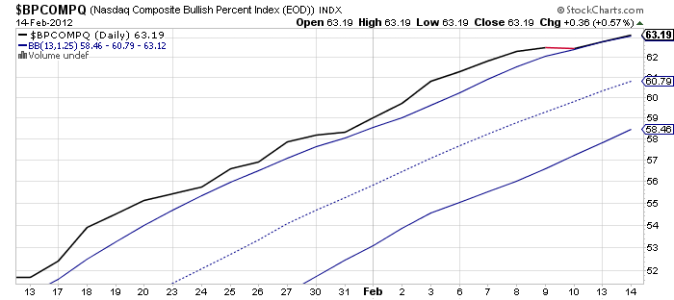

BPCOMPQ continues to track upward along that upper bollinger band. It remains on a buy.

So the signals remain mixed and that keeps the system in a buy condition.

I believe the downside remains limited and looking at the afternoon's late buying spree I suspect the market may be ready to breakout to the upside. It is OPEX week however, so a curve ball may yet be thrown, but my guess is the bulls are back in charge.

The selling pressure was attributed to news that Moody's had downgraded the debt ratings of several countries around the eurozone. France, Austria, and the U.K. were given negative outlooks to boot. I'm not so sure these events are "news" in the sense that no one saw them coming though.

On the domestic front, January retail sales were up 0.4%, but that was half the expected reading economists were looking for. Minus autos, retail sales came in at 0.7%, which bested an anticipated reading of 0.5%.

Share volume continues to be quite anemic. At the end of the day less than 750 million shares had been traded, but what's interesting is that about a third of that volume came in the final half hour of trade. End of day action like that often means a continuation can be expected the following day.

Here's today's charts:

NAMO and NYMO remain on sells.

NAHL and NYHL are also on sells.

TRIN and TRINQ are both on buys.

BPCOMPQ continues to track upward along that upper bollinger band. It remains on a buy.

So the signals remain mixed and that keeps the system in a buy condition.

I believe the downside remains limited and looking at the afternoon's late buying spree I suspect the market may be ready to breakout to the upside. It is OPEX week however, so a curve ball may yet be thrown, but my guess is the bulls are back in charge.