- Reaction score

- 2,608

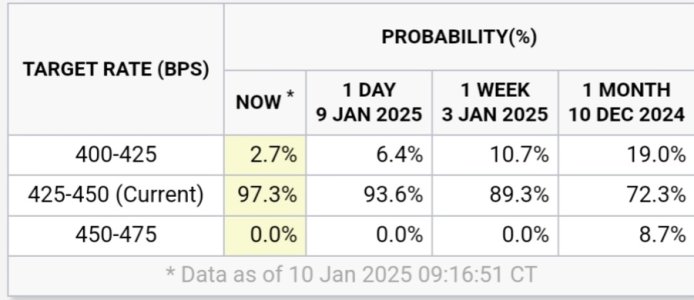

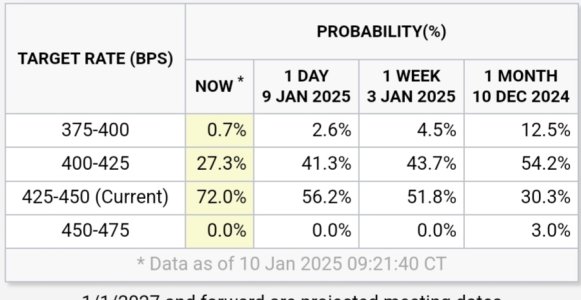

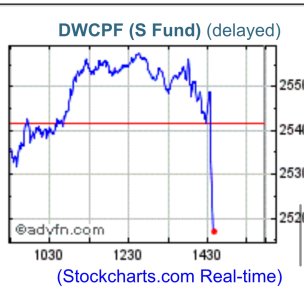

Traders see good chance the Fed cuts again in December then skips in January

Expectations for a December interest rate cut remained strong after the Federal Reserve trimmed rates by a quarter percentage point in November.

On Thursday afternoon, the U.S. central bank lowered the federal funds rate to a target range of 4.5% to 4.75%.